The smart thermostat market continues to heat up, not least in Europe where Munich-headquartered Tado is aiming to become the leader. The German company, which counts Google-owned Nest as a competitor, along with the likes of the UK’s Heatmiser and Hive from British Gas, has raised a further $17 million in backing, bringing total funding to $34 million since being founded in 2011.

Investors in this latest round include the venture capital unit of Siemens AG, and Statkraft Venture Capital, the investment company of Europe’s largest producer of renewable energy. In addition, Tado’s existing investors Target Partners, Shortcut Ventures and BayBG also participated.

Tado co-founder and CEO Christian Deilmann told me during a call that, compared to just a year ago, the majority of Tado’s smart thermostat sales now come via non-direct channels. These span partnerships like the one with publicly listed home services company HomeServe and utility company SSE, retailers such as Maplin and Dixons Group, as well as working with independent heating system installers.

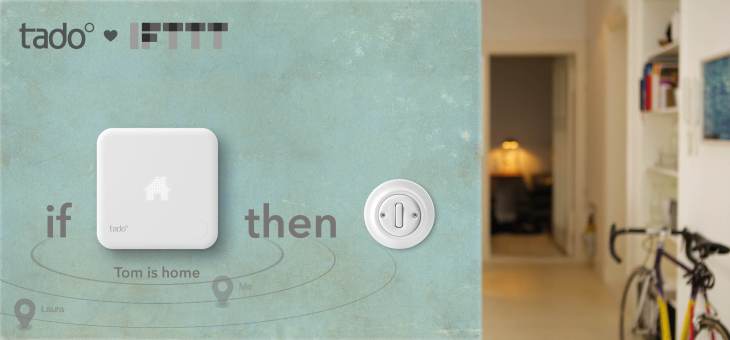

Asked how Tado differentiates itself from what is increasingly becoming a crowded market for ‘intelligent heating’, Deilmann talks up Tado’s technology. Right out of the gate, the startup made geolocation part of its offering so that its smart thermostat uses your phone’s location to know when you have left home or are returning and adjusts your heating accordingly. This, argues Deilmann is better than a purely ‘self-learning’ approach, such as that utilised by Nest, or relying on schedules alone.

Another potential technology advantage and one that goes some way to future-proofing the startup’s smart thermostat is that it is able to connect to a boiler’s digital serial interface, more typically found in heating systems in Germany and elsewhere in Europe and in newer systems in general.

This means that Tado can offer functionality such as the ability to modulate heating, rather than simple switching the boiler on or off, as well as monitor the health of a house’s heating system remotely, sending diagnostics to a maintenance company or engineer. The former offers much greater energy efficiency, says Deilmann, while the latter can help prevent a boiler from failing outright because problems can be more easily caught in time.

That said, Deilmann sticks to the line that competition in what is still a nascent market benefits all players. And although this is often typical startup speak, especially when there is an 800 pound gorilla in the form of Google (or British Gas via Hive and its recent acquisition of AlertMe), I’m inclined to agree. By some estimates the global smart thermostat market is expected to reach $2.5 billion by 2019.

To that end, Tado says it plans to use the additional capital to develop components for single room control, improve its smartphone apps, and to further scale its sales channels, including increasing activity in the U.S. and Asia.