Today’s “invisible app” market could be classified as a passing trend, but it might also be the beginning of a significant multi-year shift in how we transact when we’re away from our computers. This shift applies to mobile devices, email, home devices like the Amazon Echo and even wearables like the Apple Watch.

In this essay, I begin by explaining why the market exists and highlight some key benefits. Next, I share my mental model of how the market is structured. Lastly, I end by anticipating where it could be headed.

Why It Exists: Speed And Reduced Decision Fatigue

Invisible apps are taking off because, in many cases, they are faster than using a native application or mobile website. While scheduling a calendar event using the native iPhone calendar app takes at least six keystrokes, using an invisible app like Clara Labs, you can forward an email or send a message without any context switching. In addition, because invisible apps are asynchronous, you send the message and you’re done.

Getting a model 80 percent accurate is easy; but the following 10 percent could take years.

Invisible apps also reduce decision fatigue, which is especially beneficial when you, the user, know what you want. For example, looking at 20 different flight options from a pair of airports — 80 percent of the time, you either want the fastest or cheapest option.

That’s one of the key benefits of Operator and Luka.ai: It’s much easier to answer a yes/no question like, “Do you want to send your mother flowers for Mother’s Day?” than be faced with an open-ended question like, “Mother’s Day is coming up. What gift should I get her?” This is also the reason why clicks for “mother’s day gifts” are significantly cheaper than what BloomThat would probably pay for an app install.

In fact, reducing decision fatigue drives costs down. For instance, Uber reduces decision fatigue by limiting a user’s choices to one of three vehicle classes: UberX, Black or SUV. That’s it.

By contrast, earlier companies that attempted to take advantage of excess automobile capacity offered you, the user, a list of cars, drivers and prices, allowing you to make an offer for how much you’d pay to get from point A to point B. Decision fatigue at its finest.

Elsewhere, companies like TaskRabbit initially launched an auction model where you, the user, bid on the person you wanted to provide you a service. They’ve since switched away from that, but predictably, under such a model, by the time you coordinated the service and the person you bid on, you may as well have spent the time assembling the IKEA furniture yourself.

Excessive optionality is a liability and a burden, and messaging apps near-eliminate that by reducing the number of choices. Existing companies are slowly making that shift. Postmates, for one, defined itself as the company where, “we’ll deliver anything to you.”

Since then, they’ve shifted focus slightly to: “we’ll still deliver anything, but here are some awesome food choices we can deliver to you within an hour,” and this is one of the (many) factors contributing to their well-deserved success.

