At last month’s On Demand Conference in San Francisco which featured many of the hottest names in tech – Uber, Instacart, Sprig, Munchery, Shyp and Postmates, amongst others – one panel stood out. Amid a sea of consumer facing businesses, the CEOs of three small- and medium-sized business or enterprise focused on-demand companies explained their businesses in a talk titled “On-Demand, B2B.”

Applying on-demand businesses models to corporations (as opposed to individuals) isn’t revolutionary; existing platforms such as Uber and Shyp have formal business facing units. Grubhub boasts an ordering service targeted towards office managers. And many of Postmates’ headlines over the past year have revolved around their business facing APIs (such as burritos on-demand!)

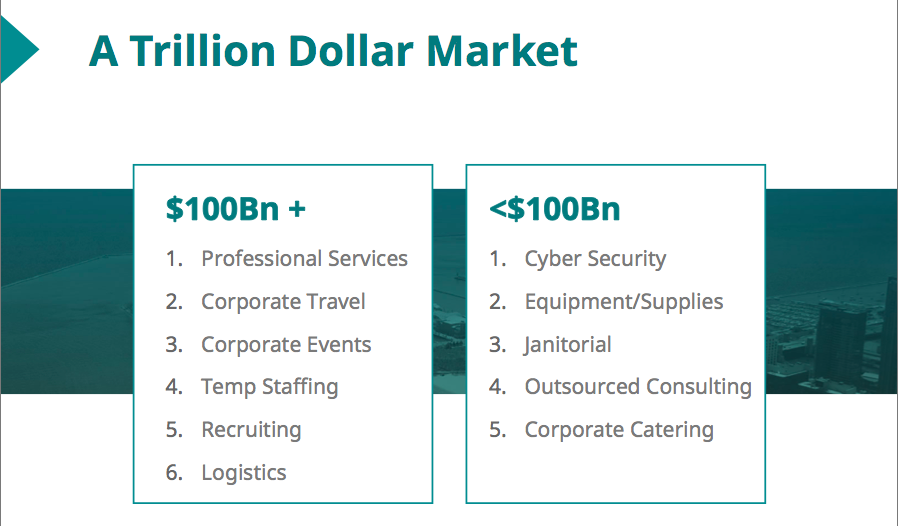

Among big businesses, however, the proliferation of these services significantly trails their adoption among consumers, despite B2B services representing well over $1 trillion in annual spend.

With the enterprise undergoing many fundamental changes – from the Bring Your Own Device movement of the late 2000’s to the recent explosion in cloud software – one additional trend is now emerging: that enterprise buyers act significantly like consumers when purchasing services.

The Emerging Models

The inevitability of B2B On-Demand platforms is a thesis we’ve held at Chicago Ventures since 2012 and we’ve backed it up with investments in Kapow Events, Shiftgig and Rocketmiles. We are currently witnessing four distinct models emerge to cater to corporations that run nearly parallel to similar approaches within the consumer space:

On-Demand People Marketplaces. Businesses which leverage freelance labor to provide services in-person. For example, the emerging class of applications providing on-demand office cleaning/maintenance or technical repair, connect people in-person with physical office spaces.

On-Demand Crowdsourcing. Platforms which use a supply of qualified experts to provide services and intelligence in a near-immediate time frame. For example, on-demand customer support platform, Directly, or on-demand security platform, Bugcrowd, both quickly aggregate the most relevant experts to the problem at hand and direct them to providing and enterprise-grade level of service.

Marketplaces for Sharing of Resources or Goods. Similar to the evolution of the “sharing economy” within the consumer sphere, businesses are becoming increasingly comfortable looking for cost savings opportunities by renting (or renting out) assets with latent downtime, such as equipment or even manufacturing capacity.

Platforms For Real-time Booking/Scheduling of Services. Unlike consumer facing booking engines such as Opentable or Priceline, many business-to-business purchases remain deficient of transparency or even online transactability. This realization was the driver of our investment in Kapow Events which provides on-demand booking for events from 6 to 100s of people – a process which previously required dozens of phone calls, voice mails, and price comparisons.

Mapping the Market

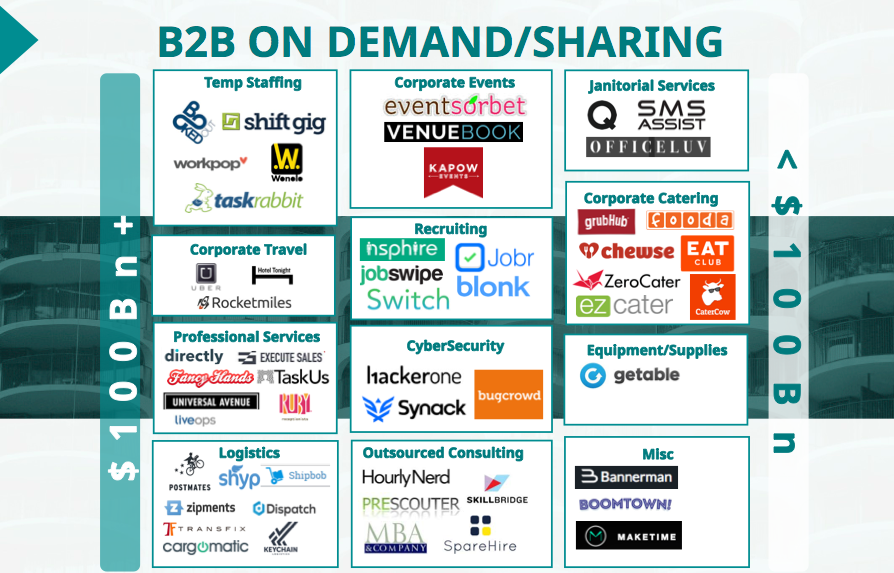

Interestingly, much of the early innovation in the B2B on-demand space has occurred within some of the smallest verticals by market size: corporate catering ($25 billion) and outsourced consulting ($30 billion) – and we are just now starting to see disruptive platforms emerge in some of the largest spaces: events ($275 billion), sales ($180 billion), temp staffing ($115 billion), executive assistance ($140 billion) and customer support.

