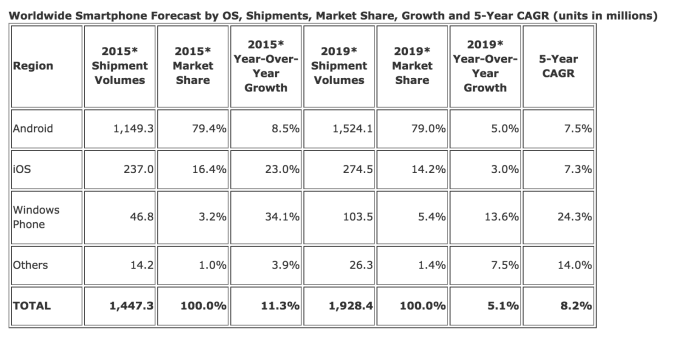

The writing has been on the wall for some time, but analysts at IDC are again confirming today that the worldwide smartphone market will continue to see its overall growth slow in 2015. The firm says that global smartphone shipments will grow just 11.3 percent this year, down from 27.6 percent the year prior. The changes are attributed, in part, to the Chinese smartphone market reaching saturation, which will make 2015 the first year that China’s smartphone growth (2.5 percent) will be slower than the worldwide market.

China’s slowdown will also impact Android’s growth, IDC says, as the Google-developed mobile platform is also expected to see slower growth than the worldwide market at 8.5 percent in 2015.

The figures are in line with smartphone shipment reports IDC released earlier this year, which had predicted 11.8 percent worldwide growth in 2015.

China’s smartphone market is still the largest in the world, but it’s no longer growing as before. Previously this month, it was reported smartphone shipments in China had decreased for the first time in nine years. During Q1 2015, 98.8 million smartphones shipped, down 4 percent year-over-year, and 8 percent on the previous quarter.

China, which is often still perceived as an “emerging” market, is actually similar to other more mature markets like the U.S., U.K, Australia and Japan, IDC analyst Kitty Fok had explained at the time. In other words, smartphone vendors are now in the position of having to convince current Chinese smartphone owners to upgrade their devices, and that’s more difficult than converting first-time buyers.

Ryan Reith, Program Director with IDC’s Worldwide Quarterly Mobile Phone Tracker, explains today how the shifts in China’s smartphone market are now affecting the top mobile OS platforms, iOS and Android.

“This has implications for Android because China has been a critical market for Android smartphone shipments in recent years, accounting for 36 percent of total volume in 2014,” he says. “As Chinese OEMs shift their focus from the domestic market to the next high-growth markets, they will face a number of challenges, including competition from ‘local’ brands.”

Reith added that Apple faced a similar situation in 2012 to 2014, when its own year-over-year growth rates were slightly lower than the worldwide market. But when it began to offer bigger-screen phones, its volumes increased. This year, IDC expects iOS smartphones to grow 23 percent, remaining above the worldwide market growth rates. In fact, Apple had capitalized on the fact that it was able to convince many Android owners to switch back to iOS after they had previously left the platform for bigger-screened Android phones, says Reith.

While worldwide growth and China in particular is slowing this year, there are still a number of markets that are expected to experience “robust growth” this year and in years to come, IDC claims. The biggest growth markets in terms of volume and year-over-year growth are India, Indonesia, Middle East (most countries, even the more unstable like Pakistan) and South Africa. Latin America has high-growth potential as well, the firm notes, but the economic situation varies so much from country to country that it is shifting quite often. Brazil has started to slow and is more in line with worldwide growth.

IDC says these markets will help push smartphone shipment volumes to 1.9 billion by 2019.