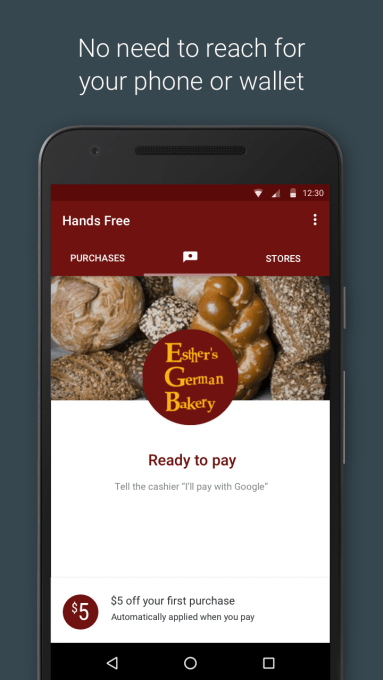

Google is rolling out a pilot program today that introduces a new way to pay cashiers — and it involves leaving your phone in your pocket.

It’s called Hands Free, and it’s a way to basically connect your phone with a point of sales system using the sensors on your phone. The end result is that a point of sale device is already aware of your phone’s presence, and when you want to pay for something, you can do so through Hands Free. The service is launching in a pilot in the Southern San Francisco Bay Area today.

“When you think about a user, in a bunch of situations, the experience is quite crummy right now, it’s quite clunky,” Google senior director of product management Pali Bhat said. “You don’t want your phone in the way, your wallet in the way, you don’t want your cash in the way. These are inconveniences that happen multiple times a day.”

Users basically walk up to a cashier, which can detect that the phone is in the area and gives the point of sale system the ability to charge the user’s card that’s tied to Hands Free. The user tells the cashier that they will “pay with Google,” and gives their initials to the cashier, who then inputs that and the transaction is closed. Cashiers also have a way to detect what the person looks like and whether it’s the same person in the photo tied to a Google profile.

Users basically walk up to a cashier, which can detect that the phone is in the area and gives the point of sale system the ability to charge the user’s card that’s tied to Hands Free. The user tells the cashier that they will “pay with Google,” and gives their initials to the cashier, who then inputs that and the transaction is closed. Cashiers also have a way to detect what the person looks like and whether it’s the same person in the photo tied to a Google profile.

The goal here is to reduce friction in the payments process. That was the main attempt of tools like Android and Apple Pay: being able to pay for products with just your phone and not having to take out your wallet and pay with a credit card. This is all beneficial to companies like Google and Apple, because it helps bring payments closer to the phone, and increases the chance that they’ll pay for things with Apple or Google with a credit card saved on that phone. And if it’s easier to pay for things on a phone, it’s easier to pay for apps and services like Google Play and the App Store.

All this, if it works, will help Android Pay continue to catch on. Google says that it’s seeing around 1.5 million new registrations each month in the United States, with 2 million locations that accept Android tap and pay. This tool will work with Android devices that go all the way back to Jellybean, Bhat said.

But if this tool sounds familiar, it should: Square took a crack at creating a payments product that enabled users to pay cashiers without taking out their phone. That worked with some geofencing technology, while Google’s works a bit different, Bhat said, but the principle is more or less the same — opening and closing a tab without taking your phone out of your pocket. The goal was to make paying for things more of an experience as much as a convenience, but that application didn’t really catch on from Square. In this case, Google can throw its weight behind the tool and it can get preloaded within Android devices, but the challenge is still there, for even Google.

It’ll be interesting to see whether Apple follows Google into this space, given the huge similarities between Android and Apple Pay. This is something that Square took a shot at, and maybe that implies that there is at least some demand for a tool like this, as long as it’s done properly. Bhat says the technology — whether that’s fraud detection or location data from Google Maps — is what gives Google an edge over potential competitors (like, inevitably, Apple).

“We believe we have some very unique assets and technologies that we’re bringing to the table,” Bhat said. “One of the things is this combination of technologies we’re using to ensure that a user’s near the store, the other piece that’s as important is all the things we’re doing on the security side. Those are pieces of technology that we feel are very critical and defensible.”

The challenge for Google with this tool will be twofold: getting point of sales services on board, and getting users to adopt it. The former tends to follow the latter, but Google has a suite of APIs that point of sale makers can tap into. The question will be whether the product has hit a big enough scale to justify having point of sale makers integrate this service into their devices — working not only with smaller point of sale services like Clover but larger ones like Ingenico.

“For us, it’s less about competition with other companies, in fact we believe that the more that mobile payments is adopted by users, it’s good for everyone,” Bhat said. “The way we think about this is that our goal is to make mobile payments awesome for users and not worry about anything, as long as we focus on the user and build great solutions, that’s what follows.”

The company is insisting it’s a pilot program — hence only being available in the Southern San Francisco Bay Area — in order to collect user feedback. The service is available in a few stores and pilot locations for McDonald’s and Papa John’s.

“Our goal is not really scaling this, our goal is to see how users are reacting and how merchants are experiencing this,” Bhat said. “Once we’ve made all the fine-tuning that potentially we get from the feedback from merchants and consumers, we then are going to start scaling it. Until then our goal is not to have millions and millions of users adopt.”