The bitcoin-watching news service CoinDesk recently released its first quarter look into the cryptocurrency’s performance during the opening months of 2015. Mostly the data is net positive, showing an increase in total wallets, and investment. However, there are a number of included data points that demonstrate slowing growth in key bitcoin, and bitcoin-related areas.

The collected data indicates that the first quarter of 2015 was the most popular ever in terms of the dollar-value of venture capital investments made into the bitcoin ecosystem. That data point, however, is skewed by a single investment — the $116 round million invested into 21, a company that remains at least partially occluded in terms of its ambitions. Aside from that single investment, first quarter venture investment was on par — $113 million — with the preceding fourth quarter.

Key to bitcoin’s performance, at least from an external perspective, is the number of wallets in existence. Those receptacles and storage locations of bitcoin help the market understand how many new people the cryptocurrency is attracting. In the first quarter, according to the CoinDesk report, total wallets grew from 7.4 million to 8.4 million, up 14 percent on a sequential quarter basis.

That growth rate is likely under expectations from a year ago. The market value of all bitcoin in circulation — some remains yet-to-be-mined — fell from the last quarter of 2014 to the first quarter of 2015 by 36 percent.

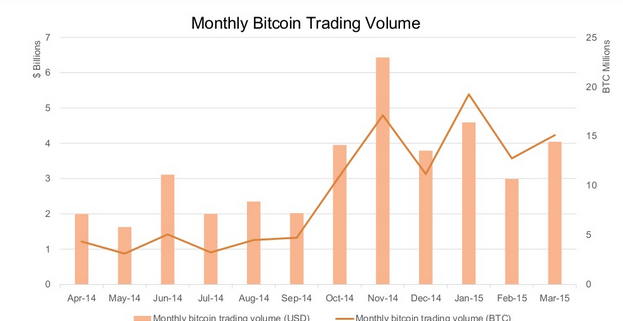

Here’s CoinDesk’s recent chart of aggregate bitcoin trading volume, on a monthly basis:

The sequential quarter total is skewed by the November timeframe, but it seems that volume hasn’t seen too great an acceleration, or deceleration in the last two three-month cycles.

Among the bulleted key takeaways that the report contains is the following: “Bitcoin struggled to gain mainstream consumer traction [in the quarter].” That has been the case for the life of bitcoin. That the trend persists isn’t, therefore, too surprising. Still, it isn’t hard to wonder what bitcoin firms that pitched investors over the past 18 months, predicted would happen — did they anticipate that the price of bitcoin be so low? Would investors have invested quite so much over the past year if bitcoin wallet adoption was as slow as it has been?

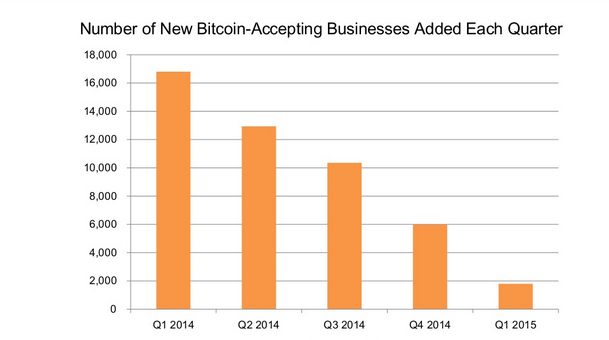

Last thought, here’s CoinDesk’s aggregate new merchant adoption of bitcoin:

You can ask yourself if that deceleration is bad, or merely a blip.