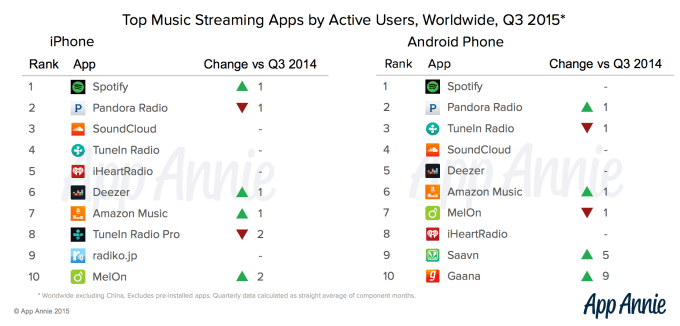

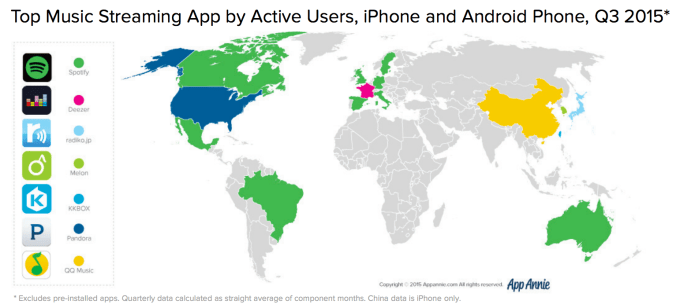

Spotify is the world’s top streaming music service in terms of active users, downloads and revenue, according to a new music-focused report out this morning from App Annie. However, while Spotify bested last year’s top streaming music app Pandora Radio from a global standpoint, Pandora is still strong in the U.S. where it remains the number one streaming service by active users on iPhone and Android.

In other markets, niche players have been carving out their own audiences.

For example, Deezer is the top music service in France, even while Spotify eats up European market share. And in India, apps like Saavn and Gaana have been climbing into the top ten on Android. LINE Music and AWA Music are growing in Japan, and South Korea’s top app, MelOn, also moved into the top 10 by worldwide active iPhone users – even though that country is traditionally an Android stronghold.

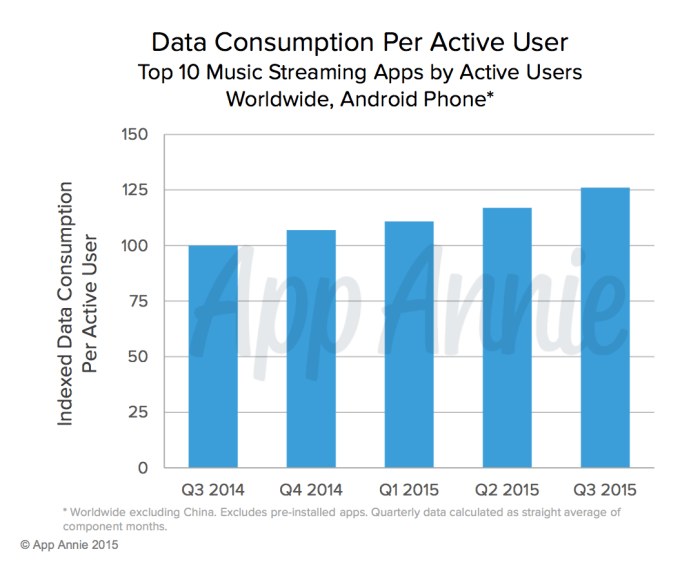

The growth potential for all these services is notable, and continuing to accelerate, the report also notes. On Android phones, for example, data consumption on cellular networks and Wi-Fi combined within top music streaming apps growing 25 percent from the third quarter of 2014 to Q3 2015.

Spotify, in particular, still has room to expand its already sizable install base, App Annie believes. Already, it leads downloads across most of Europe, and in some emerging markets like Mexico. But in the U.S., it faces stiffer competition with Pandora, while other emerging markets may end up favoring local services as their population comes online via mobile phones.

In related news, Spotify itself released new metrics today illustrating its footprint: the company said that 74 million listeners streamed over 20 billion hours of music in 2015, and its personalized “Discover Weekly” playlist reached 1.7 billion streams in 5 months. There are also now 2 billion playlists on the service.

