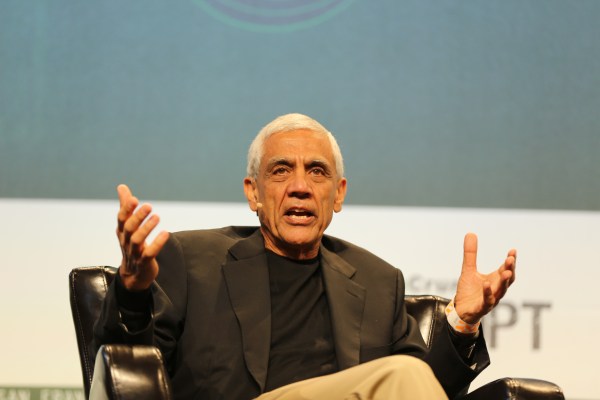

Vinod Khosla has stepped down as a director of the San Francisco-based payments company Square as it prepares to go public.

Media outlets Business Insider and Forbes reported on the news earlier today, citing an amended SEC statement.

Khosla confirmed the development shortly afterward on Twitter:

Ten-year-old Khosla Ventures, the namesake firm of the legendary VC, owns 17 percent of the company. Khosla joined the board in 2011 but prefers “not to serve on the boards of directors of public companies,” states the new filing.

It’s an interesting, and somewhat contrarian, stance to take. Venture capitalists often serve on the boards of their portfolio companies long after their IPOs. John Doerr of Kleiner Perkins Caufield & Byers remains on the board of Google 11 years after it first became a publicly traded company, for example.

A smaller subset of VCs join the boards of publicly traded companies they didn’t fund as private companies, too. Marc Andreessen spent six years as a director on the board of eBay, stepping down last year; he still sits on the board of Hewlett-Packard, a post he has held since 2009.

Khosla meanwhile remains laser focused on the world of startups, according to Keith Rabois, who spent two-and-a-half years as the chief operating officer of Square and is today an investor at Khosla Ventures. We talked with Rabois last week about Khosla’s role at the firm, and Rabois described Khosla as “super involved. He still probably works harder than the rest of us. Many entrepreneurs we work with get calls at 10 p.m. He works at least six days a week.”

Added Rabois of Khosla: “He’s extremely involved in many, many, many companies and has probably led the most investments over the last three years or [he’s at] least among the top two [most active investors] among our partners.”