It’s strange days for Fundrise, a Washington, D.C.-based crowdfunding platform that allows a range of investors to fund commercial real estate projects.

Earlier today, The Real Deal, an outlet that covers New York real estate news, turned up an SEC filing which states that Fundrise has fired its mortgage REIT’s chief financial officer and treasurer Michael McCord, citing an attempt by McCord to extort more than $1 million from the company.

“Exhibit one” listed in the filing is a letter to Fundrise’s backers that reads:

“Strategic Investors & Advisors, I am saddened to have to inform you that an employee of our company has engaged in what we believe to be an attempt to extort over $1M from the company. As part of this, he claims the company acted inappropriately concerning two real estate deals. Though we believe there is no merit to his claims, we take any allegation with the utmost seriousness.

As a result, we have engaged a third-party financial audit firm to conduct a thorough investigation concerning his allegations. We are pursuing all appropriate and precautionary steps to protect our investors and our organization.

Furthermore, we are contacting the appropriate law enforcement agency to report what we believe to be his criminal behavior.”

The letter was presumably authored by Fundrise cofounder and CEO Benjamin Miller, who, according to the same SEC filing, is taking on the role of interim CFO and treasurer in addition to his other responsibilities.

Miller did not respond to requests for comment today.

Miller’s brother, Daniel Miller, who cofounded Fundrise and formerly served as its president, wrote us on LinkedIn, saying he has “moved on to pursue other independent opportunities, which will be announced shortly. Since my departure in October 2015, I have not been involved in corporate governance or the day-to-day operations that may relate to this matter.”

Several investors didn’t respond to requests for comment; another called the development “concerning,” and said his team would be “tracking it more closely.”

Asked about the accusation, McCord told us tonight that the “current narrative” is “baseless and a pathetic deflection attempt from the real story by Fundrise.” He declined to comment further.

Fundrise has so far raised $41 million from investors, including Renren, the China-based social networking company, and several real estate firms and individuals. Among them are executives from Silverstein Properties; Rising Realty Partners; and the Ackman-Ziff Real Estate Group. Other backers include former Under Armour executive Scott Plank; former Loopnet CEO Richard Boyle; and the Collaborative Fund.

McCord joined Fundrise in 2014 after spending just less than three years as a senior associate with the auditing firm KPMG.

The Miller brothers launched Fundrise in August 2012, shortly after the JOBS Act legalized crowdfunding, and they proceeded to connect accredited investors with commercial real estate projects needing funding.

They weren’t alone. Numerous other startups that have sprung up around the same concept include Realty Mogul, Cadre, and RealCrowd. (They’ve raised $45 million, $68 million, and $1.6 million from investors, respectively, according to CrunchBase.)

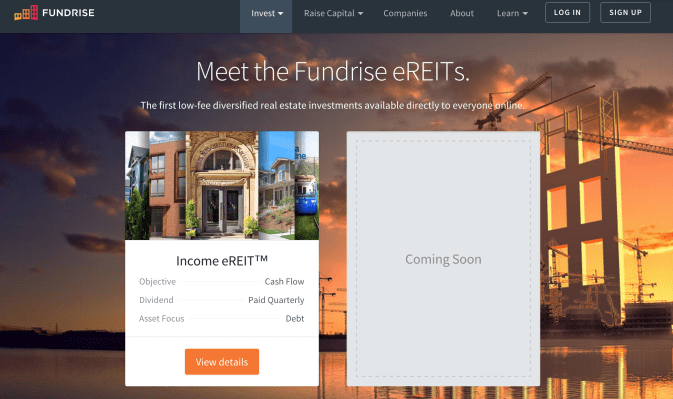

Late last year, Fundrise also launched a non-listed mortgage real estate investment trust. Unlike other non-listed trusts, its so-called eREIT is regulated under Title IV of the JOBS Act, better known as Regulation A+. It went into effect last June and allows startups like Fundrise to raise capital from non-accredited investors.

In fact, because the fund requires a minimum investment of only $1,000, Fundrise enjoyed lots of publicity around the move, with Wired describing the effort as enabling “common folk to invest in posh real estate ventures.” (We’d written about it here at TechCrunch, too.)

The Real Deal was less impressed, poking fun at Funrise’s characterization of its new eREIT as “the biggest technological innovation in the history of finance,” and saying the claim was one of many exaggerated assertions the company was using to drum up investor interest.