Kobo, the e-reading service owned by Japan’s e-commerce giant Rakuten, has notched up one more key brand among those that turning to the company to build out their e-books business in a collective bid to compete against the might of Amazon and its Kindle empire. Waterstones today announced that has partnered with the Canadian company to handle all of its e-book business. As part of it, Waterstones has stopped selling e-books directly.

The news of the closure and transfer was first made public in a direct email to Waterstones’ e-book customers earlier today. Waterstones has also posted the basic details on its own site.

“The Waterstones digital download store is closing, but we have partnered with Kobo to ensure that you will still be able to access your library of eBook titles,” the company writes. “On 14th June 2016 we will send you an email with a personalised link to transfer your eBooks to Kobo.” Users will also be able to access their current libraries from now until Monday, 13th June 2016, the company added.

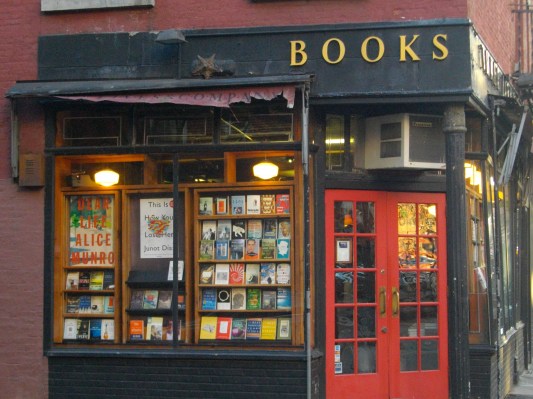

This is the latest chapter in Waterstones’ ongoing and somewhat mercurial e-books strategy, as the retailer, known in the UK primarily for its brick-and-mortar stores, continues to figure out the best way of competing against the big elephant in the bookstore: Amazon.

Waterstones’ MD James Daunt at one time was very outspoken about Amazon, calling it a “ruthless, money-making devil” once in an interview. But it then, amazingly, turned around and partnered with Amazon to sell Kindles in its stores.

That didn’t work out though, after sales were poor and being outstripped by physical books in its stores (England!), so the company killed that deal. Cue: Waterstones selling its own e-books online.

Now, however, it seems to be diving into physical with even more gusto — following a wider trend in the publishing industry, where the Publishers Association says that sales of physical books are now rising as e-books are falling. So, the deal with Kobo is the next logical step: outsourcing its e-book operation to a company dedicated to that medium, with its own Kobo e-readers for consuming that content.

The book is dead! Long live the book!

The Kobo / Waterstones deal will give current Waterstones e-book customers the option of transferring their digital libraries to Kobo — although gift cards and other loyalty services will not be usable on Kobo’s platform. At the same time, Waterstones plans to close its related audio books service, with no transfer deal in the works.

The terms of the deal between Kobo and Waterstones have not been disclosed — for example if there will be a revenue share on referred business. We have contacted the companies to see if we can find out.

While Kobo is very small in size when compared with Amazon as a direct-to-consumer service, it’s finding an interesting route to growth by positioning itself in the B2B2C market.

Kobo wants to be the go-to platform for any and all other book retailers and e-reader makers that are trying to gain a foothold in the online e-book market, but do not have the scale to compete against Amazon on their own. Others that have joined Kobo include Sony (also in the U.S.), Flipkart (Amazon’s big rival in India), Blinkbox and several others.

The two companies are treating this as a win rather than a retreat:

“We are pleased to be working with Waterstones, where we can help a great print retailer by supporting their customers who also love to read digitally,” said Michael Tamblyn, CEO, Rakuten Kobo, in an emailed release. “We look forward to ensuring that customers who have built eBook libraries with Waterstones will be able to enjoy them in the future with Kobo.”

James Daunt, Waterstones MD added that “We are very pleased that customers of Waterstones will be able to enjoy their digital libraries through Kobo. It provides them seamless continuity, and ultimately an excellence of service we ourselves are unable to match.”

The company — which was sold by HMV to Russian billionaire Alexander Mamut in 2011, last year finally inched into the black after years of losses. In February this year it managed to eke out a small operating profit.