Editor’s note: Tim Merel is the managing director of Digi-Capital, which advises mobile Internet, games and digital companies in the U.S., China, Japan, South Korea and Europe.

Hoping for $700 billion in mobile Internet revenue, and fearing over 30 percent online cannibalization, mobile deal makers shattered records last year.

There were $120 billion of mobile Internet deals ($32 billion early stage investments, $90 billion exits) in 2014. Or three times Apple’s net income. Individual mobile Internet sectors saw up to 42x average three-year investment returns.

It’s party time for mobile entrepreneurs and investors.

Drinking from the fire hose

A heady cocktail of VCs, private-equity firms, banks and corporates competed to invest over $32 billion in mobile Internet startups last year, fueling the engines of growth in not just mobile but the entire tech market. $12 billion of new money dropped in Q4 2014 alone, topping two-and-a-half times the same quarter a year ago.

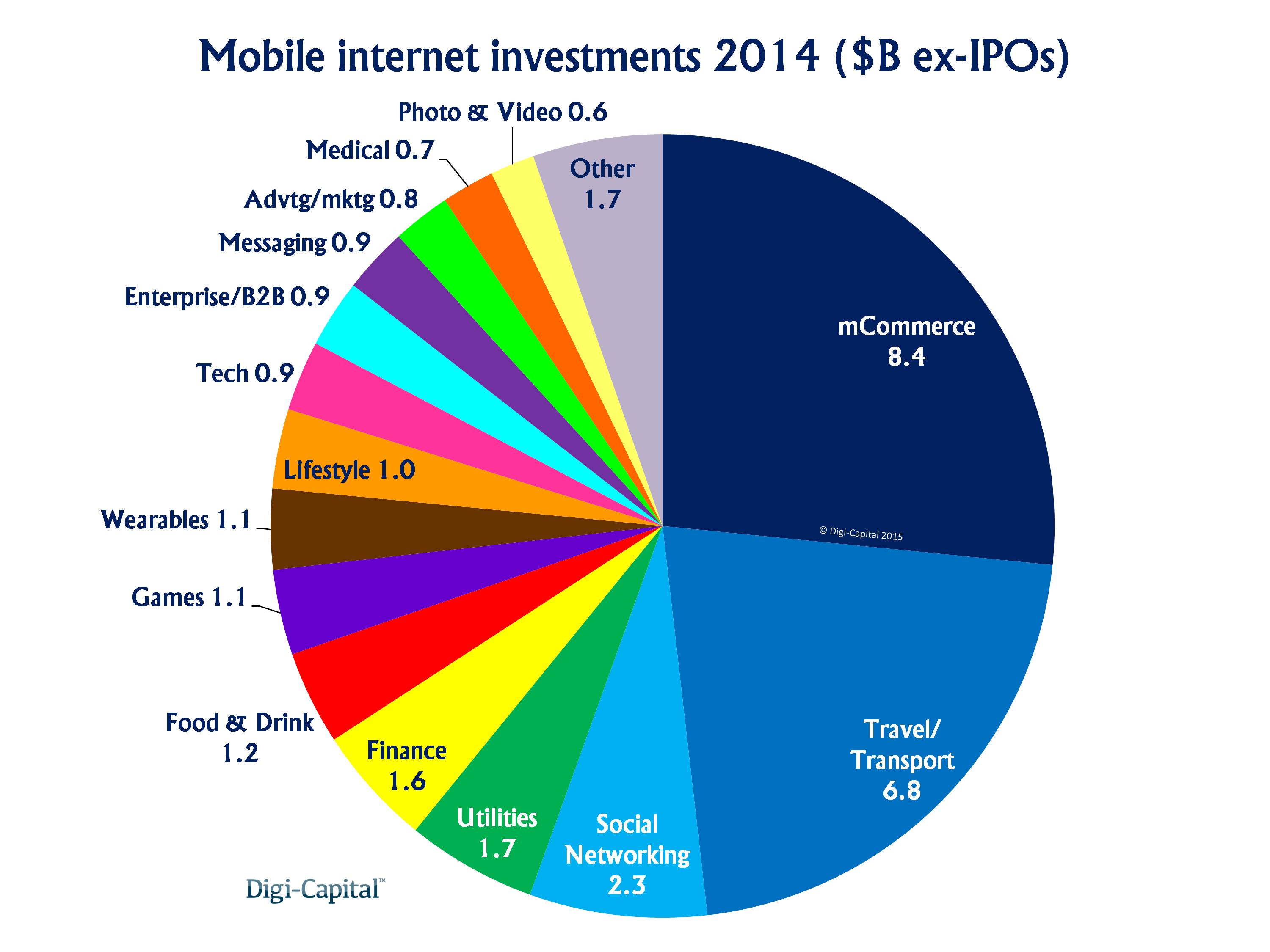

M-commerce raised $8.4 billion, travel/transport $6.8 billion, and social networking $2.3 billion. Utilities, finance, food and drink, games, wearables and lifestyle each raised over $1 billion. Tech, enterprise/B2B, messaging, advertising/marketing, medical and photo/video each raised over half a billion dollars, with 12 other sectors swallowing $1.7 billion more combined.

