FutureAdvisor (YC S10) recently announced that users and assets under management (AUM) have grown 10x over the past 12 months, with AUM now totaling more than $603 million dollars.

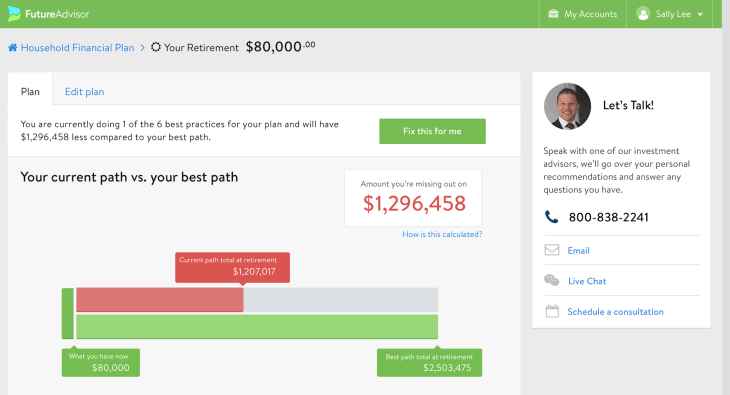

The company, which recently raised a $15.5 million Series B, is an online wealth-management platform aiming to help middle-class customers grow their money. The company has products which allow it to act either as an investment advisor or traditional money manager.

When acting as a money manager the company is in direct control of customer assets and intelligently rebalances and allocates funds in order to achieve a user’s desired investment objectives. FutureAdvisor is currently actively managing funds for more than 4,000 clients with an average portfolio of $143,000 dollars.

As an advisor (a service which the company doesn’t charge for), FutureAdvisor has over 320,000 registered users, and tracks about $40 billion in assets.

Bo Lu, CEO of FutureAdvisor, also shared that the company has recently introduced the ability to manage customer’s 529 College Saving Plans. Ten million Americans are currently using the 529 Plan, and Lu says it was one of the company’s most requested new features.

The robo-investing space is definitely crowded, with both Wealthfront and Betterment also aiming to manage investments more efficiently via technology. However, Lu is quick to note that FutureAdvisor always pairs a real person with its automated technology, insuring funds are always correctly managed.