Heal wants to take medical care forward by looking back to an earlier time.

The Los Angeles-based company has raised $26.9 million in Series A financing led by the Tull Investment Group, with participation from Breyer Capital, Hashtag One and Slow Ventures, along with Qualcomm’s executive chairman, Paul Jacobs, and the chief executive of Skydance Media, David Ellison.

Launched last year, Heal already services the entire state of California and has cared for more than 10,000 patients, according to a company statement. The company said it will use the latest investment to continue to develop its technology platform, increase its marketing efforts and build out its roster of board-certified and licensed physicians.

After the round, investors valued Heal at $110 million.

The company takes insurance from Blue Shield of California, Anthem Blue Cross of California, Cigna Healthcare, Aetna and United Healthcare.

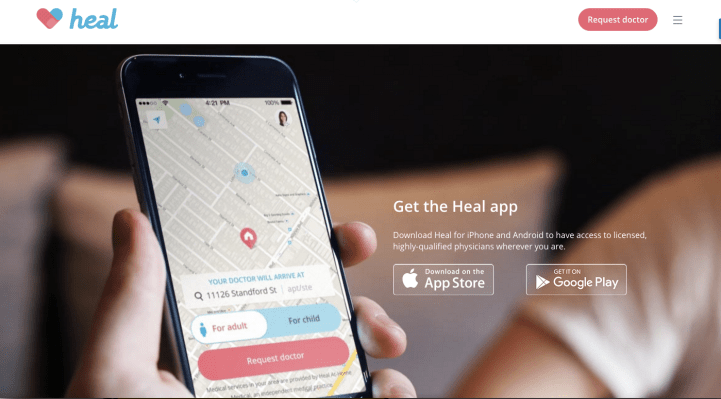

Using Heal, a patient can get a doctor coming to their door for the price of a co-pay or an all-inclusive, flat fee of $99. Doctors are available seven days a week from 8 in the morning to 8 at night — even on holidays.

“[The doctors] come with a very extensive kit of equipment,” says Heal founder and chief executive Nick Desai.

The company allows patients to request a consultation on-demand within a two-hour window, or schedule a visit in advance. Roughly 75% of the company’s repeat customers book their visits ahead of schedule. If booking ahead of time, patients can choose which doctor they want to use, but if the visit is on-demand, it’s the doctor that’s closest to a patient’s zip code.

“People are using it as their primary care doctor,” says Desai. While the company is now accepted by most insurance in California, Desai is excited about some of the new insurance plans coming onboard later in the year.

By November, Heal will begin accepting Medicare payments, a huge potential market for the company given the aging baby boomers that will start needing serious in-home care in a few years.

Heal recruits from the same pool of doctors that would either go into practice for themselves or join with an existing medical facility or HMO, according to Desai. “We have doctors who are recently board-certified who are starting their career to doctors in their 50s and 60s,” Desai said.

The company’s largest pool is doctors in their 30s and 40s, according to Desai.

For Desai, the value proposition behind Heal is obvious. “Everybody in America will get sick, everybody in America will go to the doctor, and everybody in America hates going to a doctors’ office.”

Desai also suggests that home health care can give a physician a better window into a patient’s health because of the insights a doctor can glean from being in a patient’s home and understanding the environment in which they live.

As it expands, the company is looking at markets where there’s an acute lack of primary care. So users in Texas — Heal is coming for you. Indeed, Desai mentioned Texas because the state has outlawed telemedicine as an option for primary care. Other markets that represent opportunities for the company include cities like Chicago, Pittsburgh or Detroit.

Heal’s cash pile gives it a nice war chest, and the company will need it because competition in this market is fierce. There’s direct competition from startups like the New York-based Pager and there is also a host of companies that are tackling the issue from the telemedicine angle.

Healthtap, American Well, Doctor on Demand, MDLive, Plushcare and Teladoc are all offering consultation services through mobile devices that provide an alternative to a traditional doctor’s visit.

Despite the somewhat crowded market, legendary investor (and Legendary investor) Jim Breyer, is bullish on the company’s prospects.

Indeed, all Breyer needed to hear was that Thomas Tull, the founder of Tull Investments and a serial entrepreneur who launched Legendary Pictures, was on board. After that investing in Heal was almost guaranteed.

“I looked at a number of artificial intelligence startups that are addressing the overall solution, which is improving patient outcomes,”says Breyer. “What impresses me about Heal is the quality of the physicians that the senior leaders have recruited.”

Heal might seem to be out of the wheelhouse for Breyer’s new fund, Breyer Capital, which invests around a thesis of applying artificial intelligence and machine learning technologies to vertical industries. However, for Breyer, the potential for Heal to improve its services and expand its reach through AI has yet to be tapped.

“The opportunity for Heal is to sit right at the intersection of doctors that deeply care about patients and their ability to work with patients and the incorporation of data analytics and artificial intelligence to improve outcomes,” he said.