Jet.com, the discount shopping site promising to take on Amazon by competing on lower prices, has made a fairly radical change to its business, the company announced this morning. Instead of charging members an annual fee of $50, similar to the fee associated with Amazon’s “Prime” membership program, Jet says it will now drop the fee entirely.

While initially good news for price-conscious online shoppers who now will no longer have to pay to take advantage of Jet’s savings, the removal of the fee will impact Jet’s business model and path to profitability.

Founder and CEO Marc Lore, who sold his e-commerce company Quidsi, including Diapers.com and other sites, to Amazon for $545 million back in 2010, had said earlier that Jet’s model would work when it reached $20 billion in products per year – something it hoped to do by 2020. At that point, the founder said Jet would have 15 million paying customers, or $750 million in membership revenues.

Now that membership revenues are off the table, Jet will instead have to generate revenue on its sales – just like other e-commerce sites do. That also raises the question of when Jet – a business that’s backed by $220 million in funding, according to CrunchBase, will now hit profitability.

According to Jet’s Chief Customer Officer, Liza Landsman, however, the timing of Jet’s profitability isn’t’ actually being affected. Now, it’s more like the site is shifting where its revenues come from, by moving from direct fees to slightly higher upfront prices.

“It will really be the same time frame [to profitability]. We’ve just shifted the dynamic a little,” explains Landsman. “So $20 billion by 2020 – in a world with membership fees, we were taking the commission paid to us from retail partners on the marketplace and passing a piece of them back to our members in the form of initial discounts,” she continues.

That meant Jet customers were getting a lower price out of the gate on products. That part of Jet’s model is going away. Products now will be competitive and, in some categories, lower, but not as steeply discounted.

“We’re now keeping a larger portion of that commission,” Landsman adds.

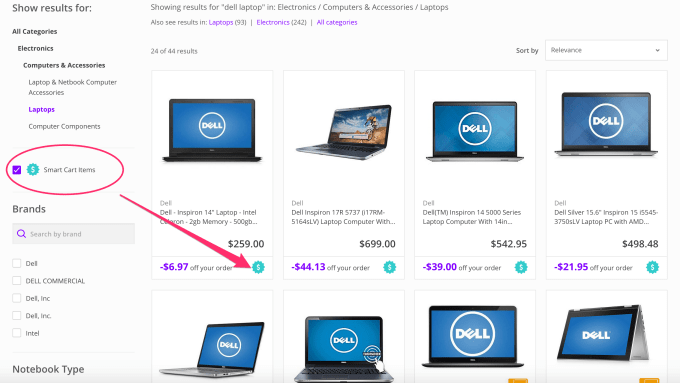

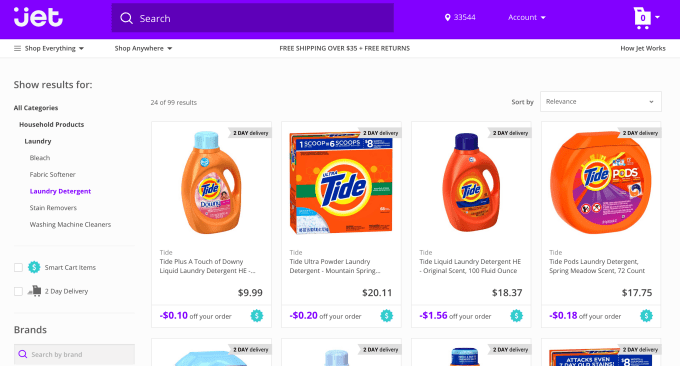

To help it generate revenues going forward, Jet will instead rely more heavily on its “Smart Cart” savings. These are the discounts that Jet offers to customers who fill their online cart with more items as they shop. Jet knows when things can be shipped together in order to save more money, and makes this transparent to the customer by highlighting those items on its site. Online shoppers view these items and their associated discounts via Jet’s search filters and icons that identify the savings.

“The response to Jet’s core value proposition has been stronger than we anticipated. With the average number of units per order twice what we expected, Smart Carts have been the rule, not the exception,” writes Lore on a blog post. “Our customers are taking every advantage of our dynamic pricing engine to place orders that can be fulfilled at a lower cost — and to have those efficiencies shared with them as savings.”

In practice, what these changes mean for consumers is that instead of savings of 8%-15% using all of Jet’s possible avenues, including initial discounts, Smart Cart savings, waiving returns, and more, the range will drop slightly to 4%-5% to 8%-10%. Power users will still be able to reach savings of 16%-17%, says Landsman.

The company believes in this new model because Jet’s customer base has picked up on how Smart Cart savings work more quickly than earlier expected, and they’re creating bigger carts on the site, spending more money and saving more in return. And because they’re spending more, Jet believes that it won’t have to lean on the membership fees after all. Instead, it can simply start matching – though not “beating” – the prices of other retailers like Amazon, while attracting customers who like to save by offering the Smart Cart option along with other ways to cut prices, like agreeing not to return purchases.

Jet has also grown more quickly than expected, Landsman tells us. It now has over 760,000 customers since its debut. The site did over $10 million in gross merchandise volume in sales in August, which increased to $20 million in September.

In addition to the savings, Jet offers free shipping on orders over $35, free returns within 30 days, and lets shoppers earn savings on other online site through its “Jet Anywhere” program.

For what it’s worth, no customers were paying for Jet.com at this point, the company tells us, because everyone was still participating in the free trial that Jet offered when it first launched.

The change to the business model will also better cater to Jet’s retailer partners, not all of whom were happy to see their products so heavily discounted on the site.

“One of the things that’s critical to our retailer and brand partners is that their brands, their price points, their products are presented in the absolute most favorable light and the focus is not on where you start your shopping journey – that starting price – but rather on the secret sauce of Jet,” says Landsman. “This shift gives us better alignment both with consumers and retailers on that front.”

In other words, product pricing will start from a more competitive, fairer playing field on Jet.com, but can then be lowered through all the special means, including the supply chain logistics, that Jet uses.

While Jet says that it’s publicly announced $225 million in funding, including convertible notes, it won’t comment on valuation which has been pegged from anywhere between $600 million to $3 billion in recent reports.

However, the company has currently opened up new round of funding, and is now raising from both new and prior investors alike, we’re told.