Tubi TV, a company offering a free alternative to paid subscription video services like Netflix, is announcing today new investments from two major Hollywood studios, MGM and Lionsgate, who have joined in the San Francisco-based startup’s $6 million Series B round of financing. The round was led by new investor Cota Capital, and included participation from existing investor Foundation Capital, bringing Tubi TV’s total raise to date to $10 million.

As a part of the new funding, MGM and Lionsgate have licensed hundreds of titles from their respective catalogs to the streaming service.

Along with the investment, Sandy Grushow, former Chairman of Fox Television Entertainment Group and CEO of Phase 2 Media, has also joined the board.

Launched under the name AdRise in late 2011, the company was originally focused on developing an ad platform for connected TVs and other devices. But, explains founder and CEO Farhad Massoudi, the team changed its direction as media companies began to launch their own streaming channels in response to the rise in cord cutting.

But Massoudi believes that there is a limit to how many subscriptions consumers can manage.

“We didn’t think consumers wanted to subscribe to a lot of subscription channels…we thought we could aggregate content from a lot of different companies and be the best destination for free TV streaming,” he says. Some thought this would be an impossible task, Massoudi says, but he is proving them wrong.

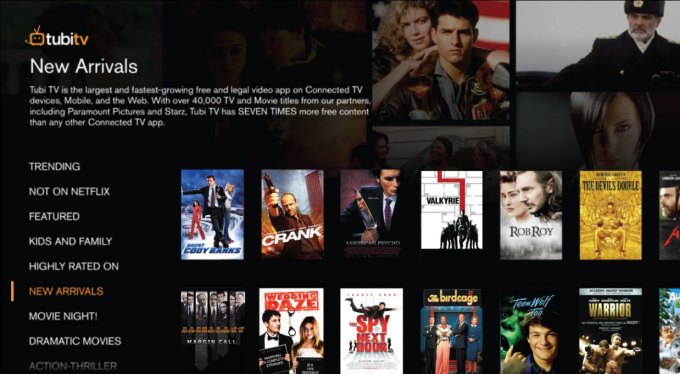

Today, Tubi TV has over 200 content partners, including Paramount, which Tubi TV added in March.

The Paramount Pictures deal provided Tubi TV with 50 new titles per month, including movies like “Top Gun,” “Basic Instinct,” “Total Recall,” “Star Trek: The Final Frontier,” “The Hunt for Red October,” and other releases from 2013 through 2014. At the time, the company said it had over 20,000 hours of movies and TV shows.

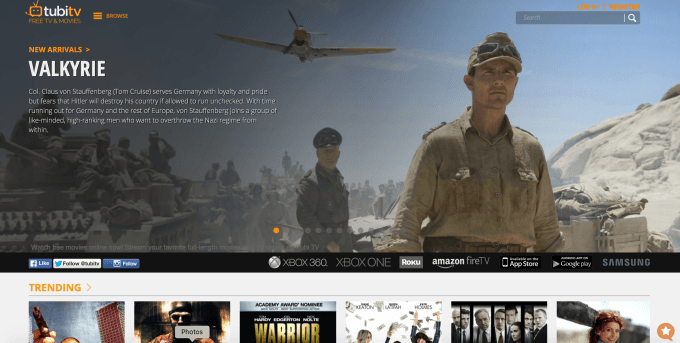

Today, Tubi TV has doubled that number to 40,000 hours, the CEO says. And while Tubi TV isn’t disclosing the size of MGM and Lionsgate’s combined catalog, it’s significantly larger than what the company gained through the Paramount deal. “Hundreds of hours” of titles are coming in, with new titles being added on a weekly basis.

Some of the titles from Tubi TV’s new studio partners include “Crash,” “Rain Man,” “The Hurt Locker,” “Pink Panther,” “Fargo,” “American Psycho” and “Midnight Cowboy,” to give you an idea of what’s in store.

The strategic investment may also open the door to expanded licensing options in the future, though the company could not disclose its future plans.

The startup itself is not yet profitable, but is growing at a fast pace thanks to its support for a range of streaming platforms, including mobile devices, gaming consoles, and streaming media players like the Apple TV and Roku. Its app has been installed over 20 million times, and Tubi TV sees “millions” of monthly active users who spend over an hour per session on its service. And that audience has grown over 400 percent since the beginning of the year.

Through a combination of direct sales and programmatic means, Tubi TV monetizes its content with ads that appear much like they do on Hulu or traditional television. The ads range from 15 seconds to 2 minutes, depending on the content. And Tubi TV has its own technology to make sure they don’t interrupt conversations in the middle of a movie.

“Advertisers get to reach an audience they can no longer reach through traditional TV commercials – the cord cutters and cord nevers of the world,” explains Massoudi. “That’s a big deal,” he says.

Tubi TV’s viewers are also millennials, with household incomes of around $100,000, and tend to be tech-savvy individuals, the company found. And the user base is also evenly split between male and female viewers.

With the additional funding Tubi TV plans to grow its 40-person team, which already tripled over the past 6 months, mainly with hires in engineering and marketing.

Despite its growth and its “free” appeal, the challenge for Tubi TV will be competing against the quality content found on the subscription services. To throw out a number Massoudi also likes to cite: a Nielsen study found that over 40% of U.S. TV homes have at least one subscription video service, and that continues to grow.

That means that Tubi TV can’t only target those who refuse to pay for streaming movies and TV – it will also have to appeal to those who can’t find anything good to watch on Netflix, either. (Or whatever their subscription service of choice may be.)

And with the big service providers like Netflix, Amazon, Hulu and HBO investing in their own quality original content, while also competing on high-profile exclusive deals, the problem of finding “nothing good” to watch on a paid streaming service won’t likely be a common one.