Last week, it was reported that after 34 years with Intel Corp., and 10 years as the head of its giant investing arm, Arvind Sodhani is leaving the company in January. Wendell Brooks, who recently joined Intel as president of M&A from Allen & Co., will be replacing him.

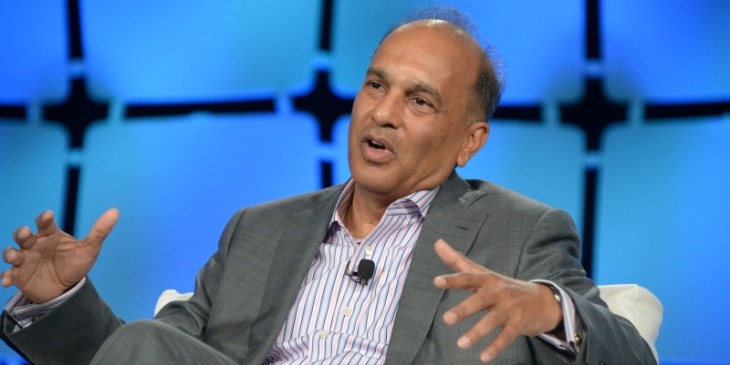

In corporate venture circles, Sodhani’s imminent departure is big news. We talked with him earlier this week about when the decision was made, and what’s next. Our chat has been edited for length.

TC: You’ve already had a long career at Intel, yet it was somehow surprising to learn you were leaving. Why now?

AS: In January, I’ll have been at Intel for 35 years, including as company treasurer. Thirty-five years is a long time, and given a number of different factors, it got to a point where we started thinking about doing a change, and so [the decision] got underway late last year.

TC: When I saw you last year, we were talking about our sons. What does yours think of the move? Is he worried about what you’re going to do in your retirement?

AS: [Laughs.] He’s graduated now and gainfully employed, so he’s off [doing his own thing]. I’ve been doing [my work at Intel] a long time. It’s time to make a change.

TC: What advice might you offer to Intel Capital’s incoming head?

AS: I think it would be improper for me to offer specific advice. [What I can say is] we’re now one of the largest VCs – corporate or otherwise – in the world. We’re consistently ranked among the top of lists [of top performers]. We have a very large team, a deep bench. We’re investing between $300 million and $500 million a year in [collectively] 25 different countries. Wendell is going to be just fine.

TC: What are some of your best outcomes most recently?

[Editor’s note: an Intel spokesman jumps in to provide the following.] Companies that have IPO’d over the last three quarters include Box, Hangzhou, BSoft, Tobii, SNSplus, and CareDx. M&A deals [over the same three-quarter period] include Virtustream, Amplidata, Revolution Analytics, Cortina Access, Feedhenry, TOA Tech, Clear2Play, Maginatics, and XPlus Two.

TC: Intel always invests for at least some strategic purpose, but sometimes, it’s hard to suss out its strategy. You recently backed Onefinestay, for example, a London-based startup that provides travel accommodations using vacant properties. Why?

AS: It’s part of the sharing economy and we want to keep abreast of that and see how it evolves.

TC: You want to – and do – keep a pulse on what’s happening everywhere in the world and in most sectors.

AS: Yes, we invest in China, India, Europe, Brazil – it’s all of interest to us. And we invest in everything from wearables, drones, handheld devices, anything that generates data, including [Internet of Things] sensors . . . to, at the other end of the spectrum, data centers and storage and data analytics.

TC: Would you describe Intel as price sensitive, or is it more important to get into the best deals?

AS: We’re very sensitive to valuations. We want to ensure our own sustainability. But we aren’t necessarily a late-stage investor [where things are particularly frothy]. We’re typically much earlier in the cycle, investing at the Series A, B, C, and sometimes D.

TC: Are you at all concerned about getting out of your many deals? There aren’t nearly so many companies going public as there are receiving late-stage funding.

AS: We’ve had 213 IPOs in our portfolio since 1991 and 373 M&A transactions, so we’ve had more M&A exits [historically] and we’ll continue to see that. Every company’s path is going to be different, depending on who will find value in its business. In many cases, [because of the lack of IPOs], corporate buyers are going to extract more value out of those companies.

TC: How are you feeling about China, where things are going haywire this week?

AS: We’ve been investing aggressively in China, where innovation is taking place right now, big time. Also, the market needs and cost structure – the price points at which things get sold in China – are much different than in the U.S., which creates a completely different set of [opportunities]. [Not last], it’s obviously a huge market in virtually every product and service – laptops, desktops, cell phones, cars, TVs…

TC: How much does Intel invest in U.S. companies versus abroad?

AS: It’s typically 40 percent overseas and 60 percent U.S., though it’s still too early in 2015 to put numbers down for this year.

TC: So what happens next for you? Would you ever join a venture firm? Would you start your own, a la former 3Com CEO Eric Benhamou?

AS: I have no plans right now. I’m contemplating getting to January, and that’s still a long ways to go. [After that], if I did anything, it would be in the same domain as my skill sets are, which is really as a VC.