Editor’s note: Ryan Caldbeck is CEO and co-founder of CircleUp.

Is there a “Food Bubble”? Robyn Metcalfe believes so. In her recent TechCrunch article she pointed to recent fundraises by Instacart and Delivroo — reportedly demanding valuations of $2 billion and $100 million on revenues of ~$100 million and $1 million, respectively — as evidence that the irrational exuberance often found in tech is seeping over into food investments.

I’ve been investing in high-growth consumer businesses my entire career. When I see revenue multiples reaching 100x, I bat an eye, too. But this isn’t evidence of a “food bubble.” And that’s because Instacart is not a food company. Nor is Deliveroo.

Each are decidedly tech. Using these two companies companies as evidence of a food bubble is akin to saying Airbnb’s valuation is evidence of a hotel bubble — or Uber’s valuation is evidence that the valuations of Detroit’s big three are due for a correction.

There isn’t a bubble in food. In fact, there are not bubbles in consumer/retail. Period. Rather than look at specific companies, let’s look at the data. Across public and private companies in the consumer space, food and beverage constitute about 40 percent of CPG, so this is a good proxy for the industry overall.

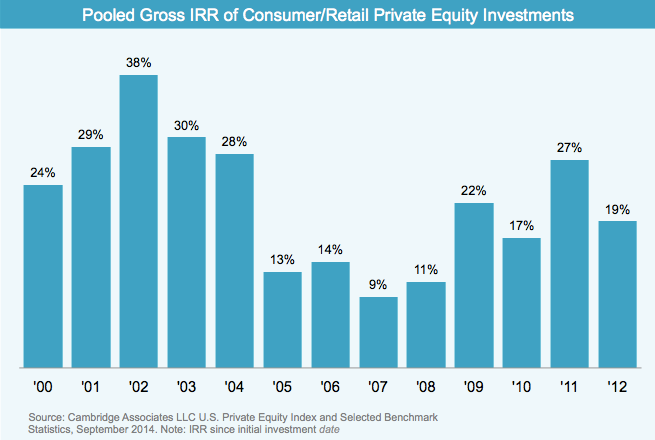

Cambridge Associates tracks the performance of private-equity investments across industries. In the past 15 years, through two recessions, there hasn’t been a single negative vintage year in consumer/retail. For investors, this means there is far less vintage risk when investing in consumer compared to tech.

Why is this? A couple of reasons. First, only 5 percent of venture capital goes to consumer investments. There isn’t as much competition, and, therefore, prices aren’t being unsustainably driven up.

Second, investors in consumer invest in fundamentals. Not just blind hope. And it’s these fundamentals — real revenues, margins, predictable growth engines — that shield investors from the valuation exercises (often based on unproven, flavor-of-the-day metrics) that you see in tech. You can’t fake your way to building a new factory or increasing sell-through 5x.

Here’s an example of what investing in fundamentals, not hype, looks like. Over the past three years 23 food companies have raised capital on CircleUp. Here’s the profile of the average company at the time of raising:

- $1M+ in TTM revenues

- $3.5M valuation (3.5x revenue multiple)

- 125% YOY revenue growth

This is hardly representative of irrational exuberance. Rather, investors are exercising discipline. You may wonder if this rationality negatively affects their return prospects. In early stage investing, is irrationality the name of the game? Do investors need to suck it up and accept spectacular valuations to do well? Absolutely not. The Kauffman Foundation found that the average returns for angel investors in consumer products were 3.6x cash on cash over 4.4 years (PDF). Higher than software.

I agree with Robyn that valuations in food tech are reaching dizzying heights. But strip out the “tech,” and the associated mania around it, and you’ll find scant evidence of a bubble.

Rather, you’ll find reasoned investments being made in exceptional companies at unexceptional valuations.