Indie developers were rightly up in arms at the recent changes to the place of supply rules for B2C sales — deftly coined #VATMESS by Twitter wags.

The rules were well-intentioned — it was not right that Apple, Google and Amazon could set up shop in Luxembourg, thus gaming the tax system and disadvantaging EU competitors. However, the implementation was cack-handed — particularly the absence of a minimum threshold, which means that the compliance burden for indies is disproportionate (a threshold may now be implemented, but could take years).

This is old news, I hear you say, and already covered by TechCrunch, among others. And you would be right, as the EU rules have now been in place since January 1st and businesses will be making their third VAT MOSS return on October 20.

However, the “successful” roll-out of VAT MOSS has led other countries to formulate plans along the same lines as the EU scheme. That golden goose is too damned tempting.

It took Europe the best part of a decade to devise and implement VAT MOSS, with much internecine squabbling among the 28 member states along the way (hence the lack of agreement over a minimum threshold, which was reputedly being pushed for by the U.K. and others).

There will be no such delays for their international counterparts, as the ground has been paved by the EU; there are no international negotiations required, and countries are keen to protect their national tech champions and collect more tax revenues.

Therefore, for those who want to sell their digital services legally, this means more compliance, more returns and incremental cost (as a number of jurisdictions require you to have a local accountant file your returns and deal with any investigations).

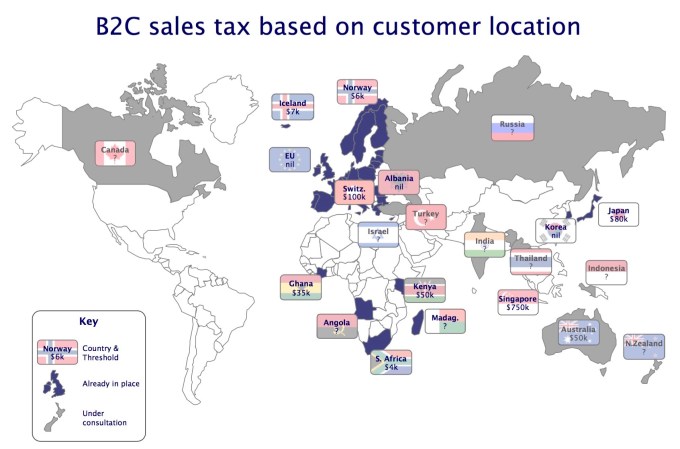

So, here’s a summary of the EU VAT MOSS lookalikes; as you will see, many of them have no or pitifully low thresholds — once again, hammering the indies. First the already launched ones:

| Country | Tax introduced | Approx threshold (USD) | Local accountant required? |

| Switzerland | a while back | $100k | Yes |

| Singapore | a while back | $750k | Yes |

| Ghana | a while back | $35k | Yes |

| Madagascar | a while back | ? | Yes |

| Norway | July 2011 | $6k | No |

| Iceland | Nov 2011 | $7k | Yes |

| Kenya | Sept 2013 | $50k | Yes |

| South Africa | June 2014 | $4k | Yes |

| Angola | Nov 2014 | ? | Yes |

| Albania | Jan 2015 | nil | Yes |

| South Korea | July 2015 | nil | Yes |

| Japan | October 2015 | $80k | Yes |

In the pipeline:

| Country | Launch date | Approx threshold (USD) | Local accountant required? |

| Switzerland | January 2017 | $100k on a company’s global sales | Yes |

| Australia | July 2017 | $50k | ? |

Similar taxes are under consultation in Canada, India, Indonesia, Israel, New Zealand, Russia, Thailand and Turkey. And that list will continue to grow.

The greatest benefit of technology businesses used to be that there were no physical barriers to selling your app, game, e-book or mp3 to a global audience. It is a shame that international tax regimes are conspiring to stifle that.