Delivery Hero, the European online take-out ordering behemoth that was recently valued at $3.1 billion by investors, is busy building a new logistics and food delivery company.

Valk Fleet is a B2B offering that provides technology and a fleet of drivers to power the food delivery of restaurants and take-outs that want to outsource delivery. Founded around May this year, the company is already up and running in four countries, according to sources. Most notably, these include the U.K. and Germany.

Unlike premium restaurant ordering and delivery startup Deliveroo (backed by Index Ventures) or its many competitors — including Take Eat Easy (backed by Rocket Internet’s GFC) and Delivery Hero’s own Foodora (which it recently acquired from Rocket Internet) — Valk Fleet is a purely B2B proposition.

It enables independent restaurants and takeouts, as well as mass-market chains, to offer delivery via Valk Fleet’s pool of drivers and through its logistics tech, regardless of where those orders come from.

It enables independent restaurants and takeouts, as well as mass-market chains, to offer delivery via Valk Fleet’s pool of drivers and through its logistics tech, regardless of where those orders come from.

These could be via a restaurant’s own app/website or through one of the many online takeout aggregators, including Delivery Hero itself (called Hungryhouse in the U.K.) or any of its competitors, such as Just Eat.

In other words, Valk Fleet doesn’t have a consumer-facing destination (or app) and can be considered more along the lines of logistics and delivery as a service. It also appears strikingly similar to Germany’s Food Express, which Delivery Hero recently acquired invested in.

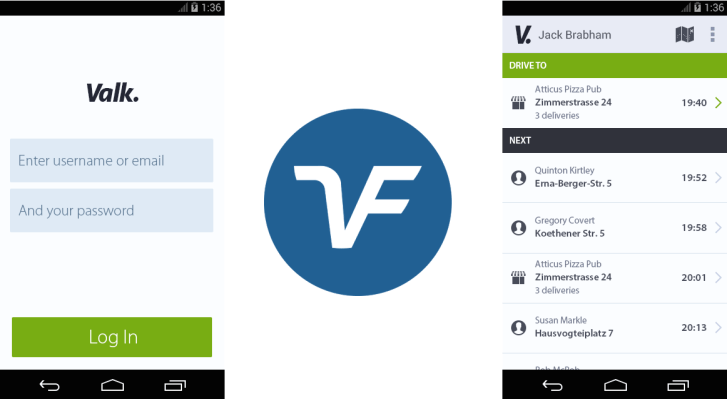

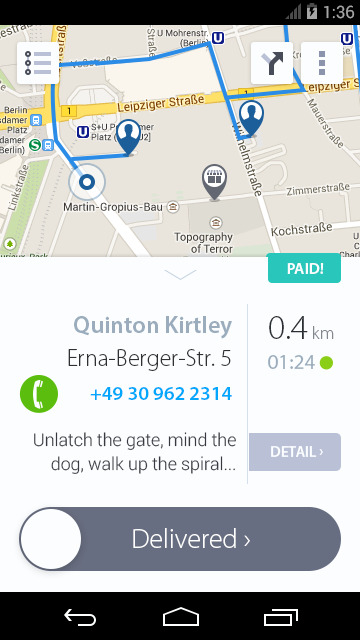

The Valk Fleet Android app for drivers/couriers is available for download in the Google Play store. I also understand that restaurants are given a tablet and/or app to place delivery requests.

Meanwhile, Valk Fleet has been — and continues to be — on an aggressive hiring spree, not least in the U.K. where it recently advertised for the post of Operations Director. The job ad described the company as:

…a young company growing rapidly in several countries. It is our mission to improve the food delivery experience by taking over the activity of delivering food from the restaurant and professionalizing it on all levels. Our proprietary technology automates the delivery process, and we hire and train a professional fleet of drivers to deliver the food in the best and fastest way possible. We are an extremely passionate team and our aim is to change the food delivery business fundamentally in the near future.

It also cites Valk Fleet as a “well funded International startup within the food delivery segment” — presumably in reference to Delivery Hero — and says it has ambitions to scale nationally and deliver 1 million orders per month across the U.K. in 30-40 cities.

“As part of our scaling plans we are searching for a strong Operations Director who will assist in the growing and setting up of the business, when fully developed you will be required to manage in excess of 4-5000 drivers and all necessary support staff across the business,” the ad reads.

So who can be considered as Valk Fleet’s competitors? On the one hand it appears to be both complementing and competing with itself, in the sense that the delivery service is consumer-facing agnostic.

B2B customers can be restaurants or chains who are either listed on Delivery Hero or sell directly online and through their own consumer app or via a competing online take-out aggregator.

But they could also be higher-end restaurants who want to cut out the consumer-facing middle person in the form of Delivery Hero’s Foodora or indeed competitors such as Deliveroo, Take Eat Easy and many others.

And I haven’t even mentioned the likes of Postmates, Jinn, Uber, Amazon and so on.

What is clear is that on-demand tied to delivery is seen as a massive growth area and in food alone could be a bigger business than the first generation of online take-out aggregators. Or so the thinking goes.

That said, delivery/logistics is a notoriously low-margin business and doesn’t always scale easily in terms of managing supply and demand.

As one industry insider told me today, the problem is that consumers typically want to order food during the same window but delivery services have to keep drivers around outside of that window or shut down the service altogether.

Another issue is geographical imbalance. The model may work in the highest density and most affluent cities but could fall down outside of those areas. That raises questions about how big the market is overall.

In the meantime, a lot of VC cash will be thrown away finding out, a bit like the food waste restaurants write off every day.

Update: Here’s a statement from Lukas Uhl, CEO of Valk Fleet Holding, describing how Valk Fleet aims to benefit from its ability to scale on a city level:

“We see the market of delivery services as extremely fragmented, with no one offering reliable, fast, integrated and scaled solution to restaurants. With experience from markets where we already operate delivery fleet, we know that productivity improvements are up to 50%. This upside comes from the fact that we can optimize delivery routes on the whole city level and not just restaurant level.”