Tighten your belts, folks. It looks like 2016 will be a challenging year for India’s venture capital-backed startups after a second of the country’s fastest growing companies abandoned expansions plans on account of uncertain investment prospects.

Hot on the heels of news that Grofers, a startup that has raised $165.5 million from investors like SoftBank and Sequoia Capital, pulled out of nine cities in India in January, PepperTap, an equally well-backed player in the hyperlocal space, has confirmed it is shutting down its operations in six cities, as was first reported last month. The move will reportedly result in 400 delivery staff being laid off, although PepperTap said 50 employees will leave.

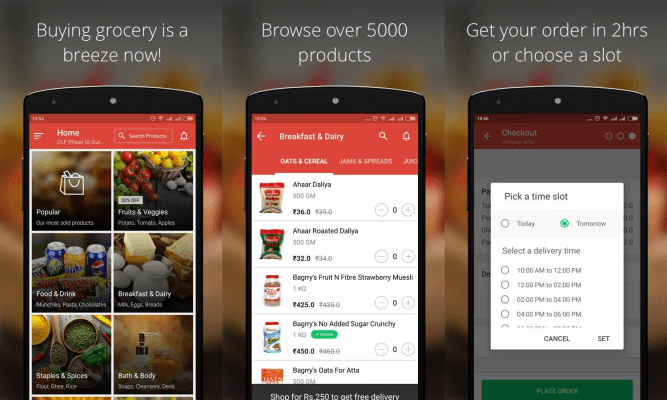

Grocery on-demand service PepperTap is less than a year old but already it has nabbed close to $50 million in funding, including its most recent $36 million Series B round in September 2015. At the time of that round, the company said it had aggressive plans to expand to cover a total of 75 cities by the end of March of this year.

Instead, it is cutting its coverage back to focus on eight locations — Delhi, Noida, Pune, Hyderabad, Ghaziabad, Gurgaon, Bangalore and Faridabad — due to an apparent slowdown in tech investing.

In a statement provided to TechCrunch, PepperTap CEO Navneet Singh confirmed the closures and emphasized that the company is focused on becoming more sustainable:

PepperTap has been able to establish itself as a leading hyperlocal grocery delivery service over the last one year. Given the short to mid-term investment climate outlook, we have decided to focus on depth rather than breadth. We are digging our heels in for the long term. We will focus on building a stellar customer experience by providing additional categories and services that differentiate us from our competition in cities where we continue to operate.

There’s been plenty of talk that India’s startup scene has entered a period of revaluation following 2015, a year of unprecedented funding rounds and startup valuations. Both Grofers and PepperTap have canceled plans for vast geographical expansions on account of the fact that audiences in more rural parts of India are not yet the type that can drive the kind of sustainable revenue that their services require, while a global crunch in startup investing — which we are seeing in the U.S. and China — is also seemingly taking effect in India, too.