WeTransfer — the quirky Amsterdam-based startup that competes with the likes of Dropbox and Box in the business of sharing large files between users online — has made its first acquisition. Today the company announced that it has acquired Present Plus, a design agency based in London and Amsterdam. Present Plus’ Amsterdam team will join WeTransfer to work on product design for new launches like an upcoming desktop app, as well as WeTransfer’s continued efforts to expand in the U.S.

The companies were already very, very close: Present Plus had worked on building several of WeTransfer’s products, including its mobile app. And Nalden, a co-founder of WeTransfer, was also a co-founder of Present Plus, along with Damian Bradfield. Nalden, as the CIO of WeTransfer, will lead Present Plus as part of the design team, while Bradfield will become the startup’s CMO.

WeTransfer last year announced that it had raised $25 million valuing the company at between $100 million and $200 million. But in a world where fast-growing startups are seeing a lot of activity when it comes to funding, this was the exception rather than the norm.

WeTransfer had been bootstrapped since being founded in 2009 and that $25 million investment, from Highland Capital Partners, was the first and only outside backing it had ever taken. The same went for Present Plus, Nalden tells me, which was founded a year after WeTransfer and never raised any outside capital apart from what he and Bradfield put into it.

Despite the founder connection, Nalden said that “There was a financial consideration for the acquisition, paid in cash, as you would expect for a high quality design studio.” But that price is not being revealed.

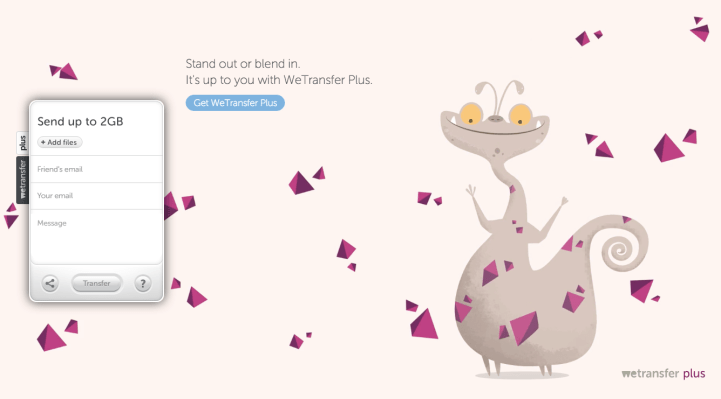

One of the things that sets WeTransfer apart from the likes of Dropbox and Box has been the company’s aesthetic. The startup shows lots of amusing, quirky illustrations behind and around the central (and frankly dry) file transferring tool/interface that it offers to users.

The company has built on that design aesthetic and incorporated it into its business plan: for free users, those pictures can be made into advertising and sold to others. For those who pay, they can customise their illustrations.

Present Plus had always counted WeTransfer among its customers — working on its wallpapers and other features. But it also developed its own list of clients, including Adidas, MR PORTER, British Airways, Sonos and Christie’s.

And, as with other digital studios like UsTwo, Present Plus developed its own digital products as well. In its case, they included illustration service Kuvva, calendar app Who’s In and the video portrait series, One Minute Wonder. (It will be interesting to see how and if this leads to other products outside of file transfer for WeTransfer too.)

Nalden tells me that Present Plus has now wound up its external projects to focus solely on WeTransfer. The exception is Present Plus’s London branch, which will continue to produce videos for new and existing clients, as “an independent film and production studio,” he said.

So if Present Plus had already been working with WeTransfer, why make the decision to acquire the company, and why now?

“The relationship between us has always been close. Both companies started around the same time. However, on the WeTransfer side, we have seen incredible growth in the last year. Given that continued, impressive success of WeTransfer, we had immediate needs to build out our product roadmap while elevating our focus on design,” Nalden told me. “Adding the design talent of Present Plus allows us to further those goals.”

WeTransfer says that today it has over 85 million transfers per month worldwide, which works out to more than 1 billion transfers annually, with more than half of its users focused around the creative industries — such as video, art and advertising. Nalde says the company is on track to double the number of transfers this year to 2 billion.

Despite this growth, the company is not looking to raise more money but to use its own capital and profits to grow.

“WeTransfer is not raising money,” he said. “We are still running the business with a bootstrapped and profitable mentality. [But] as you would expect for any high-profile internet business, we do get approached by a lot of potential investors.”

On a more general level, it’s interesting to see yet another digital design agency get snapped up by a tech company wanting to bring more of those services in-house.

Earlier this week, Atom Bank acquired Grasp, another digital studio that had done front-end development work for the still-stealthy fintech startup. And IBM has also been snapping up digital agencies, in part to better compete against the likes of Adobe and an army of management consultancy firms that also offer digital and interaction design services.