While eBay is doubling down on its core business after its split from PayPal, an upstart out of Europe is looking to muscle in on the business where eBay first made its name, collectibles. Catawiki, a Dutch online auction business, has raised $82 million to scale its business on the continent and beyond.

The Series C was led by Lead Edge Capital — an investor in other e-commerce juggernauts like Alibaba and Delivery Hero — along with past backers Accel and Project A Ventures, and several former Booking.com executives.

René Schoenmakers, the CEO and co-founder with CTO Marco Jansen, says that the business — and name, as it happens — was started from his own interest in collecting comic books. In 2008, the idea was to create an online catalogue where other collectors could contribute their own inventories of comic books in a wiki, creating a crowdsourced catalogue in the process. “The catalogue could then get used as the basis of selling those comics,” he said. The wiki actually still quietly exists, he says, although it’s not really developed or highlighted in the wider business.

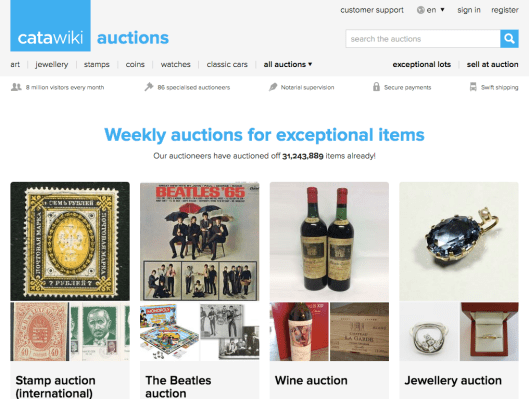

That wider business, meanwhile, has massively expanded from humble comic book beginnings, covering a variety of categories, from antiques through to jewellery, cars and wine.

Catawiki is not disclosing revenues or user numbers (or valuation, for that matter) but it does note that over the last 12 months, it has increased revenues by 300 percent and doubled its number of auction categories, and now sells over 15,000 lots per week. Typical sale prices for lots on the site are between €100 and €150, but can be significantly higher, as in the case of classic cars. The company is active in The Netherlands, Belgium, France, Germany, Italy, Spain and the UK.

It’s also grown up to have significantly different characteristics from its very large incumbent U.S. rival. While eBay has moved away from auctions as the core of its services — selling many items and often at “Buy it now” prices — Catawiki has developed an auction-only system that runs like clockwork. The auctions for items begin on Friday afternoons and last for a full week.

Why Friday afternoons? Because that’s when many people take the pedal off at work and are more likely to browse online, says Schoenmakers, adding that even as the company expands into markets like Asia, it would like to try to keep the idea of a collective starting time consistent. “It’s become a rhythm that everyone understands,” he says.

The other interesting idea is that while all items may have different reserve prices — that is, minimum prices at which the seller is prepared to part with the object — every single auction starts at €1. This is not just a gimmick but the result of the company’s A/B testing, which Schoenmakers says its engineers and designers are doing all the time.

“The 1-euro pricing helps encourage people to bid,” he says. “Many like the idea of being the ‘owner’ of an object, even for a small period of time, of a really expensive object.” He says that in tests run by Catawiki, objects that start selling at €1 see much more activity, and ultimately end up at higher prices, than when that same object’s bidding starts at a higher number. This is also some of the logic for why you may often see crazy low prices on eBay.

Another area where Catawiki has helped build trust in its platform through its approach to transacting on its site. Before people are allowed to list items for auction on the site, there is a fairly high degree of curation. Sellers are vetted by Catawiki, and items are also periodically inspected by experts to assess them as authentic. More than half the company’s staff, in fact, are auction specialists.

Then, when someone wins an auction, their money is held in escrow by Catawiki until the seller receives and accepts the item. Schoenmakers says that currently the site has only a 1% default rate on finished auctions not living up to their promise either because of faulty goods or a successful bidder who doesn’t pay.

Schoenmakers says that while Catawiki was profitable until its Series B — a €10 million investment in September 2014 — it is now in “investment mode,” aka in the red. The company makes its revenues at both the buying and selling end: 9 percent plus tax from the buyer, and from the seller we ask 12.5 percent, so 20 percent combined.

It’s not clear if Catawiki will stick to its structure quite so steadfastly as it grows and competes with more local players, but this is what has helped it get to where it is today, investors say.

“Lead Edge has a strong history of investing in successful online marketplaces,” said Mitchell Green, Managing Partner at Lead Edge Capital. “Catawiki’s curated offering intrigued us, but we were really impressed by the company’s enormous addressable market, highly capital efficient business model and buyers and sellers’ love of the platform as demonstrated through remarkable unit economics. We look forward to helping Catawiki build a global online auction platform.”

While a lot of the focus on e-commerce juggernauts in Europe has been around areas like food delivery and the Rocket Internet incubator, Catawiki underscores how online auctions are still alive and well. Earlier this year, Auctionata, which focuses on live auctions, raised $45 million for its live-streamed auctions.