In the early 1960s, Scottish engineer James Goodfellow was given a problem to solve. A colleague had invented a way to insert a card into a machine and get money out. Goodfellow’s task was to figure out a way to ensure that only the card’s legitimate owner could use these new “ATM” machines to obtain cash. So he created the personal identification number, what we call the PIN, the most secure implementation of card access the world had ever seen. Goodfellow was awarded the patent on the PIN and, later, Queen Elizabeth II awarded him the Order of the British Empire.

Point of sale payments technology has changed quite a bit since the 1960s, and although PINs still play an important role in securing many transactions, we are moving technology forward with incredible advances in security. Recent advances in payment technology give us the convenience of paying with our phones and watches, our credit and debit cards contain embedded microchips that will essentially wipe out counterfeit fraud and we can now initiate, verify and secure a payment with the swipe of a finger.

What’s next for payments security technology? How do we know it’s really you swiping the finger, dipping your card or pushing the buttons?

The generation that brought the obsession of snapping facial photos, uploading to social media channels and terming it “selfies” has unknowingly launched a new platform of cyber security for the world, a kind of biometric termed, “pay with your face.” This is a fitting legacy for millennials, who impart knowledge one click at a time.

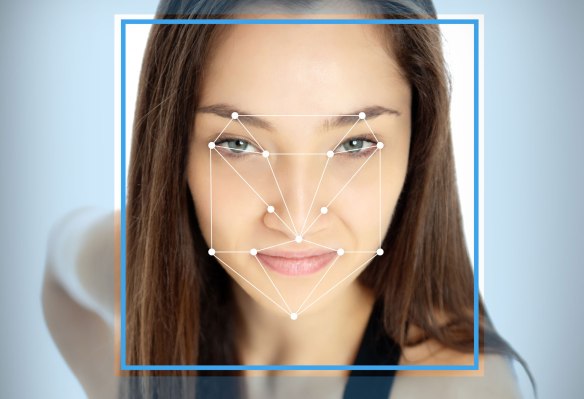

The answer to payments security is found in the mirror — and a not-so-little something called live-time facial recognition and biometrics social data mining.

Socure, an industry leader in identity verification solutions, just introduced Perceive, its patented real-time facial biometrics product that instantly matches media profile data, with the potential to end the need for passwords.

Perceive works with the click of a front-facing camera on any smartphone, instantly proving who you are by recognizing facial features.

We live in an age of unprecedented technological discovery and change.

Socure’s Social Biometrics Platform, which is already in use by financial institutions in more than 175 countries, provides analytics, assessing information about you from other public online sources, producing a social biometric profile, matching to your photo, and generating a score to determine the authenticity of your identity.

The system simultaneously performs “liveliness checks” that prevent the spoofing of a photo or video animation of a face. Within milliseconds, results are returned with a significant degree of accuracy and confidence.

Whether you have an established credit history or not, the one thing most of us have, especially millennials, is an online social platform presence. Biometrics data mining for payments security also reaches the unbanked crowd, those who have healthy online histories but might not necessarily use financial institutions or carry proper government-issued credentials.

The 2016 Olympics will provide a powerful platform upon which to promote biometric payments technology to the mass market. Visa recently announced that Team Visa Rio, a group of Olympic hopefuls, will promote wearable and biometric payment solutions during all events leading up to next year’s Olympics. Among the athletes being sponsored are such heavyweights as America’s Ashton Eaton, Canada’s Ryan Cochrane, Korea’s Kim Jae-Bum and many others.

Visa has ramped up its exploration of mobile payments and biometric security in other ways with an announcement of a new biometric specification for transactions involving EMV or “chip” cards. Other established players are also joining the biometrics trend. MasterCard is in a trial phase for facial and fingerprint biometric payments in Europe and the United States, and Verifone offers a biometric sensor in its VX 520 point of sale terminal.

We live in an age of unprecedented technological discovery and change. If recent data breaches have taught us anything, it’s the need for more secure payments technologies as cybercriminals become increasingly more sophisticated. As “chip” cards wipe out counterfeit fraud, industry experts anticipate an increase in online fraud, which requires technology beyond chip cards to prevent. Multi-factor identification methods, like biometrics and social data mining, are the future of payments.