The real estate market is bouncing back from the recession, which means house flipping shows are back on HGTV and investors are having a harder time finding underpriced properties. RealtyHop, which was developed by the team behind the Y Combinator-backed RentHop, wants to make it easier for investors to find these kinds of properties. For now, the service only focuses on New York, though.

Investing in real estate means you likely want to rent the unit out, too. But if you’re looking to invest in a New York condo or co-op, figuring out how much rent you can charge can be difficult.

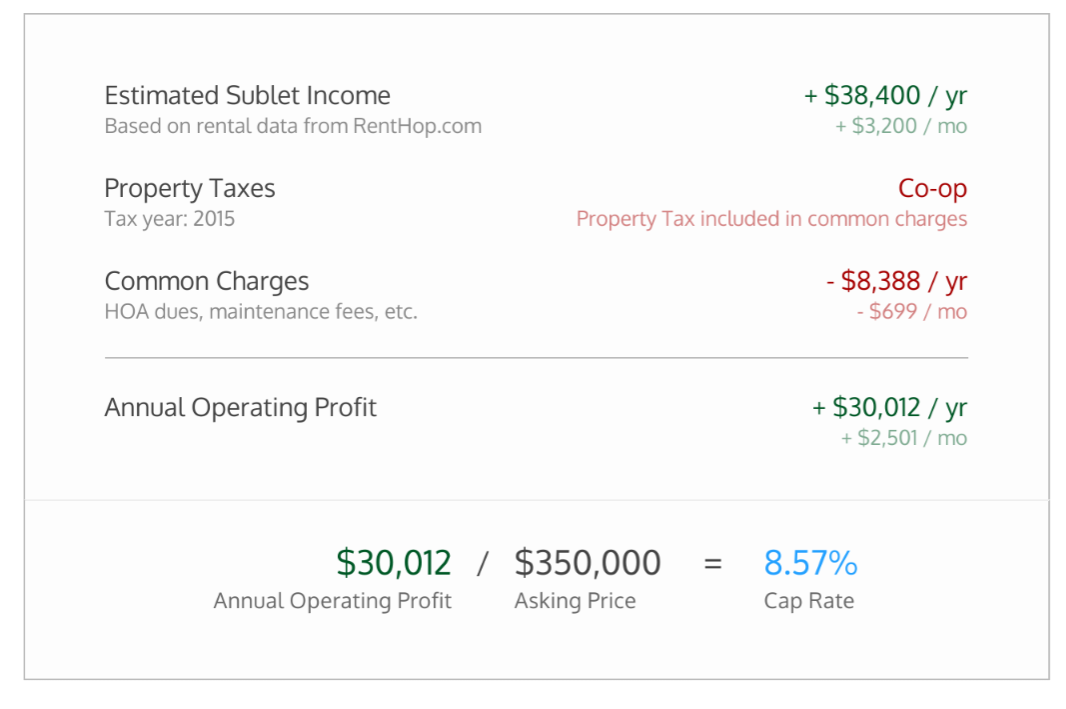

Chances are, after all, that the turnover in a popular building is relatively low, so you can’t compare rents from a few years ago with today’s market rate. Because RealtyHop has a trove of rental data through RentHop, combined with information about a building’s locations, amenities, size and other factors, it can still predict what the sublet revenue would be.

“We use data from our rental site and take into account both the building location, amenities, size, and other factors, but we know every building is a little different and we’re constantly tweaking to get more accuracy,” RentHop co-founder Lee Lin tells me.

To figure out whether a unit is priced right — and maybe even under its market value, the service looks at metrics like cap rates (that is, the measure of the net income as a percentage of the purchase price), financing, tax benefits and board restrictions (which can often be an issue when it comes to New York condos and co-ops).

Lin stresses that investors obviously still have to do their own due diligence. “We don’t make any assumptions about vacancy rates, maintenance, and closing costs, because these can vary greatly depending on the buyer and unit,” he said.

“I guess there is a bit of a bargain bin mentality (although I’m not sure I like that moniker), where not everything in the bargain bin is a good buy,” Lin said. “But for those willing to sift through some junk, they may find a great deal.”

Lin tells me that while the service is currently only available in New York, the plan is to take it to other cities next year once the company has amassed enough data about the housing market in these cities to ensure it can give its users accurate information.