If you follow the venture industry, you’ve probably heard about the barbell effect a lot in recent years. It’s a metaphor for the many individuals and small venture funds investing in lots of seed-stage companies and — at the opposite end of the spectrum — the venture, growth, hedge and mutual funds that have enormous amounts of money to deploy and have driving up the valuations of maturing startups.

According to a new third-quarter report from CB Insights and KPMG, that barbell is beginning to look more like a ski slope, with far fewer small seed fundings getting sewn up yet (and seed deals started to look increasingly like traditional Series A and even Series B deals), yet no apparent slowdown at all mega-financings. In fact, 23 new billion-dollar-plus companies were created in the third quarter alone, up from 12 in the third quarter of 2014.

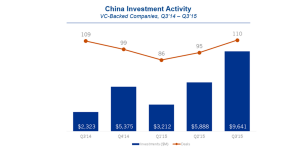

Other interesting points from the report: Asia is ascendant. At least, it’s still in the midst of a massive funding bump, despite China’s IPO shutdown.

As for Europe, it’s growing but it’s “much more tempered,” says CB Insights founder Anand Sanwal. “The good news for Europe is its growing-seed stage activity; it should portend good things for the ecosystem as some of those companies mature.”

If you’d like a look at the whole (free) data-studded report, you can check it out right here.