My belief about why corporate catering, for example, is so crowded while larger spaces remain relatively untouched is that the infrastructure and supply chain is well established (restaurants are already very familiar with handling catering orders) -– and so startups in this category are largely incrementally improved tech-enabled services rather than a fundamental re-imagining of the corporate environment and behavior.

On the other hand, services such as Universal Avenue, part of the movement towards outsourced, on-demand sales are a higher friction change – requiring a fundamental behavioral shift on behalf of the enterprise. But in spite of the added friction and increased demands of quality assurance, the rewards are high, as reported by the Wall Street Journal:

“If [Universal Avenue] can pull this thing off, I can outsource all my sales to them,” says Marcus Strömbäck, iZettle’s head of direct sales. He says that while he is just in the pilot stage with Universal Avenue, using the service only in Sweden, sales through the year-old payments platform are robust, and he is eager for the company to expand outside its native country.

Further, unlike traditional enterprise software companies where conversations often revolve around whether one sells into the marketing or IT suite, these new on-demand services sell into a variety of different managerial roles – frequently employees whom are typically not targeted by top down sales at all – all of which makes breaking in and facilitating conversations easier.

For example, on-demand office maintenance and cleaning services target office managers. On-demand consulting or temp staffing platforms might sell into project managers or the CHRO. On-demand event booking platforms target everyone from executive assistants to the event planners. And because many of these services are relatively low cost and purchasable via credit card, they bypass corporate bureaucracy and slow sales cycles.

The First Inning

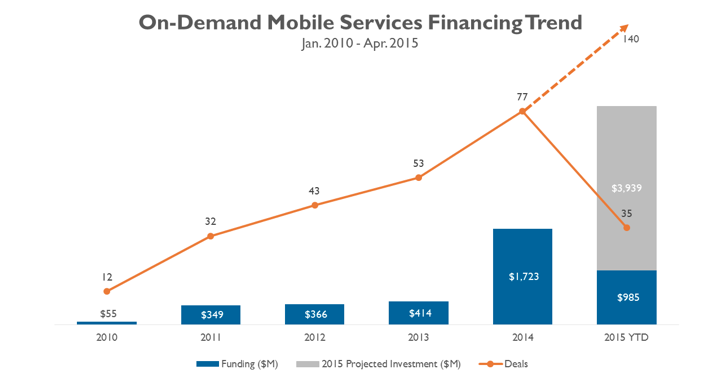

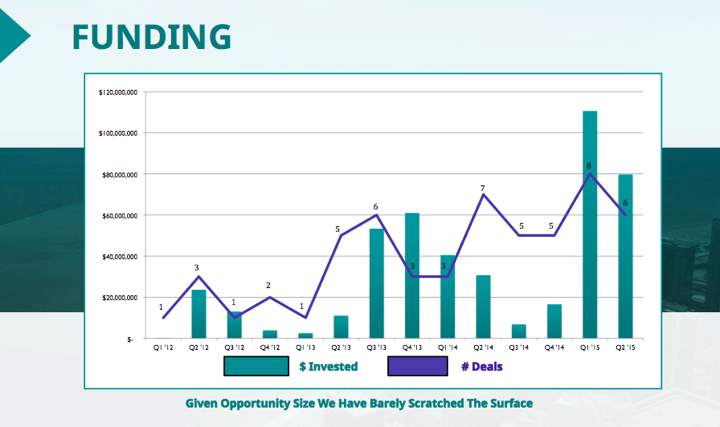

According to a recent report from CBInsights, funding to on-demand mobile service companies grew to a total of $4.1 Billion in 2014 across 79 deals. Even excluding Uber’s two mega-rounds in 2014, the industry generated $1.7 Billion in investment dollars, and is on pace to double that total in 2015:

Source: CBInsights

All that just goes to show how nascent the B2B market truly is. I was able to identify 50 companies that had raised institutional funding and fit one of the definitions above (excluding companies such as Uber and Shyp that additionally service consumer markets), and it appears that the enterprise on-demand space is akin to 2011 by consumer ODMS standards – on pace to see approximately $400M in investment this year.

Given the increasing number of freelance workers amongst millenials (a recent study commissioned by Upwork suggests 34% of the labor force is currently freelancing – many of whom hold higher education degrees and material professional specialization) and emerging software and digital communities catering to freelancers (such as WhenIWork and Peers) the category of enterprise focused apps should continue to grow, leveraging these significant tailwinds.

At less than 10% of 2015’s expected consumer on-demand deal volume and invested capital (excluding Uber), and a market size as big, if not larger, than the $1.2 trillion spent annually on consumer services, it is undeniably the early innings.

Nevertheless, investors should have some concerns around this emerging class of people marketplaces. Namely, what if freelance labor is simply less efficient processing many services than either artificial intelligence or traditional software?

For example, while outsourced personal assistant platforms exist that offer remote freelance labor on-demand to manage scheduling, travel plans, and other administrative tasks, AI-powered virtual assistants such as X.ai may improve to the point where they are able to replace those human-powered tasks entirely.

In the meantime, expect the on-demand battlefield to continue transitioning towards the enterprise/SMBs with hundreds of new platforms emerging in the coming years.

Thanks to my colleagues Jason Duboe and Peter Christman for their assistance with this article.