New lending companies are now a dime a dozen in the U.S. with a startup launching seemingly every week to tackle some problem associated with the industry.

And while millennials seem to have taken the advice from Shakespeare that no one should borrow or lend money, startups still want to give them a taste of that sweet, sweet credit.

The latest company to tilt against the lending windmill with a solution for borrowers who might not have the best credit rating — or who might not have any credit rating or credit history at all is Backed.

Of the dozens of lending companies looking to carve out chunks of the millennial market (given their notorious disdain for traditional credit cards), Backed has a particularly unique spin. To reduce the interest rates on their loans, Backed borrowers can line up sponsors with better credit histories to sign on to the loan as well.

For co-founders George Popescu and Gilad Woltsovitch the problem of accessing credit isn’t academic. ”

When I came to the U.S., I had no credit score,” Popescu says. “The idea is to help millennials build their credit and have their parents underwrite them to build credit.”

Woltsovitch calls these millennials the “credit invisibles” who haven’t had an opportunity to build a credit score, because they haven’t been able to even get access to credit lines to begin the process.

“If you have a thin credit score we allow you to bring in a backer with a higher credit score to build in a two-step default mechanism… and we’re able to price the loans in a much fairer way,” Woltsovich says. “The main differentiator between a backer and a co-signer is that you’re responsible for the full amount of the loan as a co-signer and you’re only notified after the credit score is damaged.”

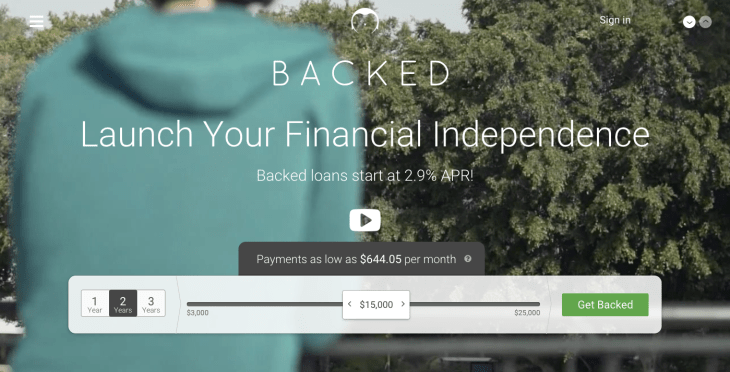

Backed connects borrowers with lenders offering loans of anywhere between $3,000 and $25,000 at interest rates that average roughly 11%.

The company has raised over $2 million in seed financing so far, from a collection of angel investors, iAngels, and Cyhawk Ventures, and is now accepting applications for loans in New York, New Jersey, and Florida.

Backed will use half of the funds to further develop its product and hire new staff and the rest for customer acquisition.