Market Structure

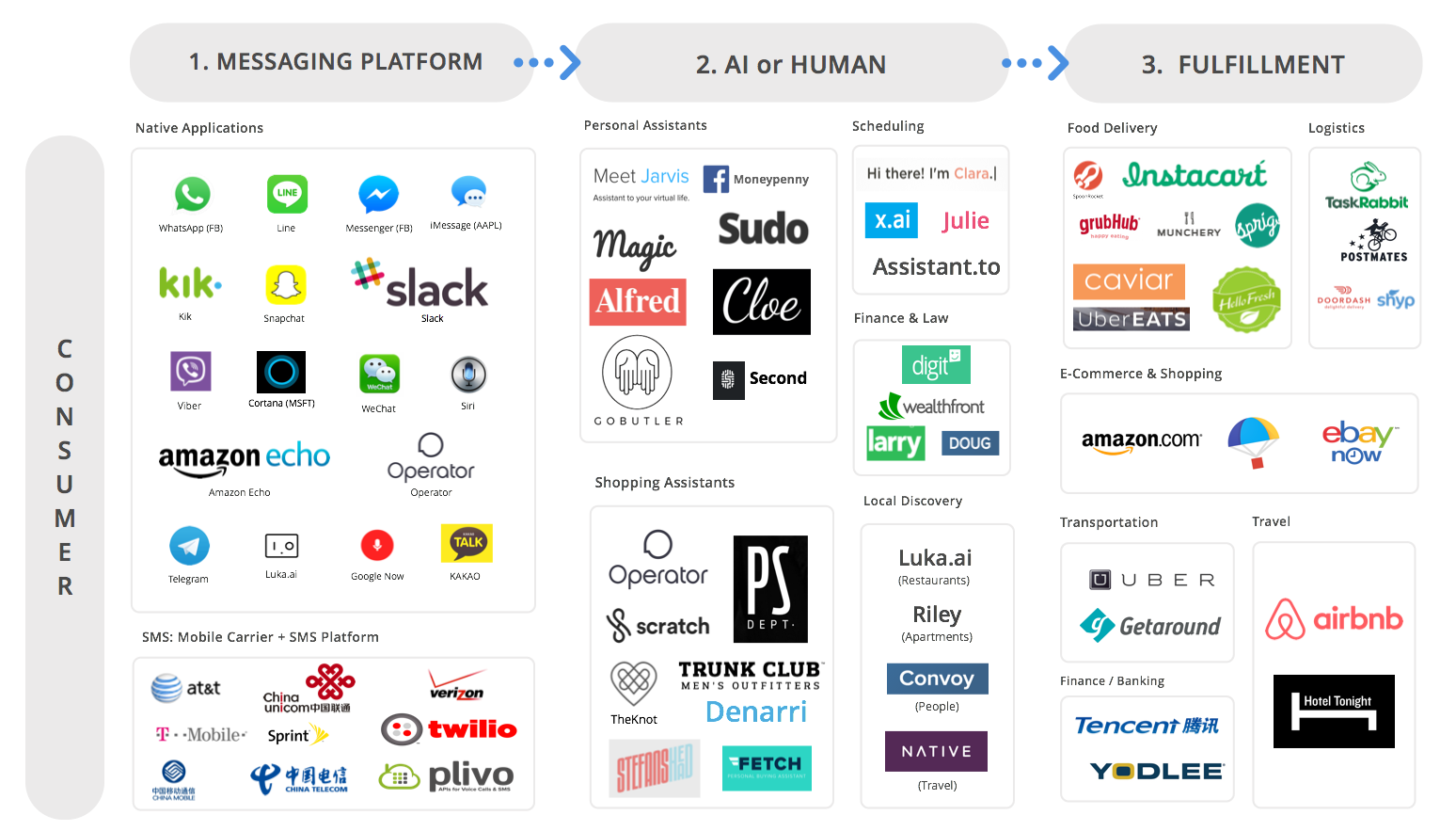

The invisible app market has three pieces:

1. The Messaging Channel: From where does the user express his or her intent? Right now, there are a few different ways:

- Mobile Messaging Platforms: WeChat, LINE, Facebook Messenger, iMessage, Slack, Kik, etc.

- Cellular Carriers + SMS Platforms: AT&T, Verizon, Sprint, T-Mobile, China Telecom, China Unicom, AND — an SMS gateway like Twilio or Plivo.

- Native Application: Operator or Luka.ai. These apps are bespoke and built specifically for that one messaging application.

- OS-level Assistant: Siri, Google Now, Microsoft Cortana, Amazon Echo, Apple Watch.

2. Operator/Assistant: What’s on the other end to receive the message?

- Completely human: Some companies have what are essentially call centers that dispatch requests to humans. Example: Magic, Operator.

- Leverage humans through AI: Some combination of human labor leveraged by artificial intelligence and natural language processing to understand intent and field requests. Example: Clara Labs.

- Pure AI: All done through software. Example: luka.ai.

3. Fulfillment Layer: Once the request is understood (either by a human, a machine or some combination thereof), which service will actually fulfill the request? The answer varies based on what the user wants. For example:

- Transportation: Uber, Lyft, GetAround, RelayRides, FlightFox.

- Food delivery: Instacart, UberEATS, Postmates.

- Travel: Airbnb, Native, HotelTonight.

Monopolistic And Vertically Integrated

Invisible apps might eventually promote vertical integration, and indirectly, monopoly power. Being the universal top-of-funnel is extremely valuable: By owning the customer experience, you can exert downward price pressure on suppliers.

Let’s take Digit as an example. Digit is an invisible app that automatically moves money from your checking into your savings account. If they keep delivering on the user experience and keep a rock-solid, secure foundation, they could be poised to be the savings bank of the future.

I presume they currently store customer funds in FDIC-backed savings accounts at large financial institutions (like Wells Fargo and Citi), but that’s an irrelevant detail to Digit’s customers, who don’t need to know where their money is being stored.

At scale, Digit could work with whatever bank makes the most competitive terms, or conceivably could set up an independent banking operation, thereby becoming more vertically integrated.

The same applies with many messaging apps in China. WeChat, for example, released WeChat Taxi last year and users booked more than 21 million taxi rides in a single month. There’s immense value at being the top-of-funnel for mobile, and I predict the winner will become very successful.

Challenges

Companies in this space will face a handful of challenges.

First, operator/assistant companies must be differentiated in order for users to stay top-of-mind. By claiming to do “anything” for the user, you end up doing everything decently well, but you fail at staying top-of-mind with your customers.

The mobile space is thirsty for such an operation: On the desktop, we’ve come to know “I’ll find you anything” as search; developing such an operation on mobile remains a challenge.

Today’s “invisible app” market could be classified as a passing trend, but it might also be the beginning of a significant multi-year shift in how we transact when we’re away from our computers.

Next, scaling such an operation can be arduous. If you’re lucky enough to have a growth spike, you have to scale operations proportionally. While this sounds like a good problem to have, it is still nevertheless a big problem that could sour many first impressions.

Speed is one of the core benefits of messaging services, and if your ssa can’t respond to the user within a timely manner, they’ll likely move on. Therefore, first impressions really matter in this space.

If your company decides to use artificial intelligence and natural language processing, you’re in luck because of the wealth of open source frameworks (python nltk, etc.) and APIs (like wit.ai).

That said, these will only get you so far. And while boosting your AI’s natural language interface’s mean-squared-error from 80-82 percent is an internal cause for celebration, users are much more shrewd.

They generally expect things to work all the time, which is hard to do with a natural language product. It also be a resource rabbit hole — getting a model 80 percent accurate is easy; but the following 10 percent could take years.

Where It Could Go

Like most things in Silicon Valley, messaging may just be a passing trend that we look back at in 12 months and laugh. But there’s also a chance that we could be onto something really exciting. Many of the most important technological innovations in the past 50 years were ex-ante novelties with little business application. That is, until they weren’t.