It takes a much heartier stomach to jump into the startup game now than it did a year ago. Zenefits recently became the latest unicorn to face devaluation after compliance issues forced the CEO to resign. Publicly traded tech companies like Twitter weathered layoffs and stock sell-offs.

Those few companies that are doing well have created their own sets of problems, with The New York Times and later The Information making the case that today’s tech incumbents are too big to be disrupted.

They have a point. It’s hard to raise money for a music streaming app in an environment where Apple can launch and acquire 9 million users in a matter of months. It’s hard to build image-editing software when Instagram or Facebook can promote a similar product to its billion users at no cost. The bar is high, that’s for sure; but there are also a few reasons why the industry’s pessimism is due a reality check.

Mobile is still underdeveloped

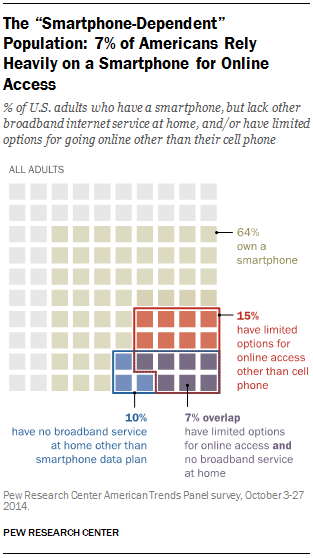

Mobile has survived several cycles of buzzword status, but the fact remains that it still represents one of the biggest opportunities for founders to target. The latest reliable numbers, from Pew, found that smartphone ownership was still hovering below 70 percent.

Globally, smartphone ownership is probably somewhere in the ballpark of 2 billion users, a figure that’s expected to surpass 6 billion within the next few years. As far as market saturation, we’re still not even halfway there. And of the five giant companies that are doing well, none were developed to be mobile-first. Snapchat only recently got serious about monetizing, rolling out Discover in 2015 and signing a contract with Viacom’s ad sales team earlier this year.

Cord-cutting has not affected entertainment; rather, the large mass of consumers using mobile phones and tablets as entertainment devices has impacted the lack of desire to own a TV. It is possible that the outcome will result in more connected screens providing higher volumes of entertainment than owned TVs. This will expand a greater industry with more consumers using entertainment products more frequently than traditional televisions.

We have many more paths to market than the Apple Store

It’s true that there are a lot of apps in the App Store. The life cycle for apps has also grown swift, to say the least; Peach was proclaimed “dead” by some publications less than a week after its launch. However, it’s important to note even the most snarky of the app’s detractors found nice things about it.

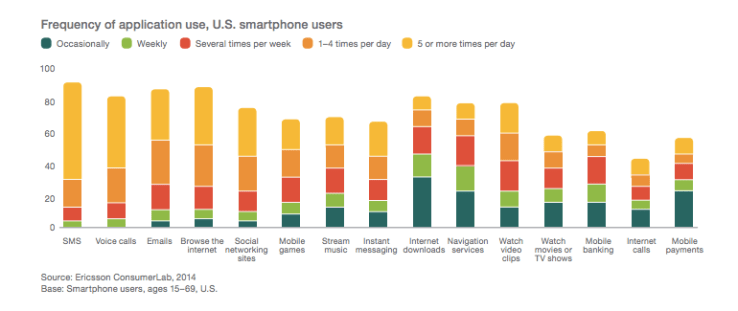

More importantly, however, one or two years ago developers had one, maybe one-and-a-half places that were really popular for product discovery: the App Store. For a while, being featured by Apple’s secretive editors was seen as a make-or-break moment in a startup’s success. Increasingly however, the App-store effect is proving ephemeral, with the vast majority of app use focused on a core group of three-six apps that users frequently log into.

Startups have many more paths to market now. There are robust communities discussing new products sprouting up every day in Quora, Product Hunt and Medium. There are publications devoted to technology now which are far more recognized than the blogs we had back in 2007. And open-source treasure troves like GitHub have made it easier than ever for small shops to collaborate and get off the ground. VentureBeat recently reported that while the market for IPOs has obviously cooled, the count of “unicorn” mobile startups worth $1 billion or more still grew in the first quarter of 2016, despite waves of media pessimism.

Talent was too expensive

There’s also a strong possibility that Silicon Valley’s battle for talent was self-defeating. Tech giants like Facebook and Google are better equipped to cover high salaries and relocation to their impressive facilities than a venture-backed startup. And that’s to say nothing of the technical founder who’s currently working out of a garage. Cheaper talent will make it easier to get fledgling companies off the ground, and there’s now an entire generation of technology employees who have lived through multiple cycles of booms and busts.

Looking ahead

For all those reasons and more, a lot of concern about our unicorns has been misguided. Many are building businesses outside of their core offerings: Uber has arguably been a logistics company for a year now and Amazon’s web-hosting business will likely be spun off before long. It’s certainly true that some big names are facing headwinds, but companies never should have expected the good times to last forever. Many will emerge from 2016 as stronger companies, and mobile’s best days are still ahead of it.