Not every employee, especially those at smaller businesses, can get a corporate credit card — but they still need to pay company-related expenses. That’s where Emburse, a startup that issues prepaid cards quickly to employees, is hoping to help.

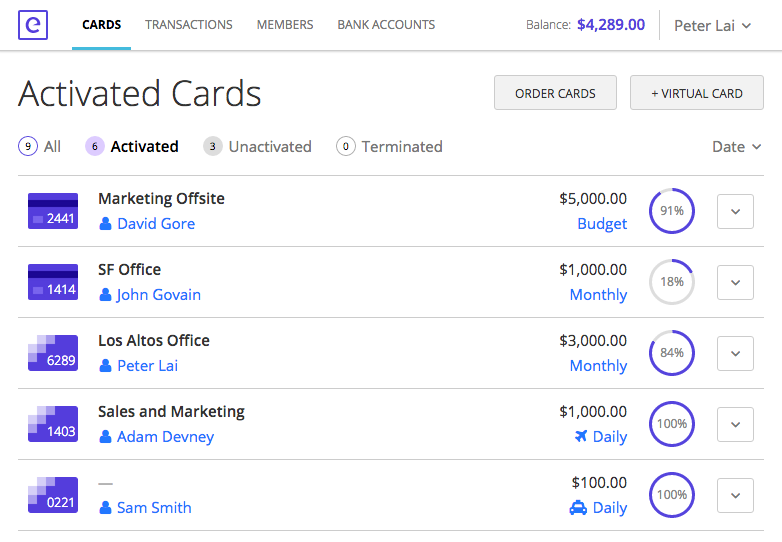

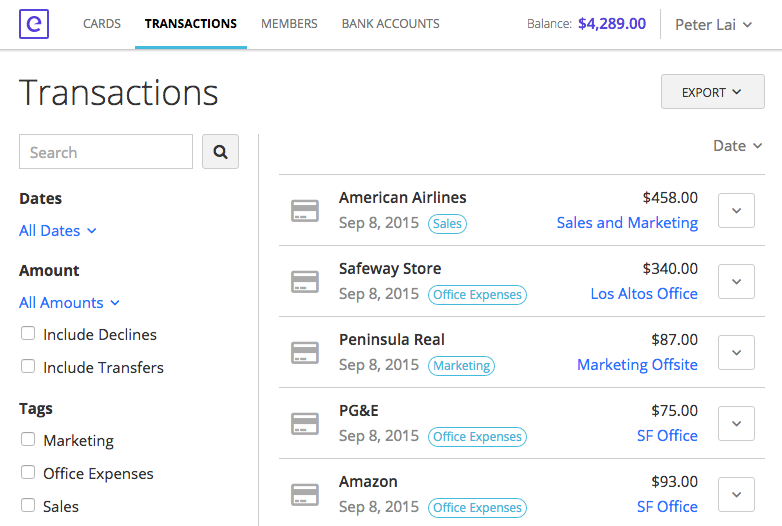

Emburse works with a card-issuer and a bank to help companies issue company cards with specific balances that it can manage closely, whether they are physical or virtual cards. They can be set as one-time use or refillable, and they can be geared toward specific expenses like a company offsite meeting. Emburse launched at TechCrunch Disrupt SF 2015.

“It’s a way for companies to take control of expenses,” CEO Peter Lai said. “You could have a company come in and create instantaneously virtual cards for specific products for a company. A lot of [companies] depend on purchases of other goods on behalf of other clients, and that’s what Emburse is initially targeted at.”

“It’s a way for companies to take control of expenses,” CEO Peter Lai said. “You could have a company come in and create instantaneously virtual cards for specific products for a company. A lot of [companies] depend on purchases of other goods on behalf of other clients, and that’s what Emburse is initially targeted at.”

Emburse isn’t launching with a subscription plan in place right away — it’s free for now — because there are users that are using it for transaction delegation, Lai said on stage at TechCrunch Disrupt SF 2015. Part of what needs to happen is to construct a pricing plan that’s fair for users, such as a nominal fee for cards and a base fee for companies.

The company works with a bank to hold the funds, and then a card issuer that moves those funds back and forth to prepaid cards, and the cards can basically be used anywhere. Emburse was started about a year ago by Peter Lai, a sole founder who was a co-founder of Crocodoc (which was acquired by Box). It now has a team of five distributed across the world.

“I knew I wanted to be in the [financial technology] space, and doing customer dev. I asked them to list the problems they had, and of the problems listed this seemed to be the most interesting problem to set about trying to solve. And the successful companies I’ve been at or started have been B2B companies — revenue is important to me and it’s way easier to acquire revenue in the B2B space from my perspective.”

Here are two theoretical use cases, according to Lai: One would be on-demand workers with product-related expenses (like food) that they need to pay for as part of their daily activities. The other is positions like office managers at companies that have a lot of company-related expenses but need to have cards geared toward specific needs.

In the case of the offsite, Lai said, the goal is to pre-emptively set a budget for the event that isn’t just a handshake agreement. If the event exceeds the budget it was given, that’s going to create a headache for the company — especially if the person who ran it may be on the hook for the responsibility. Each card can have a specific allowance set for it.

There are certainly other companies in the space like PEX Card, and of course corporate card issuers can throw their weight behind a similar product or buy their way into the space. But Lai says the kind of products Emburse are working on probably aren’t going to be built at a larger company like that. Regulatory issues aren’t quite as much of a problem, though, Lai said.

“I would say from a regulatory perspective there doesn’t exist as many hurdles as there does from finding good partners that will help you with the launch of this product,” Lai said. “Everything is built on trust and money, and a startup has neither. So it takes a long time to build that relationship that’s willing to take a bet on a new business like mine.”