Vouch, a so-called “social network for credit” founded by ex-PayPal and ex-Prosper alumni, now has an additional $6 million in Series A funding to continue to grow its business. While there are a number of alternative lending startups on the market today, Vouch’s differentiating factor is that it leverages a person’s social connections in order to determine their credit-worthiness. In addition, these connections can choose to “vouch” for a loan recipient – even agreeing to pay back a portion of the debt if the borrower defaults.

New investors in the network include Core Innovation Capital, Data Collective, Stanford StartX Fund and Cooley LLP, and are joined by Vouch’s existing investors, First Round Capital, Greylock, IDG Ventures and AngelList. Combined with an earlier seed round, this brings Vouch’s total raise to date to $9.6 million.

Arjan Schütte, Founder and Managing Partner of Core Innovation Capital, and whose background includes time spent managing a venture fund targeting the unbanked and underbanked, is also now joining Vouch’s board.

Vouch was co-founded in 2013 by CEO Yee Lee, previously of PayPal, Slide, Skype and more recently, Katango (acquired by Google), and One Jackson (acquired by TaskRabbit); Sue Korn, previously VP of Finance and Head of Operations at peer-to-peer lending marketplace Prosper; and PayPal vet Hugh Olliphant. The team also includes several other execs and engineers hailing from PayPal, Prosper, and Google.

The service has been in beta for a year, but launched publicly last month.

Why A Social Network For Loans?

The idea of co-signing on a loan is not a new one, but Vouch is bringing it into the modern era, while also helping borrowers establish a trusted network of connections who can aid them in their borrowing efforts. The service makes sense in particular for younger users who have yet to build a solid credit history – for example, those fresh out of college and landing their first jobs, but who don’t yet have years’ worth of good credit behind them. In their case, mom or dad, as well as other family and friends, could vouch for their credit-worthiness to help them borrow money.

The service could also be used by those who are trying to rebuild good credit after making a few mistakes, but doesn’t go after those who have really screwed up – borrowers must have a FICO score of 600 or more. They also can’t be involved in bankruptcy or foreclosure proceedings.

Vouch additionally serves the immigrant demographic. According to Lee, one-quarter of its hundreds of borrowers are from that population. As a first-generation American, he’s familiar with the struggles immigrants face when trying to get credit.

“My parents had no credit score when they first got over here, and they really relied on aunts and uncles,” he says.

Vouch’s user base is diverse and heavily mobile with 70%-80% of Vouch’s traffic from mobile, including via its iOS and Android apps. Around half of its borrowers are over 35, and skews slightly female.

How It Works

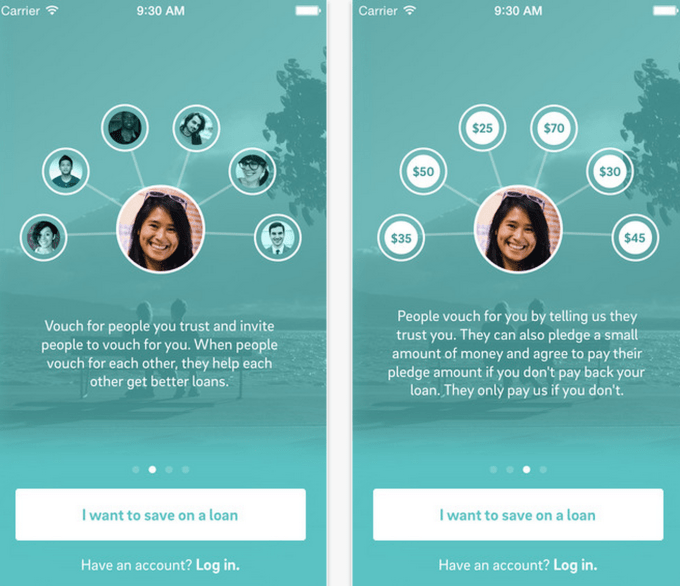

To use the service, borrowers sign up for an account online or on mobile, fill out some personal information, then invite others to join their network. People can “vouch” for the borrower by choosing an amount of money they agree to pay if the borrower defaults on the loan. They also answer questions about how they know you and how financially responsible they believe you are. And the larger and stronger the network a borrower builds, the larger the loan they can receive. The “vouch” amounts can be any number, but those of $100 or more have more impact.

Until today, Vouch offered installment loans of $500 to $7,500 with interest rates between 5 percent and 30 percent, based on a combination of factors, including traditional criteria, like your credit score and your Vouch network. The loans are paid back over the course of one to three years. But starting now, thanks to the new funding, Vouch can loan up to $15,000. This will allow borrowers to do more, including paying off credit cards or student loans, planning trips or making large purchases among other things.

Vouch loans have reduced fees compared with many traditional lenders, as they don’t include an application fee, annual fee, or prepayment fee. However, there is an origination fee of 1 to 5 percent of the loan amount – which often comes in lower than the usual 5 percent charged by others. Late fees (5 percent of the loans amount or a minimum of $15) are also assessed.

Today, the company has originated a million in loans, and its expanded network has thousands of users, including borrowers and sponsors. The majority of the loans are in good standing, too.

“We’ve had a remarkably low delinquency rate compared to industry standards,” says Lee. “We kind of expected this,” he adds, noting that in other areas, like microfinance, where this model has been tried, lenders are seeing great repayment rates on what would have otherwise been considered risky loans. “Building a novel social network around a person – it really does work. It really does provide much better lending outcomes,” Lee says.