Collaborative Fund is bringing on a pretty big partner for a new seed-stage fund focused on improving children’s lives — and it’s not someone you’d expect to get into the venture capital game.

Craig Shapiro’s venture is launching a new $10 million fund that’s tied to Sesame Workshop, creator of Sesame Street and other children’s programming. The fund is primarily targeted at the seed stage, which the new venture will invest up to $1 million in, Shapiro said. Collaborative Fund will be leading the investments, while Sesame Workshop executives work in the selection process for the startups.

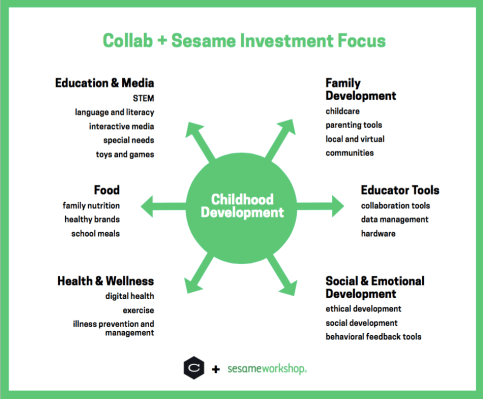

“[Our investments are going to be] seed investments in startups that are basically focused on some element of making kids stronger, smarter, kinder,” Shapiro said. “If something is endorsed by Sesame it brings tremendous legitimacy. That’s in part because they’re nonprofit, Sesame is the gold standard for anointing that something is safe for children. If you’re launching a toy or an app or a product or a service for kids, and you have the opportunity to bring Sesame and its brand into the fold, it gives it infinitely greater legitimacy. It’s what ESPN is to a sports fan or what Anthony Bourdain is to the food world.”

Some firms have a lot of value-add thanks to their additional staffing beyond just partners, Shapiro said. For a fund like this, Collaborative Fund is able to bring in a Sesame Street executive to help companies figure out how to solve some of their problems, he said.

“I think that by bringing a strategic partner in like Sesame, a very focused subset group of companies, it’s likely that they’re a number one if not top three strategic partner out there, and the nice thing about Sesame Street is it’s a nonprofit,” Shapiro said. “It’s non-threatening, it doesn’t limit a company’s options as it relates to exit opportunities.”

Collaborative Fund, while investing often in companies that aim for social good, is still a fund looking for a financial return — and that doesn’t necessarily exclude how this fund is going to work. The startups still have to represent some potential financial opportunity to cross the threshold, Shapiro said.

Collaborative Fund has already invested in a few companies that might fit the portfolio of companies in which the new fund is looking to invest. He pointed to a few examples in Collaborative Fund’s portfolio, like Revolution Foods — which looks to replace the food in public schools around the country with healthier options. Another, he said, was Hopscotch, a startup that looks to teach children how to code without having to type words.

This isn’t the only fund that is necessarily focused on startups that look to improve children’s lives. There are funds like Owl Ventures, which invests in startups looking to change education, and Imagine K-12, an accelerator for education tech startups. But it would seem there hasn’t been something of the form of this new fund — much less one that involves Sesame Street.

“I think there’s opportunities for us to be somewhat contrarian and invest in areas that are underserved,” he said. “There are so many funds that are saying, oh, VR is the next hot thing, or drones, let’s create a fund just focused on drones. I just think there [are a lot] of investors chasing those hot areas. But you’ll see us investing in areas that are a bit underserved so that gives us a chance to have a competitive advantage.”