“Every failed on demand startup will reappear as a successful robotics driven business in five to 10 years.” So tweeted Jeremy Conrad, founding partner of the San Francisco-based hardware fund Lemnos Labs, one recent afternoon.

Conrad apparently means what he tweets, having investing in Marble, a new, San Francisco-based ground-delivery robot that will focus on ground-based last-mile delivery for business, then consumer, applications. (Conrad wouldn’t discuss the still-stealth startup’s funding picture, but another source tells us it’s currently meeting with investors.)

He’s hardly alone in thinking that ground robots will be bringing us everything from canned goods to Christmas lights sooner than we think. For example, this past Wednesday, Andreessen Horowitz announced it had led a $2 million investment in Dispatch, a company whose self-driving ground delivery robots look like minibars on wheels.

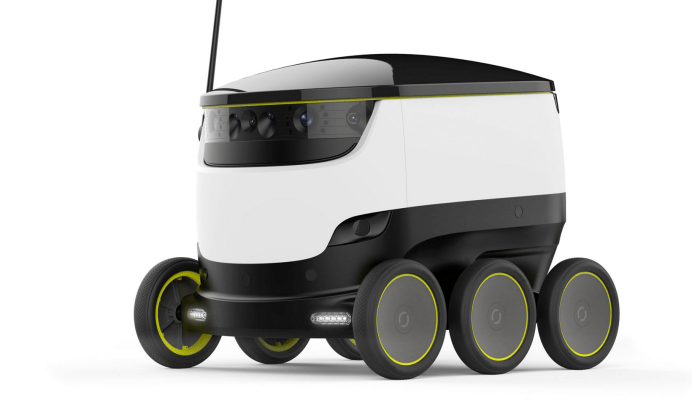

And Dispatch’s machines look an awful lot like the robots of Starship, an Estonia-based outfit created by Skype cofounders Ahti Heinla and Janus Friis, who took the wraps off their still-in-beta machines late last year. The robots, which also look like little refrigerators, are designed to deliver goods like groceries – about two bag’s worth – in 30 minutes of less.

In each case, the idea is to save money on deliveries by cutting out costly humans. Starship is also promising to give customers more control over the delivery process. It says it will enable residents to schedule deliveries only when the timing works, as well as track in real time the whereabouts of the robots, whose tech includes GPS, gyroscopes, and nine cameras. (As an added bonus, its robots will produce zero emissions, says Starship.)

Whether these new ground-based robot couriers represent the beginnings of a broader trend or a series of one-off bets remains a question mark. We’d bet on the former, though.

It’s true that have investors have already made an enormous bet on unmanned aerial vehicles. According to CB Insights, VCs plugged $450 million into 74 drone deals last year, up fourfold from the $111 million they invested in drone companies in 2014.

But Amazon’s interest alone in drones means it will be difficult for many related startups to compete on the consumer delivery front.

That’s saying nothing of lingering regulatory considerations. The FAA is expected to issue rules by the end of June for flying unmanned aircraft that weigh more than 55 pounds, but the proposed rules don’t apply to drones that would eventually handle consumer delivery because they don’t permit drones to fly at night or beyond an operator’s line of sight.

Another obstacle: growing concerns over a world peppered with annoying drones flying overhead. You might be astonished by quickly how residents can come together when threatened with noise pollution. San Francisco’s denizens have defeated all heliport and helipad proposals since the early 1960s, save for a year-old helipad at a new San Francisco hospital that’s meant for carrying children and pregnant mothers facing life-threatening emergencies.

Perhaps it’s no wonder that Conrad told us he’s “very bearish on [air] drone delivery,” when we gave him a call last week. In fact, though Lemnos Labs helped incubate Airware – a company that raised $30 million recently to sell drone hardware and software to enterprise customers – Conrad goes so far as to call “drone delivery in cities maybe the dumbest thing I’ve ever heard of. Even if you can get past the safety issues – and you can’t — the idea of 10,000 drones buzzing around is idiotic.”

That’s not to say ground-based robots are a no brainer.

For starters, consumer-facing ground robots represent new territory for regulators, who haven’t had much reason to consider them just yet.

Even if robotic ground couriers come to be viewed by regulators as friendlier than unmanned aerial vehicles – which seems likely, given they can’t fall out of the sky and onto someone’s head –- not everyone agrees that ground-based delivery robots are a huge opportunity.

“It’s a complicated value proposition,” notes Ben Einstein, managing director of the hardware-focused seed-fund Bolt. “Certainly, there are some companies whose problems are really hard to solve with humans and whose unit economics would make more sense with robots.”

At the same time, says Einstein, “I think a huge percentage of items will still be delivered the old-fashioned way. The [new ground-based delivery] businesses where there will be a high degree of robotics and automation that cause other companies to go out of business – I think that’s a little more on the margin.”

As happened with air drones, many investors are betting first on industrial applications to see where they might lead. In the highest profile bet to date, Amazon in 2012 paid $775 million for Kiva Systems, a maker of robots that move items around warehouses.

A younger company, two year-old Fetch Robotics of San Jose, is similarly producing ground-based robots that look like oversize Roombas and feature autonomous navigation, automatic distance following (so they can trail behind a warehouse worker who can pile products atop it), and warehouse monitoring and statistics. The company has raised $23 million in funding so far, and it’s signing up warehouse customers left and right, suggests Rob Coneybeer of Shasta Ventures, a seed investor in the company.

The reason is cost savings for enterprises. “[Fetch’s] customers look at this as the equivalent of paying three bucks an hour” for an employee, he said during a panel discussion in San Francisco last week.

Entrepreneurs and investors are beginning to take more seriously the cost savings that automating direct-to-consumer delivery could produce, too.

“Obviously,” ground robots could “dramatically alter the economics of service delivery,” notes Niko Bonatsos, a managing director at General Catalyst Partners. “If you have a person in the mix, it’s expensive; you need to have [them making] at least two to three deliveries per hour, or you have no business.

“There’s hope that some of these technologies will take care of a niche part of the service deliveries landscape,” he adds. “But it’s early days. It’s like talking about self-driving cars a few years ago. It’s not going to be next year but seven or eight years down the road.”

For Bonatsos, that means it’s time to start looking. More investors (and inventors) might be wise to do the same.

Photo above courtesy of Starship Technologies