Gifting a child money for future education expenses is nothing new. However, giving cash is almost always awkward, plus the giver misses out on the chance to show off a physical gift.

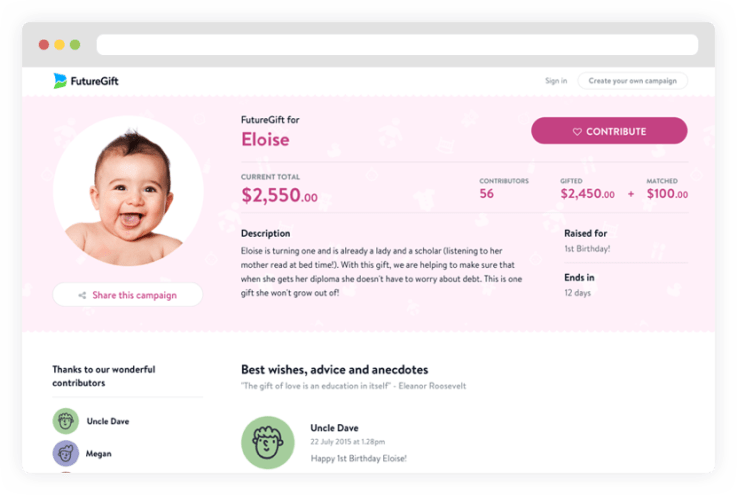

Just launched by wealth management startup FutureAdvisor, FutureGift is a new product that solves these problems by allowing parents to create campaign pages where all money is contributed to a college savings account for their child.

The company provides those giving the gift with a wrapped and framed certificate that they can present to the parents or child at events like a baby shower or birthday.

What makes the service different from existing campaign donation services like GoFundMe or Charidy is that the company only allows gifts to be deposited into a 529 savings account, which by law may only be used for education-related expenses. This definitely removes the awkwardness of gifting cash, because it avoids the worry of if the gift will actually be used for college expenses.

Multiple campaigns can also be opened over time for different occasions, all which will funnel into the same college savings account.

While FutureAdvisor said that part of the inspiration for the product was to drive new user growth, it’s important to note that the company won’t force parents to manage these funds on its platform. Specifically they note there is “no obligation to hire FutureAdvisor once a parent is ready to redeem their FutureGift contributions, as long as the contributions are put into a 529 on behalf of the child.”

Additionally, the company is making the entire process free by subsidizing any transfer costs or credit card fees. They also are kicking in $25 to each child’s campaign for every four people who contribute online, up to $100.

Covering 2 to 3 percent in payment-processing fees, the cost of the framed certificate, and matching program means that FutureGift will definitely cost the company money in the near future. However, assuming they’re able to use the free program to acquire new clients for their retirement management service, the investment should pay off in the long run.