In a prospectus filed today by the company, Tesla announced the intention to sell up to 2,100,000 shares of common stock. Underwriters will also receive a 30-day option to purchase up to 315,000 additional shares.

Using yesterday’s closing price of $238.17 per share, the company expects net proceeds from the offering to be around $492.6 million, or $566.5 million if the underwriters exercise their option to purchase additional shares in full.

The stock jumped about 2 percent today to around $245 per share after this announcement, which is a sign that investors are more confident in a well-capitalized Tesla. However, this share price is still about 8 percent lower than the three-month average for the stock, which came after disappointing production estimates last week during the company’s Q2 earnings call.

Underwriters and book-running managers in the deal include Goldman Sachs & Co., BofA Merrill Lynch, Morgan Stanley, J.P Morgan, Deutsche Bank Securities and Wells Fargo Securities.

Notably, the offering has said that Tesla CEO Elon Musk has indicated interest in purchasing 83,974 shares for an aggregate price of about $20 million.

This announcement comes just a week after multiple analysts on Tesla’s earnings call asked Musk and Deepak Ahuja, CFO, about the company’s plans to raise capital.

While Ahuja responded to a question saying the company was “comfortable with the cash levels,” Musk also included that he “doesn’t think that there’s not a need to raise equity capital.” In fact, he said that “there may be some value in doing so as a risk reduction measure.”

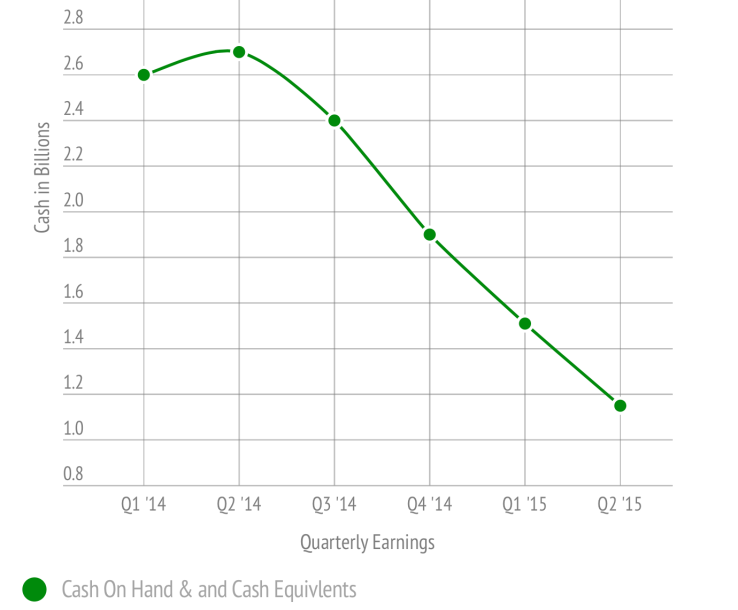

This new capital will give the company some breathing room, especially after a few periods of rapid spending. At the end of 2014, cash and cash equivalents were at about $1.9 billion, and by their Q2 earnings just six months later had decreased about 40 percent to $1.15 billion.

In the chart below, you can see the steady decline of cash-on-hand for the company. An additional $500 million infusion should bring it to the level it was at between Q4 ’14 and Q1 ’15.

Below is the company’s statement on what they will use the new capital for, which primarily amounts to continued growth and expansion costs.

We intend to use the net proceeds from this offering to accelerate the growth of our business in the U.S. and internationally, including the growth of our stores, service centers, Supercharger network and the Tesla Energy business, and for the development and production of Model 3, the development of the Tesla Gigafactory and other general corporate purposes. Pending use of the proceeds as described above, we intend to invest the proceeds in highly liquid cash equivalents or United States government securities. – Tesla Inc.

Disclosure: Author owns a small amount of shares in Tesla by way of a family trust.