CurrencyFair, one of a number of so-called peer-to-peer currency exchanges, has scored a further €8 million in funding. The round was led by Octopus Ventures, with participation from Proxy Ventures. It brings total raised by the 2010-founded company to around €20 million — a figure that is dwarfed by noisy rival TransferWise, which closed $58 million in Series C funding last year alone.

At the same time, the Ireland-based startup is announcing the appointment of Unibet Group PLC’s former CMO Nils Andén. The marketeer will help CurrencyFair further differentiate its currency exchange from other claimed p2p-based exchanges, as well as continue the narrative, propagated most nakedly by TransferWise, that these fintech upstarts are set to give the banks a run for their money with fairer exchange rates and more transparent fees.

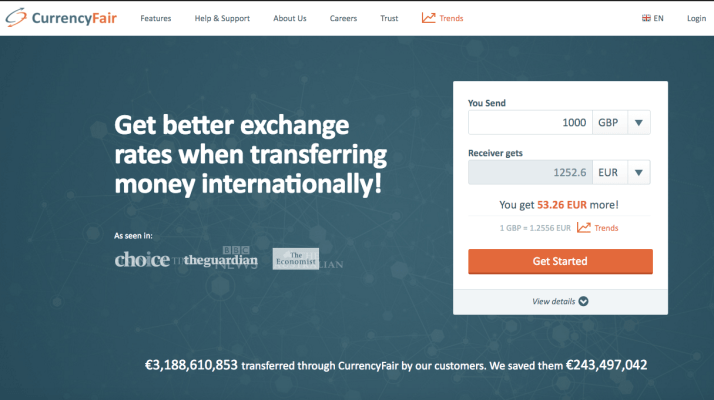

In case you’re not familiar with the so-called p2p model, the idea is that by matching customers in different countries with inverse currency exchange needs, money doesn’t unnecessarily leave each country and any subsequent savings can be passed on to customers, providing a better exchange rate than banks typically do.

However, where there is a mismatch between the amount of money customers in one country/currency want to exchange with another, these startups have to fall back on the open FX market where margins are tighter, leading some to suggest that the p2p model isn’t quite all it’s cracked up to be.

To that end, CurrencyFair is perhaps more open about this discrepancy than most players in the p2p currency exchange space. It actually operates a hybrid model: If you want to transfer money immediately and with a guaranteed rate, the startup will step in and buy exchange on the open market on your behalf, taking a pretty competitive cut along the way.

But, presuming your FX needs aren’t urgent you can list your requirement on the CurrencyFair Marketplace, which is purely p2p and, according to the company, has a far better chance of actually beating the mid-market ‘interbank’ rates that are typically beyond the reach of consumers.