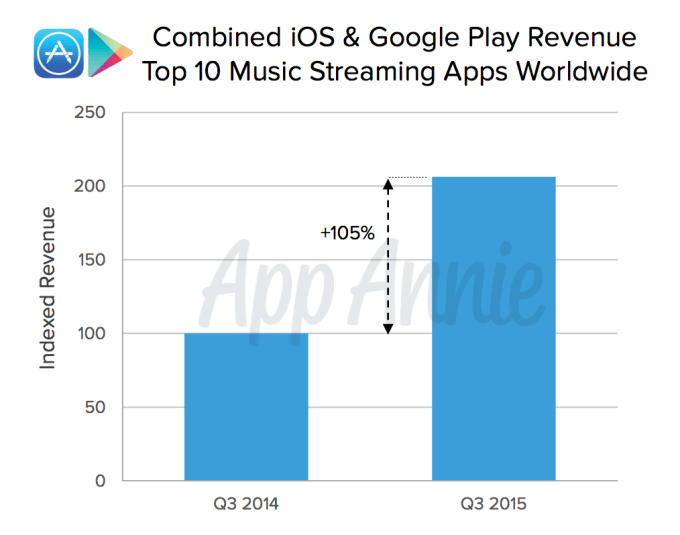

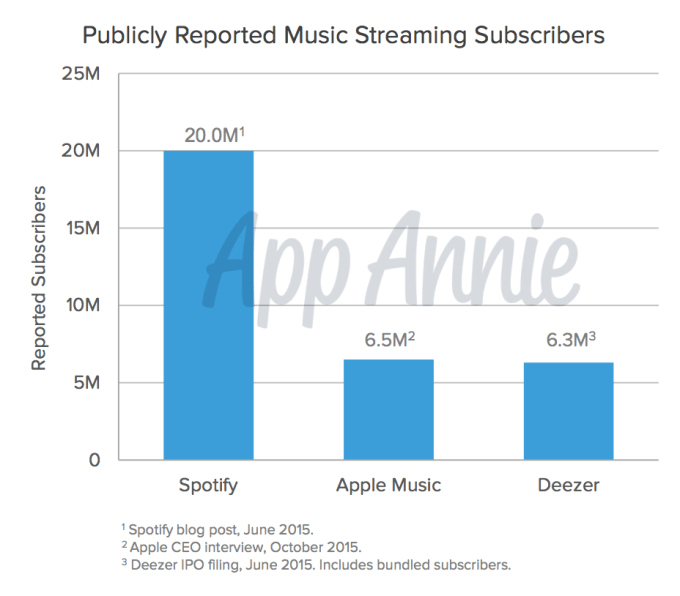

As more users turning to music streaming services on their phones, app store revenues have been growing as well. Although failures like the shutdown of Rdio indicate how hard it is to compete in this space where margins are slim, and app stores eat into those meager revenues, the money made from subscriptions sold through in-app purchases has more than doubled from Q3 2014 to Q3 2015, says App Annie.

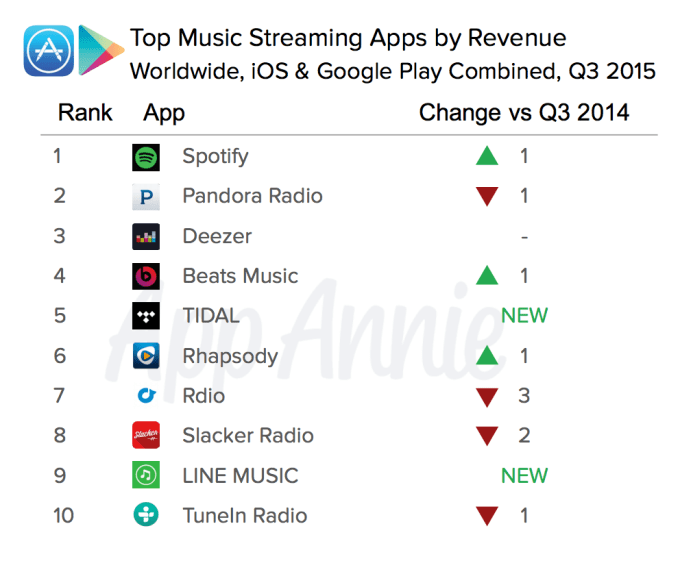

Ranked by revenue, Spotify followed by Pandora still leads the way, and the top 10 chart is filled with similar on-demand offerings, taking up 7 out of the 10 spots worldwide. Even newcomer TIDAL whose future is still iffy managed to place on this chart in position #5. And as #7 Rdio has now been bought by Pandora, the future looks to be increasingly focused on on-demand streaming.

How everything plays out in the long term has a lot to do with the unique dynamics in the various markets. In the U.S., it’s more about a shift to music streaming being driven by younger users – on average, those under 25 consumed 15% more data than those aged between 25 and 45, and 65% more than users over 45.

However, in overseas markets, other changes are impacting the landscape. For example, mobile music streaming in Japan was historically driven by internet radio and services from operators like KDDI and NTT DoCoMo, but more recent launches from local companies like AWA Music and LINE Music have altered the landscape, pushing data consumption on streaming apps up almost 4 times between Q3 2014 and Q3 2015.

Meanwhile, in emerging markets, users coming online for the first time may turn to local services for streaming music.

In addition, this past year, big players like Google and Apple have also stepped into the fray, the latter with Apple Music, which has 6.5 million paying subscribers and 15 million users. That already makes Apple Music a notable competitor to Spotify, based on the publicly reported number of subscribers.

Meanwhile, Google’s new YouTube Music app just launched in the U.S., along with YouTube Red, which integrates Google Play Music with YouTube’s music selection. And of course, YouTube, being one of the most downloaded apps of all time, should not be ignored, either.

As the market matures, companies may turn to other potential revenue streams as well, the report notes. For example, Pandora acquired Ticketfly for $450 million, and Spotify has been moving recently to help direct users to local events as well. It even launched a concert recommendation engine in November, and may soon be heading into ticket sales. Apple Music’s “Connect” platform, which lets musicians communicate with fans, is also poised for further expansions into ticket and merchandise sales.