At Roger Lee’s last startup, he wanted to set up a 401(k) plan for his employees. He soon realized how frustrating and outdated the process was; it required stacks of paperwork and even faxing documents.

That’s what prompted him to start Captain401, a service built for quickly spinning up 401(k) plans for small- to medium-sized businesses that aims to be less complicated. The company said it raised $3.5 million in financing today in a round led by SoftTech VC and SV Angel, among others.

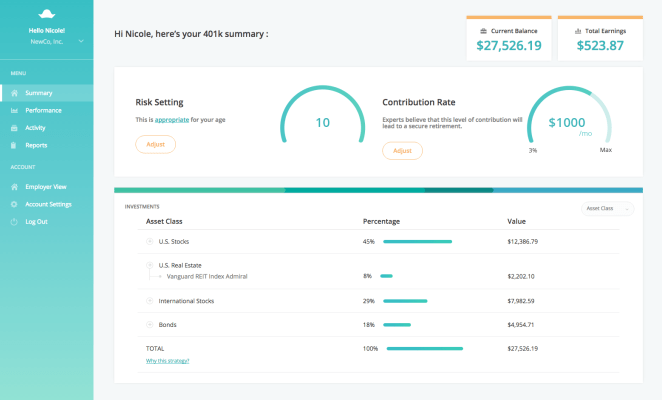

Companies use Captain401 to set up a 401(k) plan for their employees online through a couple of simple steps. After that, the ongoing administration pulls data from HR software like Gusto and Intuit, and the service automatically manages investments for employees through index funds like those from Vanguard.

It’s important that companies get 401(k) plans up and running as early as possible. For one, it’s a morale thing: employees want to know that their company is helping work through their retirement plans. But it’s also an important incentive for attracting employees to a company. Lee recognized that at his last startup, he says, but found the process difficult to get up and running.

“Individuals are increasingly responsible for their own financial futures, now that pensions are going away, social security is uncertain,” Lee said. “People are now responsible for providing for their own retirements and 401(k)s are the primary way of doing that, yet you find these 70 million people work for companies that don’t offer those plans.”

The process can also be confusing on the employee end. Many 401(k) plans are a complicated to set up and require intense research about various funds that employees can invest in — not to mention what the risk profile of those funds are. Lee says that Captain401 will look at the profile of an employee, like their age and risk tolerance, and ask a few questions before giving a personalized recommendation of what funds they should invest in.

“Normally you’d get a list of like 30 funds and they’d have confusing names — what the heck is ‘SPRTN IDX’ — no one can decipher what these things mean and you’re expecting what employees to choose what percent of money into these funds,” Lee said. “We’re able to make sensible recommendations on what funds people would invest in, present in a way that’s not these jargon-filled fund names.”

Going along with that, Lee said he saw that employee participation was also low because the process was so complicated. “Typically we found that in a normal 401(k), especially one that doesn’t do any matching, less than half of employees will participate,” he said. “Historically the thinking had gone, you’re never gonna get everyone to participate because some people don’t have the budget to save for the future, but we found consistently that our customers are seeing participation rates upwards of 90 percent even without a match.”

Captain401 is certainly not the only company in this space looking to simplify the 401(k) process. There are other startups like Money Intel that want to not only simplify the overall process, but make it incredibly easy to set up 401(k) plans for companies. And, of course, the company is competing with larger 401(k) providers, but Lee’s pitch is that its ease of use on the employee end will win out employers.

Captain401 came out of Y Combinator’s summer 2015 batch.