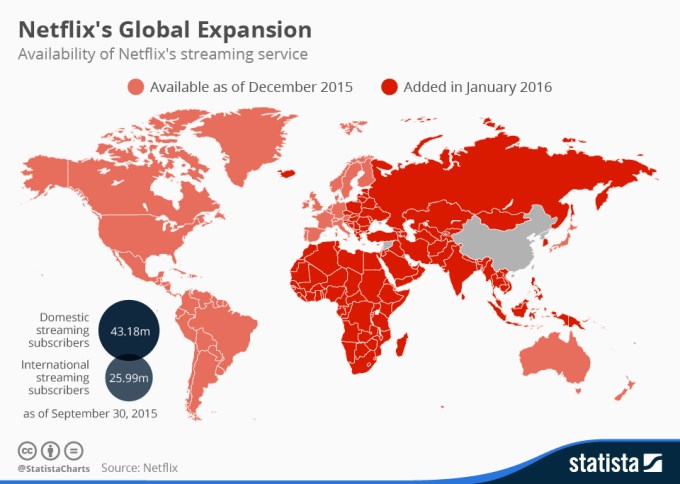

Netflix is now in Africa. In one fell swoop, CEO Reed Hastings took the company’s presence from 0 to 54 countries on the continent with his CES global expansion announcement.

The move was a surprise to Africa and its nascent video-on-demand (VOD) markets. Industry chatter and local African media pointed only to South Africa as a maiden entry point.

So what happens when the world’s largest streaming video service switches on for over a billion people across an area larger than the U.S., China, and India combined?

Here’s a primer on the backdrop and issues the U.S. streaming media pioneer will face on its Africa journey.

Netflix and Africa’s VOD Value Proposition

A number of factors are shifting Africa’s priority for big global businesses. The Cliff’s notes version goes like this: record FDI, diversifying economies, and modernizing infrastructure are linking to one of the world’s fastest growing consumer markets expected to spend $2 trillion annually by 2020.

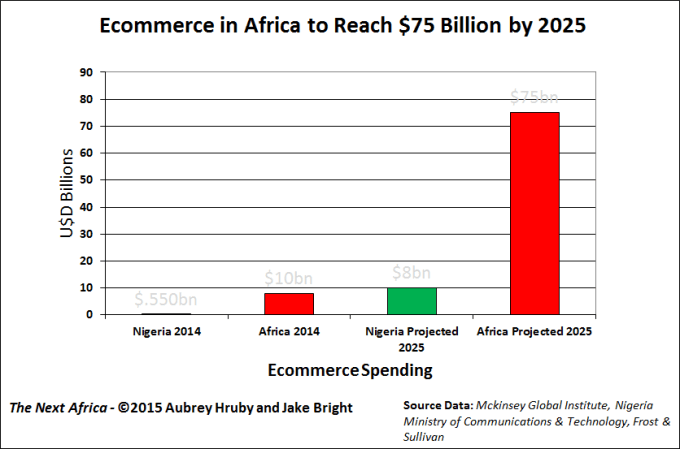

Whether Netflix’s move was driven by hard analysis or to simply fill in more red on its global map, Africa’s business and demographic trends create a compelling case for VOD. Increasingly, the continent’s expanding consumer spending is going digital–a portion of it to purchase creative content and VOD capable devices.

Smartphone penetration in Africa is rising: up to 34 percent in South Africa and 27 percent in Nigeria, its largest economy and most populous nation. And tablet ownership is becoming more common and accessible. Nigerians now purchase them through ecommerce startups Konga, Jumia, and MallforAfrica and South Africans at local Apple iStores.

Though expensive, Pay-Tv service (a VOD precursor) has also grown in Africa: from 5 million legal subscribers in 2010 to 18 million in 2015, according to Sylvain Beletre of telecoms and broadcasting consultancy Balancing Act.

Unfortunately, data on Africa’s streaming movie markets is hard to find. “Everyone’s attempting to put revenue numbers on VOD…but reliable stats are not yet there. Most of the players are still not releasing traffic or sales figures,” said Beletre.

Netflix and Africa’s VOD Landscape

Photo courtesy Flickr/Joyce S. Lee

Netflix enters a market with existing VOD providers–notably a few VC backed startups and several platforms connected to Africa’s largest media and telecoms companies. The continent’s emerging subscriber bases are largely limited to South Africa, Nigeria, Ghana, and Kenya.

Africa’s VOD marketplace has high demand for local content and Nigeria’s Nollywood film industry is the second in the world by volume.

The industry was valued at $3.3 billion in 2014, however, less than 1 percent of that revenue is captured through official sales and royalties, largely due to DVD pirating. Subscription VOD presents an opportunity to take Nollywood to another level through better distribution and monetization, which in turn could increase production budgets and quality.

Emerging VOD startups include Nigeria’s iROKOtv (backed with $24 million in VC) and Buni.tv in Kenya.

