Snapchat is worth a lot less this month than it was last month.

Fidelity, one of tech’s most active late-stage cross-over investors, recently decided that Snapchat is worth about $23/share, instead of the $30/share initially estimated.

It’s part of an ongoing trend of cross-over investors trying to figure out exactly what unicorns are worth.

But what does that mean for the average entrepreneur?

Not much.

The bubble didn’t pop. It just landed back on our planet. The best thing you can do for yourself, your company, and your future investors is build a business that works in real life.

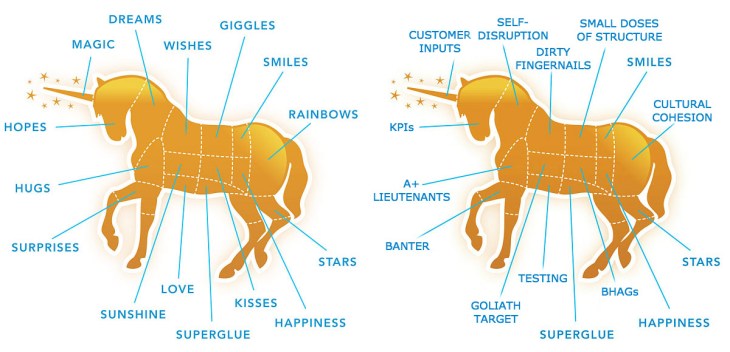

Where Unicorns Come From

Unicorns never used to exist. The IPO market today has no resemblance to the past. Intel IPO’d at $6.8M, chump change by today’s standards. Oracle raised $55M during their IPO. Yet Box raised $175M and, just recently, Square raised $234M.

Why did this happen? Because investors have determined that it’s easier to keep a company private during its initial rapid growth phase, then let it go public when it’s more mature. Intel didn’t have anyone but the public market to finance its growth. Today’s unicorns have—or had—large funds like Fidelity and T. Rowe Price writing large checks beforehand.

Now these investors are trying to figure out what unicorns are really worth. A lot of tech IPOs have underperformed, and institutional investors realize they need to value companies appropriately before they go public. SEC questioning of mutual funds’ valuation practices makes the pressure even more acute.

Writing Down Unicorns Benefits Everyone

Although unicorn valuations contained anti-dilution provisions that still enabled late-stage investors like Fidelity to make money, they still skewed the market to the point that everyone is now reconsidering their assumptions.

Inflated valuations rippled down to the seed stage, influencing early-stage VCs to fund companies based on qualitative metrics like number of users, and also assume that valuation based upon wild growth rates would continue forever.

These are not the assets of a viable business, and now that IPO thresholds are being reconsidered, everyone will benefit. Placing an honest dose of realism into the top of the market will lead to accurate valuations all the way back to the seed stage.

Entrepreneurs shouldn’t change a thing. Do what you’ve always done. Build a company with real customers and real revenue.

Also know that the lack of IPOs and the return of venture-backed company valuations to market reality should enable the M&A markets to come back to life. Strategic acquirers, who have mostly sat on the sideline watching the high prices of innovative tech companies, should now be willing to engage in more M&A activity. This will be a real positive for entrepreneurs and VCs alike.

Unless you’ve geared your entire startup to be valued based on momentum—amassing high rates of growth with negative margins—unicorns coming back to Earth won’t affect you. Grab a bag of popcorn and watch the unicorn valuations unwind.