Dating app Tinder’s move into the subscription business seems to be paying off. According to remarks made by parent company IAC during its quarterly earnings reported this week, the company is pleased with Tinder’s penetration rates – it reached its current level of penetration quicker than IAC’s OkCupid did, in fact – and renewal rates are higher than any other product, the company said.

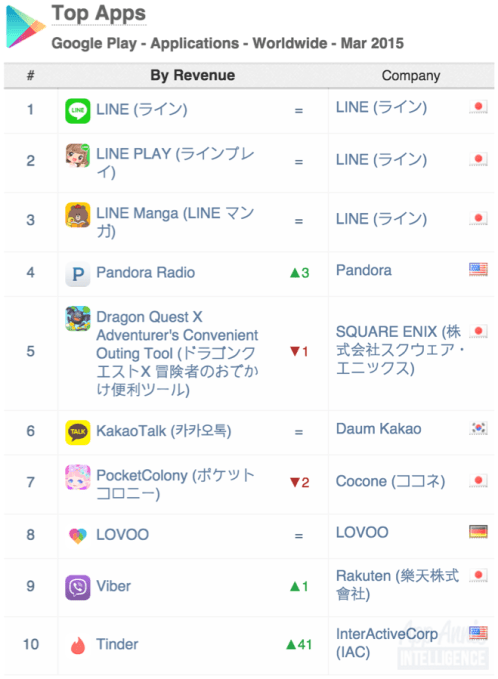

Now new data from app store analytics firm App Annie also showcases Tinder’s climb in the charts following the release of Tinder’s subscription service Tinder Plus, which saw the app moving up six spots in Google Play’s revenue rankings, while on iOS it jumped from No. 969 in Overall revenue rankings to No. 26.

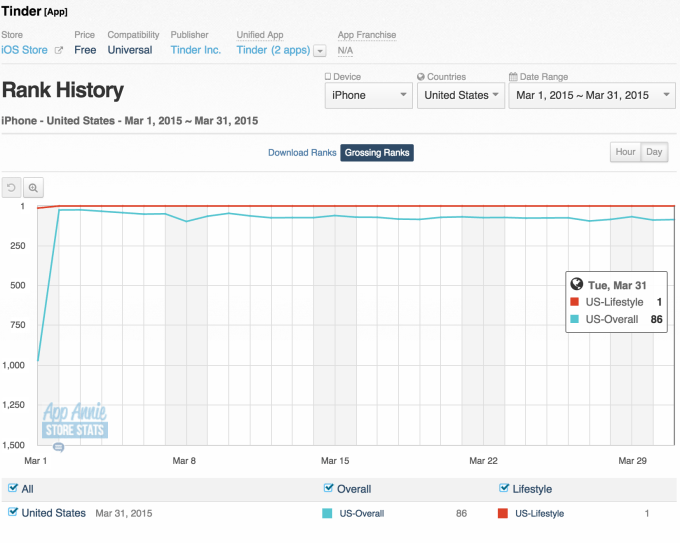

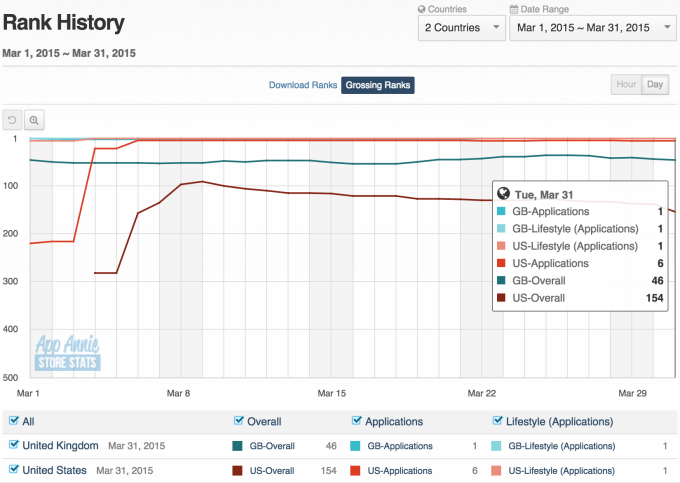

Tinder reached that No .26 position on March 2 – when the Tinder Plus subscription service debuted. So while the jump is related to a launch event, it’s still a massive leap over a short period of time. More importantly, perhaps, is that throughout the month of March the app remained in the top 100 Overall revenue rankings on iOS. It also climbed up from No. 14 in Lifestyle prior to the Tinder Plus launch to maintain a No. 1 position throughout the month.

The app is still riding high today, at No. 1 in Lifestyle and No. 43 Overall on iOS; and No. 1 in Lifestyle and No. 89 Overall on Google Play by download rankings. And it remains a top-grossing app on both platforms today in the Lifestyle category (No. 1 on both iOS and Android). This indicates the app is continuing to bring in revenues even into its second month following the paid service’s launch.

In case you missed it, Tinder Plus was the dating app’s first move to generate subscription revenue for its previously free service. Instead of restricting core features like IAC does with other products out of its Match Group, including Match.com and OkCupid, for example, Tinder Plus adds to the app’s main feature set by offering in-demand options like the ability to undo errant swipes, for example, and Passport, a way search for matches beyond your current physical location. It also made a more risky move by limiting the number of right swipes. For unlimited swipes, you have to pay.

The company has been experimenting with its revenue model, charging a range of prices for access to the Tinder Plus subscription based on users’ ages, starting at $10 per month, as well as running in-app advertisements. Its ad with Bud Light “blew away our expectations in terms of user engagement,” Match Group chairman Greg Blatt said this week.

IAC last year stated that Tinder could produce $75 million in revenue in 2015. Some analysts are coming in with different figures, however. Barclays analyst Chris Merwin, for example, pegged Tinder’s quarterly revenue at $10 million to $12 million.

But IAC is bullish on the subscription service. Tinder Plus’s “payment and renewal rates came in solidly against expectations,” Blatt said in a statement.

Revenue from IAC’s numerous dating sites grew 2 percent in the quarter, and the number of paid subscribers grew by 16 percent. Overall revenue in The Match Group grew by 13 percent. Many of those new subscribers are Tinder Plus users, IAC said, attributing some portion of the growth in dating paid members to the launch of this new subscription service.

Credit Suisse believes Tinder Plus has reached 100,000 subscribers while Morgan Stanley is estimating 297,000 paying users. However, the latter firm believes the company will have to double its subscriber base to meet revenue expectations.

App Annie’s data hints at Tinder Plus’s growth, too – in addition to climbing the charts and jumping up in the revenue rankings, the subscription service also saw strong uptake in both the U.S. and U.K., the firm found. (Both those markets sport user bases that tend to pay for premium apps and services).

Tinder’s parent company isn’t talking about Tinder’s monthly active users, specifically. But it did report that Q1 2015 was the highest registration quarter for the app that it has seen to date, and the growth in active users remains strong.

Tinder’s app has been estimated to have 22 million to 24 million users, as of late last year. IAC said in December the app had been downloaded over 40 million times, and users were swiping left or right more than a billion times per day.

Tinder Plus resonated with users because it gave them the option to pay for features they had wanted for some time, and the company is now poised to continue that model going forward, it seems. Blatt says the company has “10 other features” they’re going to layer on top of Tinder in the long-term.