In South Africa, Naspers recently launched Showmax, while telecoms giant MTN rolled out VU–each planning to expand to other countries. Common to each of these VOD services are subscription offerings that include a mix of international, Nollywood, and local content. All four have also begun producing proprietary programming.

As for price points, monthly subscription rates (≈ with FX) range from iROKOtv’s $1.50, $5 for Buni.tv’s Buni+ service, and about $6 for Showmax and VU.

Netflix is offering its standard U.S. plan across Africa, starting with $7.99 basic service, according to Joris Evers, the company’s Head of Communications for Africa. Payment can be made by major credit card, PayPal, or iTunes, he explained on a telephone call.

Evers confirmed Netflix will offer African subscribers a curated selection of its U.S. library of original series, documentaries, films and comedy. “Orange is the New Black” and “House of Cards” are not currently included in that package due to global rights issues, but Netflix is working to acquire those rights.

For now, Netflix will have a “point-of-presence” data center only in South Africa, “to provide ISPs a way to connect directly to Netflix,” said Evers. While the company has no immediate plans to prioritize African content, Evers underscored Netflix’s practice of licensing and producing quality content around the world, including Netflix produced Beasts of No Nation, which was shot in Ghana.

African VOD users overwhelmingly prefer Nollywood content and Netflix offers almost no Nollywood. Netflix in Nigeria will likely be more of a 1 percenter product: too expensive for the average person due to data costs. Jason Njoku, chief executive, iROKOtv

African tech experts, such as TechCabal’s Bankole Oluwafemi, play down predictions Netflix will instantly crowd out Africa’s fledgling VOD upstarts.

“In the short term I don’t think it will impact the leading VOD services like iROKO at all,” he said, naming price and content considerations. Oluwafemi also noted much of Netflix’s African market segment already accesses the network using VPN services.

In separate conversations, iROKOtv CEO Jason Njoku and Buni.tv CEO Marie Lora Mungai shared views that Netflix would have “little impact” on their business.

“African VOD users overwhelmingly prefer Nollywood content and Netflix offers almost no Nollywood,” Njoku said, noting iROKO is the largest licensor and distributor of Nollywood in the world. “Netflix in Nigeria will likely be more of a 1 percenter product: too expensive for the average person due to data costs.”

Some Nigerian ISP’s have already broken out special Netflix data bundles priced at around $2 for 2 hours of streaming. That makes Netflix bingeing a fairly expensive proposition in Nigeria, at around $20 – $40 a day.

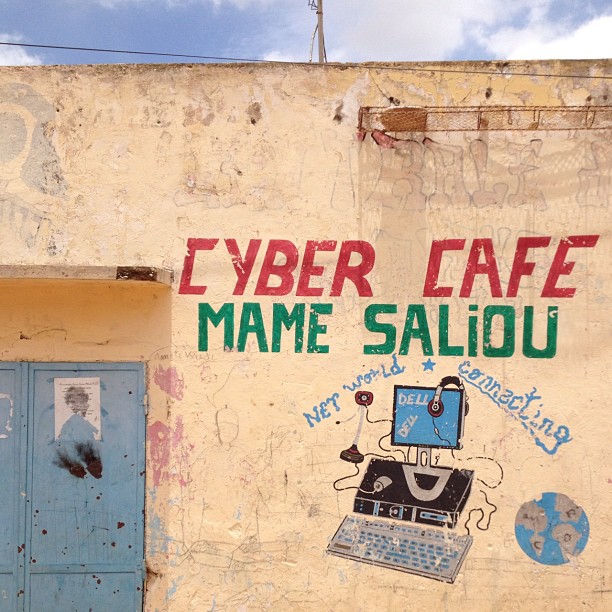

This raises the central hurdle for Netflix and all VOD services in Africa. Selling a product that requires fast and affordable internet on a continent that has the least of both in the world. Africa’s burgeoning tech sector is promising, but internet access continues to be its weakest link.

IROKOtv recently moved its Africa platform away from streaming entirely, shifting to an android file download model. “We found for our clients maintaining continuous streaming on 3G is just not possible. Data is too expensive,” said Njoku. Netflix’s Evers confirmed the company is developing new encoding and compression technology for to stream higher quality at lower bitrates.

What to Watch Moving Forward

Given Africa’s wanting ICT grid and sheer enormity, it’s going to be a long haul before Netflix scales to market or exerts its anticipated influence.

Content, connectivity, and cost will be core factors for Netflix and other digital TV providers in African VOD. The U.S. based company will face some tough decisions around its one-size-fits all model, compared to African VOD providers who are adapting to local preferences and realities.

Though its product infrastructure is largely remote, Netflix could create ripple effects that improve Africa’s ICT grid. It will certainly change consumer demand around ISPs and smart device makers. The U.S. VOD company could also impact Africa’s fintech environment, if for example, it partners with local mobile money leaders, such as Kenya’s M-PESA. Time will tell, but Netflix’s entry could prove a milestone for IT in Africa.