CoverHound, a site that lets people search for, compare and buy auto and property insurance both through its own site and Google’s insurance search, is today announcing that it has raised a further $33.3 million in funding as it adds one more large and strategic investor to its list of backers.

Insurance giant ACE Group is leading the Series C investment, and CEO Keith Moore tells TechCrunch values the company at around $103 million, after the company hit a milestone of 50,000 policies sold in the last two years, growing 170% in the last 12 months.

CoverHound’s service comes in the bigger wave of vertical marketplaces that let consumers search for, compare and buy financial products in a single place — a very successful area of e-commerce, with others like Zenefits and Credit Karma now valued in the multiple billions.

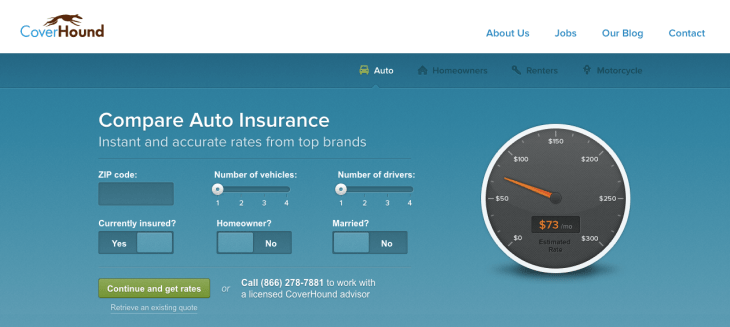

In the case of CoverHound, users can enter a few details about their car or home and get served a selection of offers from competing insurance providers. Then, unlike other aggregators — Moore says Compare.com is probably the biggest of them — CoverHound also offers fulfilment services.

Essentially, fulfilment is the aftercare of receiving and processing claims on that policy once you’ve signed it. This means that while some portals may make margin only from referral services, CoverHound also makes additional revenue by servicing the policy after it has been signed. Moore says that additional stream can be between 7 percent and 15 percent of the premium price.

While CoverHound’s own portal and sales of auto insurance have been its biggest business drivers, it is also expanding its engine to other places.

The company was also announced as the first — and so far the only, Moore says — partner in Google’s new insurance comparison portal in the U.S. There may be more partnerships of that kind in the works, Moore tells me, while CoverHound will also starts to explore other avenues to target more specific kinds of users, specifically businesses.

First up, taking a page from its own experience and immediate business environment, CoverHound is partnering with accelerators and incubators to offer insurance policies to startups.

“If you are a startup, you need a business owners’ policy before you can start to raise funding and operate,” Moore says. “We will provide startups with quick quotes and let them get policies online.” Then, as a startup grows, the policy can be expanded as needed. The first partner for the entrepreneur-focused product will be AngelPad — where CoverHound itself grew its business in 2011.

“Thomas Korte [who runs AngelPad] is really excited because it’s been such a pain to get a policy in place before going into an accelerator,” Moore says.

CoverHound is also planning to use some of the funding for business development. Currently the company works with 30 in the area of auto, home and umbrella insurance and plans to add several more in the near future.

Others in this latest round include RRE Ventures, Blumberg Capital, Core Innovation Capital, Route 66 Ventures and CoverHound’s other big strategic backer American Family Ventures (the venture capital arm of American Family Insurance). This brings the total funding raised by the company to date to over $53 million, after raising a smaller Series B earlier this year.

As part of this latest round, James D. Robinson III, co-founder and general partner of RRE Ventures, is joining the CoverHound board. “Driving innovation and leading the insurance industry forward into a digital world has never been more important,” he said in a statement. “The industry is ripe for change and it’s a great pleasure to play a bigger role at CoverHound as the company paves the way into the next generation of insurance.”