With Project Loon and Internet.org Companies like Google and Facebook are spending hundreds of millions of dollars each to ensure that everyone on the planet has access to the internet, but with a modest $4.3 million in equity and debt the new startup PayJoy is solving an equally important problem — getting actual smartphones into those people’s hands.

Co-founded by Mark Heynen, Doug and Tom Ricket, and Gib Lopez, PayJoy is an attempt to resolve the financing problem faced by the nearly 2 billion people around the world who have access to internet connectivity but currently can’t afford to buy a smartphone.

It’s essentially a credit problem; and it’s one that Doug Ricket first identified in another industry entirely — solar energy. After working with Heynen at Google on the initial Google Maps attempts to digitally map parts of Africa and other emerging markets, Ricket returned to the continent to distribute solar power products in Gambia.

While he was there, he came up with a new system for paying for the products, which essentially involved setting up installment payment plans for folks who couldn’t afford to pay. The model took off.

Ricket returned to the U.S. and after a stint at Stanford’s business school decided to apply the same model to the problem of smartphone connectivity.

For Ricket and his co-founders internet access isn’t as much of an issue for the thin-file and sub-prime customers that could use smartphones, but are stuck between a rock and a hard place when it comes to buying them.

Most of those customers, especially in the U.S. (more specifically Los Angeles) where the company is making its initial push, either have to pay cash up front for their smartphone, or they are forced to turn to the tech equivalent of payday lenders who require up to 500% interest on their loans to buy a smartphone.

“The next two billion people aren’t going to have credit, and the $100 functional smartphone doesn’t exist yet,” says PayJoy co-founder and chief business officer, Mark Heynen. “For the next 2 billion people, the smartphone is going to be their first computer.”

PayJoy launched its services in Los Angeles at Boost Mobile retailers and is looking to expand across California and eventually the rest of the U.S. with its latest round.

Using PayJoy software, a would-be customer can give a store their driver’s license, Facebook identity and a phone number, and PayJoy will front up to 80% of the cost of a phone at 50% to 100% interest. And while that number may seem high, it’s lower than the up to 500% annual interest that customers would pay using other lenders.

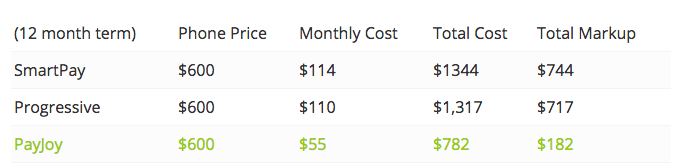

Payment plan cost analysis between leading lenders and PayJoy

“There are 80 million people in the U.S. who don’t have access to credit,” says Heynen.

If a customer can’t pay their monthly installment, the phone locks until payment has been received.

So far, PayJoy has raised $2.3 million in initial funding led by Metamorphic Ventures and Red Swan Ventures, with participation from prominent angels, and another $1 million in venture debt for its operational costs.

To finance its lending operations the firm has turned to a novel investment vehicle. Through a $1 million lending fund which closed yesterday, investors can finance the distribution of smartphones to people who otherwise might not be able to afford them. “It’s the first fund that’s completely dedicated to phone contracts and device loans,” says Heynen. Annualized returns are 20% to 25%, according to Heynen, which in an era of low yield, is pretty phenomenal.

Beyond their financial returns, the lending fund is also a clear social good.

“When we think about shifts in technology and the economy, it has become clear that the smartphone will be at the epicenter of work and education for the next decade,” wrote David Hirsch, Metamorphic Ventures founder and managing director. “However there’s still a huge barrier to entry in buying a smartphone for much of the population. Payjoy’s unique software-enabled financing solution completely erases this barrier and can significantly improve people’s lives.”

Initially, the company will continue to focus on expansion within the U.S., but there are opportunities for the company in Mexico, Brazil, Indonesia and Malaysia, all in the near term, according to Heynen. “Very quickly i can imagine us rolling out in foreign markets,” he says.

It all comes back to the numbers for Heynen. Four billion people on the planet have mobile phone subscriptions but only 2 billion have smartphones.

“For the majority of the latter two billion, they have access to networks if they want to use them and they have access to wifi if they want to use that. There’s a primary, or a priori, problem to solve there which is to make sure everyone has devices that they can use in a good way, and that’s the problem we’re trying to solve,” he says.