Lumity, which devises and recommends health care plans to employers by comparing employee profiles against its own historical data, said today that it has raised $14 million.

Social+Capital led the round, with True Ventures and Rock Health participating.

The company gathers data by first asking employees who opt into giving the service their prescription history, and then runs that against a database of claims history where it can draw patterns between prescription claims and conditions. One example CEO Tariq Hilaly gave was that some patients who have a short-term use of physical therapy and medication might be related to an injury like a broken leg, whereas ongoing treatments could imply more chronic conditions.

By doing that, Lumity is able to devise a healthcare plan of attack for the company by aggregating that data anonymously and presenting the company’s CEO with a comprehensive health profile of employees, Hilaly said. The employer then works with Lumity to determine the best health care plans they should make available to employees.

“Our models are able to take prescription history and reverse map that to a health profile. [Our goal is to] be able to take a little bit of data from the employee and accurately infer a great deal from it,” Hilaly said. “We then look at a database of claims history which we’ve procured: 70 million person years of insurance claims history.”

He continued with an example: “Say I have three years of your history and it’s arranged longitudinally. If I have three straight years, I can see how your conditions evolve and how the costs and treatment of those conditions evolve. Our predictive models are able to look at these to identify evolutionary patterns of diseases and treatment protocols and costs.”

This is a complex process that previously required consultants to come in and charge large fees to devise these plans, which smaller companies often can’t afford. Lumity’s bet is that it can use technology to do just that, and while it only has 10 companies on board, currently it only launched in July earlier this year. The benefit here is also that Lumity, with a data-driven approach, can serve as a sort of wedge into medium- to large-sized companies — though smaller companies will probably go through something like Zenefits.

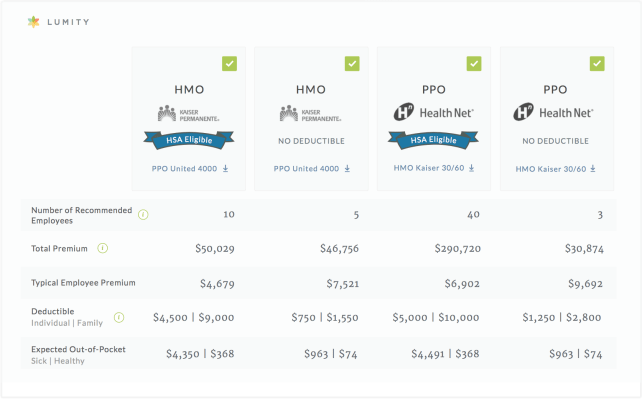

Lumity can also recommend to employees the lowest-cost option based on their conditions, which it also determines from comparing that to the historical data it gathered. Typically, selecting plans requires going through large, and often very complicated, charts and tables of what is and is not insured, along with other data points like deductibles — so any simplification here is probably pretty welcome.

“Think of what we’re doing as being a little like, you can do your taxes on paper but god it’s painful, or you can do it on TurboTax,” Hilaly said. “We’re taking this nightmare and making it brain-dead simple.”

Lumity serves as an insurance broker, meaning it sells insurance from companies like Blue Cross Blue Shield and Aetna to these companies and takes a commission. This allows Lumity — and other companies like it — to be able to offer its services for free to companies. For now, Lumity works with businesses that have around 60 employees and goes up to companies that have around 1,000 employees, Hilaly said.

There are a couple of startups active in this space using different strategies. Oscar, worth $1.5 billion, is a health insurer itself for example. The obvious one that would jump to most people’s’ minds is Zenefits, which also generates revenue from insurance brokerages. But that company is targeted at smaller businesses, Hilaly said. Any of these company’s strategies could prove to be the most successful, and it’s also possible that larger companies that handle similar processes with consultants that could enter the data-driven game. In the end, it will be on Lumity to prove that it will have the most successful model.

“I would fully expect others to try and follow our approach, and what I would say is the predictive models that we’ve built and map back that information into a lot of insight is not easy to do,” Hilaly said.