Shares of Twitter, a popular social media company, fell sharply today, dipping nearly 6 percent by midday trading. The company’s equity fell in value below the $30 mark, setting new lows. As of the time of writing, shares of Twitter are worth just over $29.

For context, Twitter went public at $26 per share, and saw its value skyrocket. The firm debuted at $45.10 per share1, and managed a 74 percent day-one pop. Investors, quite simply, were ecstatic about Twitter.

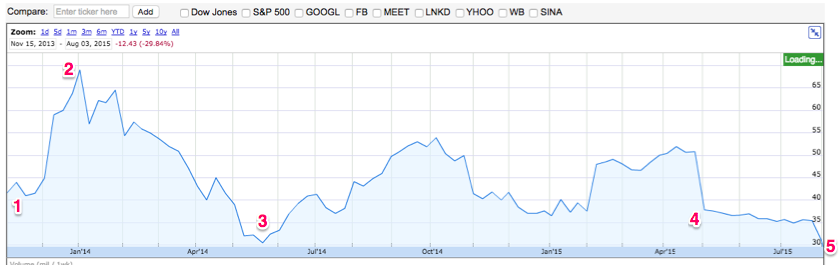

The street was not done, however. Twitter’s value on a per-share basis nearly reached the $70 mark in early 20142. Then the company went into a massive slump falling to just above $303. Twitter then managed a year of see-sawing, before suffering from a massive decline after its first quarter recent earning report4.

Twitter then limped along until its second quarter earnings report, which led to several sharp declines in the firm’s value5. (We’re seeing media reports that Twitter’s new, intraday all-time low is $28.91, set today. We’re trying to verify the figure.)

Here’s the chart:

TechCrunch reached out to Twitter regarding its share price, and its declines, but we don’t expect to hear much back.

Twitter has been in difficult public-market spots before, and has managed comebacks. Today’s decline, however, isn’t something that can be dismissed. Falling share prices can undermine employee morale, harm retention, and hinder a company’s ability to hire; each of those can lead to slower product growth and quality.

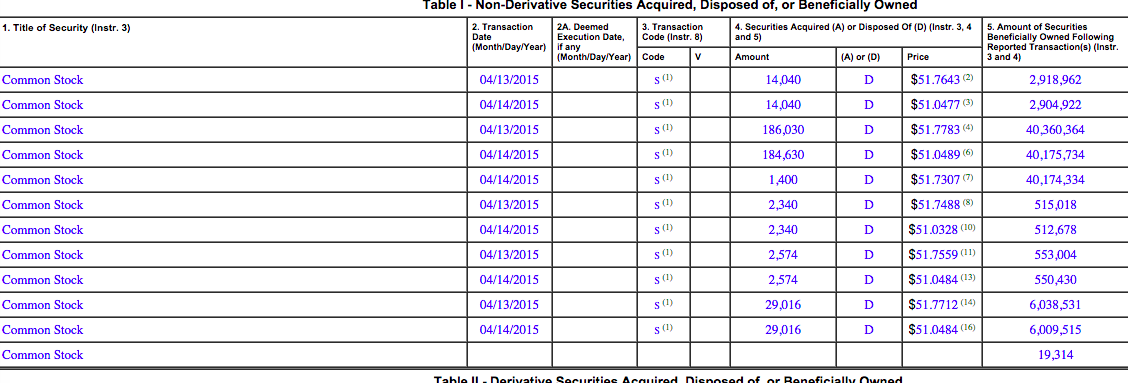

While stock is accrued to eventually be moved, say via sale, one of Twitter’s co-founders has been extremely active in the market so far this year. One of the very few people not being discussed to be the next CEO of Twitter, Ev Williams, has sold $275,037,833 worth of stock in 2015. Liquidity is great, but this serves as a potential signal that even Williams knows that tough roads are ahead.

It is worth noting that when Williams sold off 468,000 shares in April, it was on a trading plan, as if to signal it wasn’t a big ol’ dump. But let’s be serious, Twitter stock was $51 during April’s sell, so the time was right.

Even though the company doesn’t have a permanent CEO in place at the moment, Wall Street would feel way more comfortable if its user growth looked a little more hockey-stick-esque. It’s the opposite of that. Depending on what numbers you look at, Twitter gained around 8 million monthly active users from the previous quarter.

In case you weren’t sure…that’s awful.

Everyone and their brother seems to have ideas on how to “Fix Twitter,” as if the company isn’t thinking about how to fix itself, but it does look like it’s going to take a while for the Twitter to get out of the doghouse with Wall Street.