Make way in the VC world for a new player that’s opening for business today in London. Frederic Court — a former parter at Advent who is considered one of the more successful investors in Europe with investments in successful startups like Zong (sold to eBay), Vitru (sold to Oracle) and Ubiquisys (Cisco) under his belt — is launching Felix Capital, a new VC with an initial fund of $120 million that he says will be focused in large part on the “creative class” — a group of tech startups that are at “the intersection of technology and creativity, in large markets such as digital commerce, digital media and connected life.”

Investments will be both early and later stage and range anywhere from $100,000 to $10 million, most often in the $2 million to $5 million range.

The firm has already made a few investments out of its first fund of $120 million, which Court tells me was oversubscribed and is funded by some interesting strategic backers as limited partners. They include Unilever, as well family funds and larger investment funds. Initial Felix investments include an investment in online fashion boutique aggregator Farfetch, the Business of Fashion trade news portal, and streetwear portal RAD. There are more investments that will be announced later this year, and in other sectors.

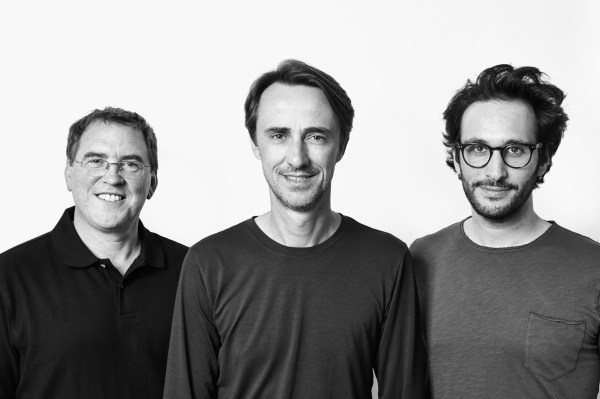

Perhaps what is also interesting about Felix is its structure. In addition to Court, the team includes another Advent alum, Les Gabb, as finance partner, as well as Antoine Nussenbaum as a principal, coming from Atlas Global and ABN Amro. But in addition to these three, there is an even longer list of “venture advisors” that Court tells me are also partial investors in the fund, who will help advise on deal flow and other aspects of maintaining the portfolio.

And if this list is an indicator, you’ll see that the investments are likely to extend well beyond fashion.

They include David Marcus (VP Messenger at Facebook, previously President of Paypal, and Founder & CEO of Zong); Reggie Bradford (SVP Product Development at Oracle, ex Founder & CEO of Vitrue); Rene Rechtman (President Intl at Maker Studios, ex SVP Intl AOL, CEO GoViral); Jon Kamaluddin (Board member at Klarna , ex Intl Director and CFO at Asos); Sebastian Picardo (Chief Retail Officer at Lane Crawford, ex MD Digital Commerce at Burberry, CFO of Net-A-Porter); Julien Codorniou (Director Global Platform Partnerships at Facebook, previously Business Development Director at Microsoft); Christophe Maire (Top EU Seed investor, previously CEO Textr & Gate5); Lopo Champalimaud (Founder & CEO of Wahanda, ex lastminute.com); Pelle Tornberg (Senior advisor Ericsson, ex Metro, MTG, Kinnevik); Henri Moissinac (Mobile Partnerships at Uber, previously running Mobile at Facebook and eBay); and Tom Ryan (CEO Pluto.tv, previously CEO Threadless, VP Digital EMI).

“They are all doing this while still being aligned with their day roles,” Court says. “They would not give us access to private information but what we are looking for, taking David Marcus for example, is access to his U.S. network and his experience in continuity in taking a startup to the U.S. from Europe,” he notes, referring to his mobile commerce company Zong that was acquired by eBay. “That is relevant experience and tricky for entrepreneurs.”

The rise of Felix comes at a time when many like to talk of bubbles in the tech world, although a lot of the harshest criticism of over-valuations and too-easy funding has often been reserved for the Valley.

And just as it’s been easier to come by funding if you’re a startup, up the chain the VCs are also in a flush period as larger investors line up to get their own skin into the tech startup investment game. Just earlier today Point Nine Capital in Berlin announced its third fund totalling $60 million. And Court told me that Felix itself was oversubscribed, with the intention originally to raise only $80 million. With others like Google Ventures also setting up shop out of London we currently have a large swathe of new VCs entering the scene to compete against or invest alongside more established firms in Europe like Accel, Balderton, Index, Sunstone, Passion Capital, and many more.

Court believes that he and his team and advisors offer something unique that set themselves apart from all these, and will provide a fitting filter to sift out signals for true startup successes from all the noise.

“I’ve been looking for the perfect set up, and I have conviction about what we’re doing,” he says. “I have the dealflow and I’m looking to bring something new. And I’ve brought the best people to work with me. These are my go-to guys.”