Drug discovery platform Atomwise has raised $6 million in seed funding to dig deeper into artificial intelligence and potentially speed up the process in which we discover new drugs.

The funding came from VC firms that all have some sort of a science-focused component. Data Collective led the round, with participation from Khosla Ventures, DFJ, AME Cloud Ventures and OS Fund.

Atomwise launched out of YC this spring with the goal to find cures for both common and orphan diseases – diseases that would otherwise be too expensive and time-intensive to take on. It has worked with IBM and other institutions and has launched more than a dozen projects tackling everything from multiple sclerosis to ebola. It also announced collaborations with Merck, Notable Labs, and Harvard Medical School while in YC.

A company that produces a huge win for all of these areas is a no-brainer for an investor with our particular portfolio. Matt Ocko, DCVC

Labs can take that information and begin testing compounds with newly discovered materials in order to find a cure. Another YC alum, Notable Labs has been able to use Atomwise to parse through existing drugs used to test effects on cancerous tissues in the lab.

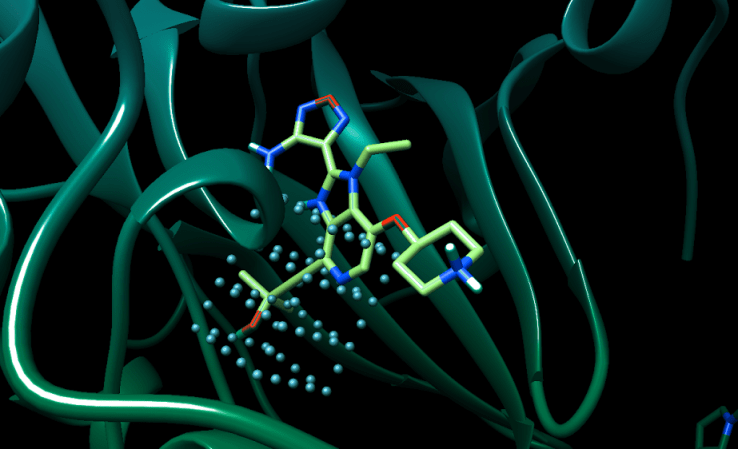

Atomwise performing simulated drug research. This image is of a hypothetical drug molecule being slotted in to the protein for which it may interact.

Atomwise is unique in that it pulls massive amounts of data out of the life or death processes. But Data Collective’s Matt Ocko mentioned that it also solved a “life or death” problem for the pharmaceutical industry because it deals with massively expensive and time-consuming drug discovery. According to the Tufts Center for the Study of Drug Development, it takes an average of 12 years and about $2.6 billion to put a new drug on the market.

“A company that produces a huge win for all of these areas is a no-brainer for an investor with our particular portfolio,” Data Collective’s Matt Ocko told TechCrunch.

Even with the early wins, the startup will still need to deal with an often slow-moving regulatory industry. It’s one thing to discover the compounds that might save someone’s life and another thing to get FDA approval. Take, for example, 23andMe. The FDA halted the company’s ability to inform new users about certain genomic markers related to their health in late 2013. Since then, the FDA has opened up the possibility for 23andMe to market for certain tests related to genetic diseases with the clearance of one such test for Bloom Syndrome, but has yet to approve other information regarding genetic health.

Ocko acknowledged the potential stumbling block for Atomwise but said he believes the startup to be one of the “ponies” based on what he’s invested in and looked at in the space. “When you start getting into animal trials and show evidence and applying drugs that already meet FDA approval I think you’ll see a stampede,” he said.

The startup plans to build on its current partnerships as well as seek out new ones moving forward. It will also use the money to hire those with expertise in machine learning, computational biology, medicinal chemistry, business development, sales, marketing, and partnerships.