Kabbage has taken root in the U.S. and UK markets as a platform where small businesses can quickly apply for and receive working capital loans — with Kabbage making fast decisions about eligibility through a mix of smart algorithms and online and offline data sources. Now the startup is growing its business on two fronts. It’s kicking off a new white-label offering where third parties will power loan services using Kabbage’s technology. And through its first white-label partner, it is expanding to a third market, Australia, its first in Asia Pacific.

The service in Australia will be offered through a new service called Kikka Capital that will launch in May. Kabbage — named after a slang term for money — says Kikka will license its platform to onboard customers, as well as underwrite and monitor the loans. Kikka, meanwhile, will be responsible for marketing, funding, loan servicing and other operations. The loans will be up to $100,000 and be over a term of one to six months.

The expansion to Australia and more generally the Asia Pacific region was something that Kabbage hinted would be coming last year, when it raised a $50 million Series D round led by Japanese investor SoftBank Capital.

Overall, Kabbage has raised more than $460 million in a mix of debt and equity. A large portion of that going towards providing the capital upfront for SMBs to borrow on its platform. CEO Rob Frohwein tells me that to date, Kabbage has loaned out $700 million and is on track to loan out $1 billion to SMBs this year — in addition to its newer consumer business Karrot. Altogether, the company currently has over 40,000 active customers.

(The Karrot business, meanwhile, is growing, too: Frohwein says it is “on track to do $250 million in loans this year and aiming for $1 billion next year.”)

This is not the first time that Kabbage has worked in partnership to scale up its business. In the U.S., the company has also been partnering with banks to provide loan services; and earlier this month it announced a deal with MasterCard to power a small business loans service that MasterCard will be offering through its merchant acquiring banks.

CEO Rob Frohwein tells me that Kabbage will be making two similar announcements along the lines of the MasterCard deal in the next four weeks. “These deals have exclusivity and bring us into banks and closely related financial services companies such as merchant acquirers,” he said.

(This means that in theory, an SMB in the U.S. can now get Kabbage loans directly through Kabbae’s own retail portal, a bank, or through their credit card services supplier — most commonly a bank again.)

What’s different about the Kikka service is that it will be the first time that Kabbage is rolling this out internationally, and also giving up its branding and involvement in the financing side of the business to another startup, acting only as the tech partner — not unlike what Paydiant, recently acquired by PayPal, provides in its mobile wallet services with CurrentC.

The white-label structure also means that Kabbage can expand more rapidly to other markets. Indeed, when Kabbage announced its $50 million Series D round and its plans for Asia nearly a year ago, Frohwein pointed out that the expansion would not be immediate:

“Obviously many international markets pose not only regulatory hurdles but also technology challenges,” he said at the time. “We tend to focus on markets where there’s a strong technology infrastructure for small businesses and where data is meaningfully available electronically.”

While this may mean that Kabbage’s own cut of the commission on these loans is smaller, it has lower costs in other areas. For example, by swapping to a white-label model, Kabbage is able to bypass some of the licensing and financing that it might have needed to undertake were it to launch a full offering, leaving these parts to local providers.

“Working with Kabbage gives us a tremendous opportunity to bring their breakthrough lending technology platform and seamless user experience to small businesses across Australia,” said David Brennan, Kikka Capital founder and managing director, in a statement. “Launching on the Kabbage platform allows us to dramatically accelerate our entry into small business lending and to manage risk effectively by underwriting businesses in real time, throughout the entire lifecycle of a business.”

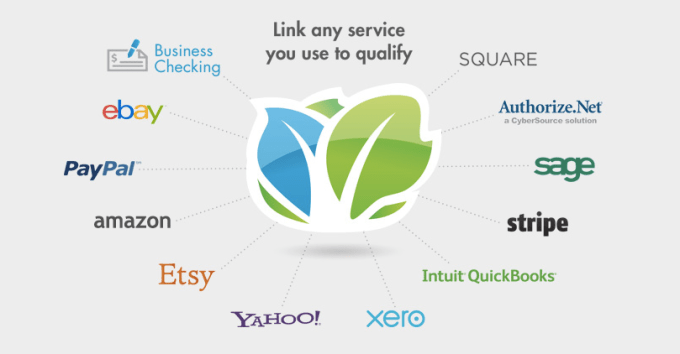

That Kabbage platform’s unique selling points are based firmly around data. The company currently bases its eligibility for loans on an applicant’s track record and data across a lot of different services. Originally developed first for online businesses, it’s heavy on using data from sites like eBay, Amazon, and Etsy where these SMBs may already be doing business, plus several other sources such as accounting software from the likes of Xero and Intuit.

Ultimately, Kabbage claims that its mix of data sources and how it is able to parse the information gives it a more accurate reading of suitable loan candidates and helps make it more certain that what gets borrowed also gets repaid (a thorny issue that has foxed other online loan providers).