Following the bell, and Apple’s massive media meltdown, Box detailed its fiscal second-quarter financial performance. In the period, the company lost $0.28 per share, using adjusted metrics. The company recorded revenue of $73.5 million during the fiscal period.

The street had expected Box to lose an adjusted $0.29 per share, on revenue of $69.81 million. Box’s revenue expanded 43 percent, compared to its year-ago fiscal second quarter. In its sequentially preceding quarter, Box’s revenue grew 45 percent, compared to its year-ago results.

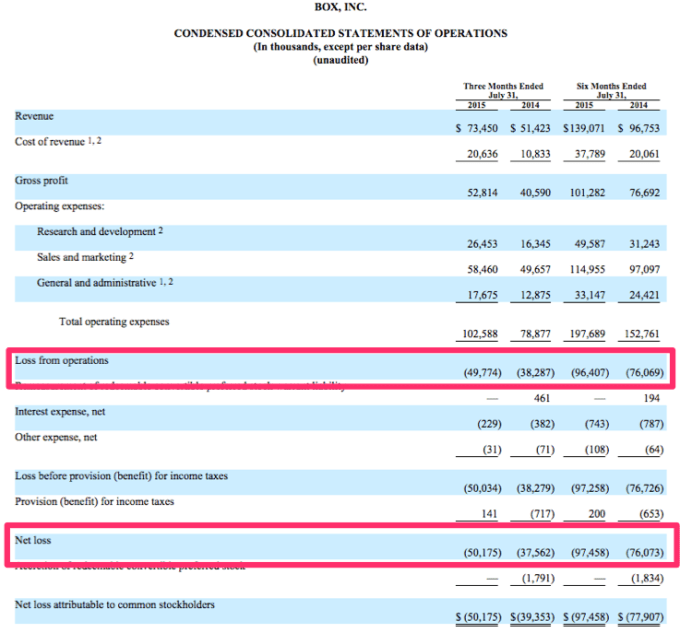

Using standard accounting metrics (GAAP), Box lost a stiffer $0.42 per share.

Following its earnings announcement, Box is up several points in after-hours trading. Shares of Box rose in regular trading, despite turbulent domestic markets. Box closed normal hours back above its $14 IPO price. Box has hit stiff winds in recent quarters, as public markets have retreated, and recently public technology companies have been especially hard hit.

At the end of the quarter, Box had $242 million in cash. That compares to the more than $280 million it had at the end of its sequentially preceding, fiscal first quarter. The company stated in its release that its net cash usage in the quarter was $21.7 million, down from $26.3 million in the comparable year-ago period.

Looking forward, Box expects revenue of $76 to $77 million in its current quarter. The firm also raised its full-year guidance:

Full Year FY16 Guidance: Revenue is expected to be in the range of $295 to $297 million, compared to previous guidance of $286 to $290 million. Non-GAAP operating margin is expected to be in the range of (47%) to (49%), compared to previous guidance of (49%) to (51%).

What All That Means

Box had more revenue than expected, a smaller loss than expected, and its forward guidance continues to improve. While the company still consumes quite a lot of cash, it did not update its expectations of reaching cash-flow breakeven in its fiscal 2018 (the company is currently in its fiscal 2016). That could change on its earnings call, of course, but for now, things look stable.

So, Box is doing what it said it would do, and better than what outside analysts expected. Not bad.

The Other Side Of The Coin

Let’s not be unduly generous. Here’s a chunk from Box’s 8-k SEC filing:

What those highlighted areas indicate is that Box, using normal accounting techniques, is losing more money than a year ago. Investors have largely focused on Box’s net cash burn instead of its GAAP losses, but the latter remain material and notable.

This isn’t a World Ending problem for Box, especially since it was intentionally done, but it could keep more skittish investors on the sidelines, and perhaps shares in Box trading for a lower price than they might.

Box burned less cash than it did a year ago, but that doesn’t mean that all things are rosy.