Berlin-based DreamCheaper, which has been operating fairly stealthily until now, could soon become the hotel booking industry’s most hated startup. It operates a service that aims to ensure you never overpay for a hotel room again, even if you (miraculously) get the best deal available at the time of booking but the price since goes down.

Specifically, DreamCheaper exploits the “flexible booking” option typically offered by hotels, by canceling your hotel booking on your behalf once its algorithms have located the same room type, at the same hotel, for a cheaper price and made a replacement booking. Meanwhile, the service continues working on your behalf, right up to the day before check-in, canceling and rebooking if and when a better deal comes along.

The hotel booking industry, dominated by aggregators such as Hotels.com, Booking.com and Trivago, is opaque to say the least.

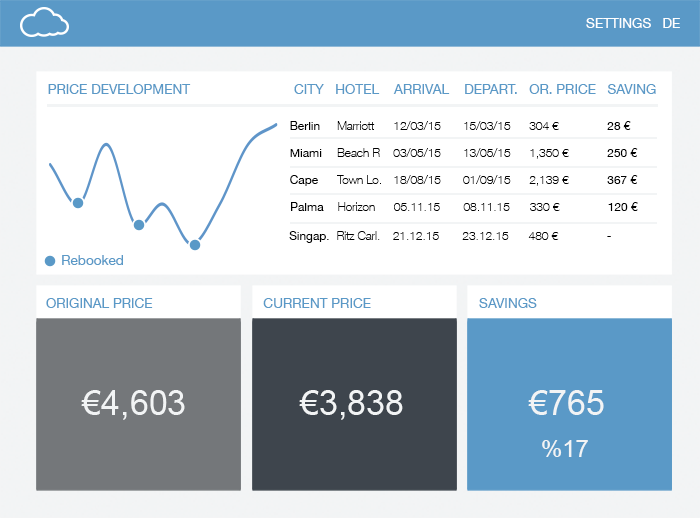

And it usually does. The German startup reckons customers typically save 15 percent on their original booking price. That’s because hotel room prices fluctuate dramatically based on things like supply and demand, discounts offered by hotel booking aggregators and the hotels themselves, and sometimes because of more shady tactics, such as geo-targeting, that are deigned to drive the price up. The hotel booking industry, dominated by aggregators such as Hotels.com, Booking.com and Trivago, is opaque to say the least.

What’s more, despite the somewhat convoluted tactics that are employed behind the scenes, from a customer’s point of view DreamCheaper’s user experience couldn’t be much simpler. After registering with the service, you simply forward your hotel booking confirmation email to the startup and the price-comparison process begins — a process that the company’s CFO and co-founder Nathan Zielke tells me is already highly automated, employing minimal human labour, so that DreamCheaper’s model can scale.

There’s no point leaving money on the table.

In contrast, DreamCheaper generates revenue by taking 20 percent of any money saved, meaning that it is always incentivised to find the cheapest deal, even if it also sometimes generates affiliate revenue as a pure side product and secondary to its business model. There’s no point leaving money on the table after all.

Might hotel booking sites block DreamCheaper, should it grow too big? It’s possible, concedes Zielke, though the startup has ways around this, such as further developing its payments system so that each subsequent booking is technically made by the individual customer. That would make it a lot more difficult to stop the service.

Lastly, Zielke and his co-founder and CEO Leif Pritzel argue that DreamCheaper is good for the hotels themselves. Similar to Triptease, it could help increase revenue by ensuring that more customers book direct, thus helping to wean hotels off the large hotel booking aggregators who squeeze margins because of the high commissions they take.