There’s a savings crisis in America.

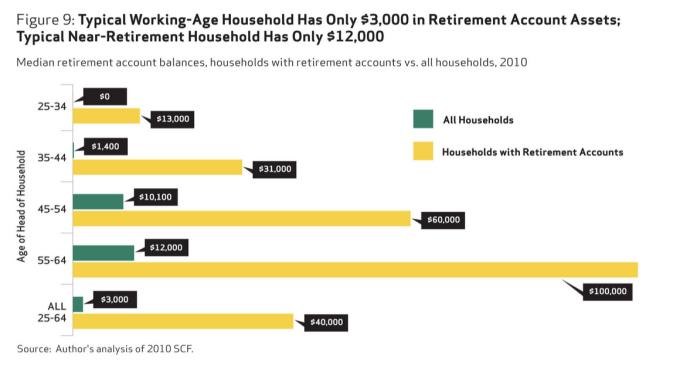

Despite the $5.5 trillion Americans have invested in savings plans to prepare for their retirement, too few have still saved too little to make life comfortable in their later years.

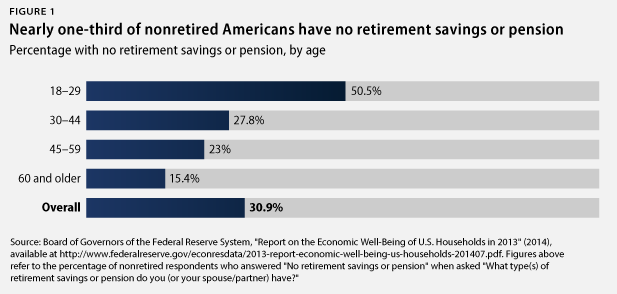

The numbers speak for themselves, with roughly 30.9% of the population with no retirement savings or pension plan. For millennials, many of whom were late to the job market thanks to the financial crisis of 2008, those numbers are actually just above 50%.

Stepping into the breach is the automated wealth management service Betterment. The New York-based company is announcing a 401(k) retirement service, called Betterment for Business, aimed to make it easier for employers to establish, administrators to manage, and employees to monitor retirement savings plans, according to the company.

Credit: Center for American Progress

Folks who enroll in the new service (which launches in 2016) will get advice on how to invest their money with a holistic view of their income and existing retirement benefits through Social Security, according to Betterment chief executive Jonathan Stein.

“This is a replacement for the shitty 401(k) system we have today,” Stein said in an interview.

Betterment has already signed up several undisclosed companies for its 401(k) service instead of going with larger asset managers. Mostly the company is culling its customers from the pool of early-stage startups like Earnest, which often don’t have the capacity or cash to set up a more traditional 401(k) plan.

“Most tech startups want these, but can’t have them because they’re too difficult to set up,” says Stein.

The new service from Betterment represents the first new bundled retirement plan provider to launch in the U.S. within the last 30 years, virtually since the passage of the Employee Retirement and Investment Savings Act in 1974, according to the company.

The company’s service will automatically work to ensure plans are compliant with regulations, and will leverage the same investment tools the company uses to monitor investments for its customers in its new retirement plan.

Plan participants will be investing in a portfolio of index-tracking exchange-traded funds (ETFs), in much the same way that Betterment’s retail accounts are managed. Using Betterment, participants can also open taxable investment accounts, traditional and Roth IRAs, and trust accounts.

There’s no upfront fee for employers with more than $1 million in assets and Betterment charges a fee ranging from 10 to 60 basis points, which Stein says make them the lowest cost plans in the industry.

Credit: National Institute On Retirement Security

“This is something that’s always been on our roadmap,” says Stein. “It’s something that we’ve been talking about since we launched at TechCrunch five years ago.”

The tipping point, says Stein, was his own experience with 401(k) plans. “We’ve been thinking about it in the bakcground and building for it for a long time. What pushed us to do it now was that we set up a 401(k) plan for our employees and it was such a trying process. It was so hard to find to prepare it to compare prices.” So the company built their own.

While Betterment’s offer may make things easier for employers to set up plans, it’s still no silver bullet for the coming retirement crisis if employees don’t take advantage of the tools available to them.

Stein hopes by making the process as easy and transparent as possible, it’ll take some of the confusion out of the experience and get more people to sock money away in retirement plan instead of stowing it under a mattress.