M-commerce raised $8.4 billion, travel/transport $6.8 billion, and social networking $2.3 billion. Utilities, finance, food and drink, games, wearables and lifestyle each raised over $1 billion. Tech, enterprise/B2B, messaging, advertising/marketing, medical and photo/video each raised over half a billion dollars, with 12 other sectors swallowing $1.7 billion more combined.

It looked hard to not raise money in mobile if you were doing something interesting last year.

Exit through the gift shop

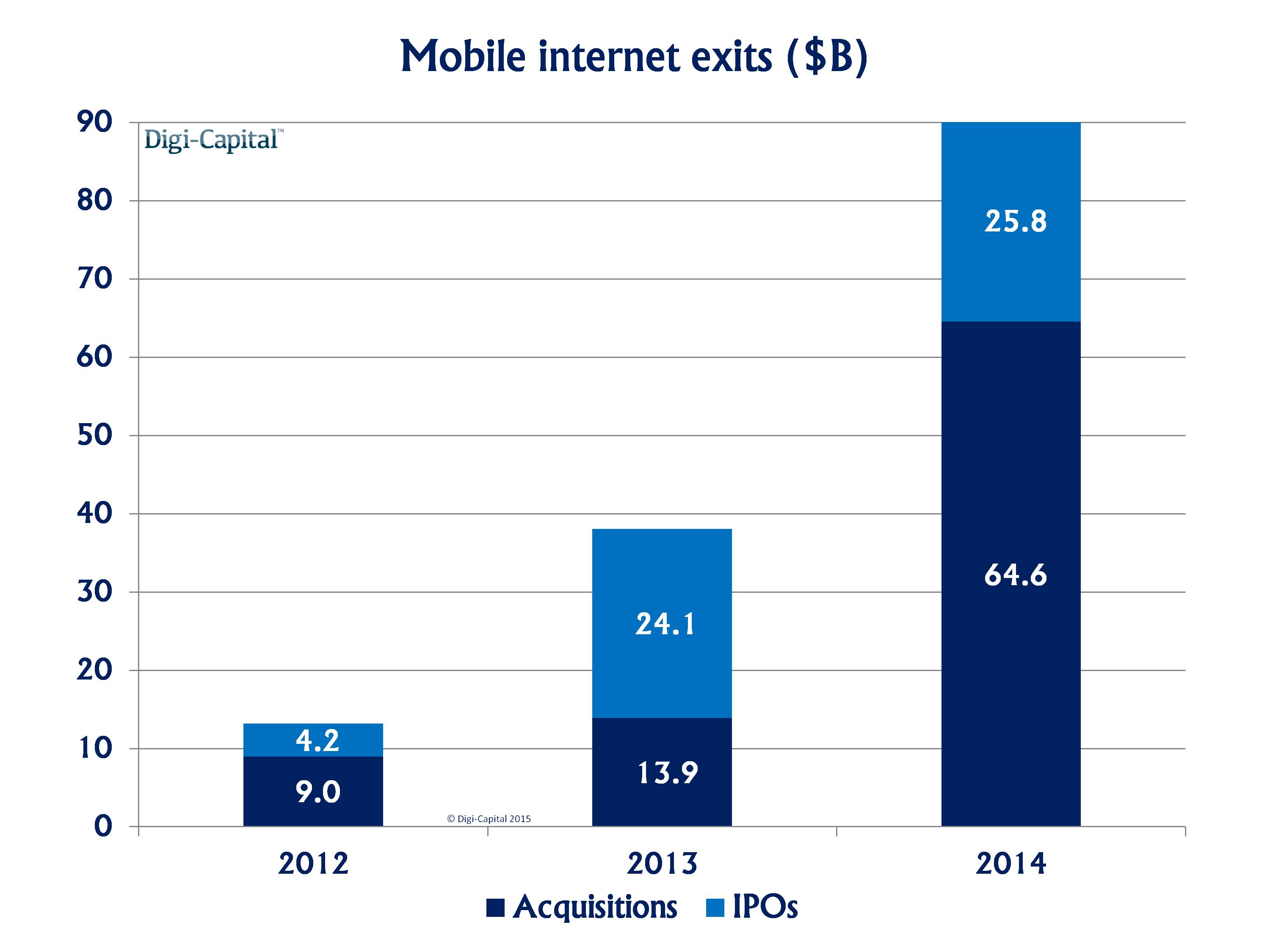

Mobile Internet exits smashed through $90 billion ($65 billion mergers and acquisitions, $26 billion IPOs) in 2014, more than twice the previous record from the year before. Even taking out Facebook/WhatsApp’s $21.8 billion, there was an 80 percent jump from 2013.

Institutional investors backed IPOs hoping to get in on the ground floor of a high-growth market. Online corporates facing massive cannibalization of their core businesses, and hoping to share in high growth, were major drivers of the acquisition boom. Early-stage investors and entrepreneurs had a field day.

Billions are cheaper by the dozen

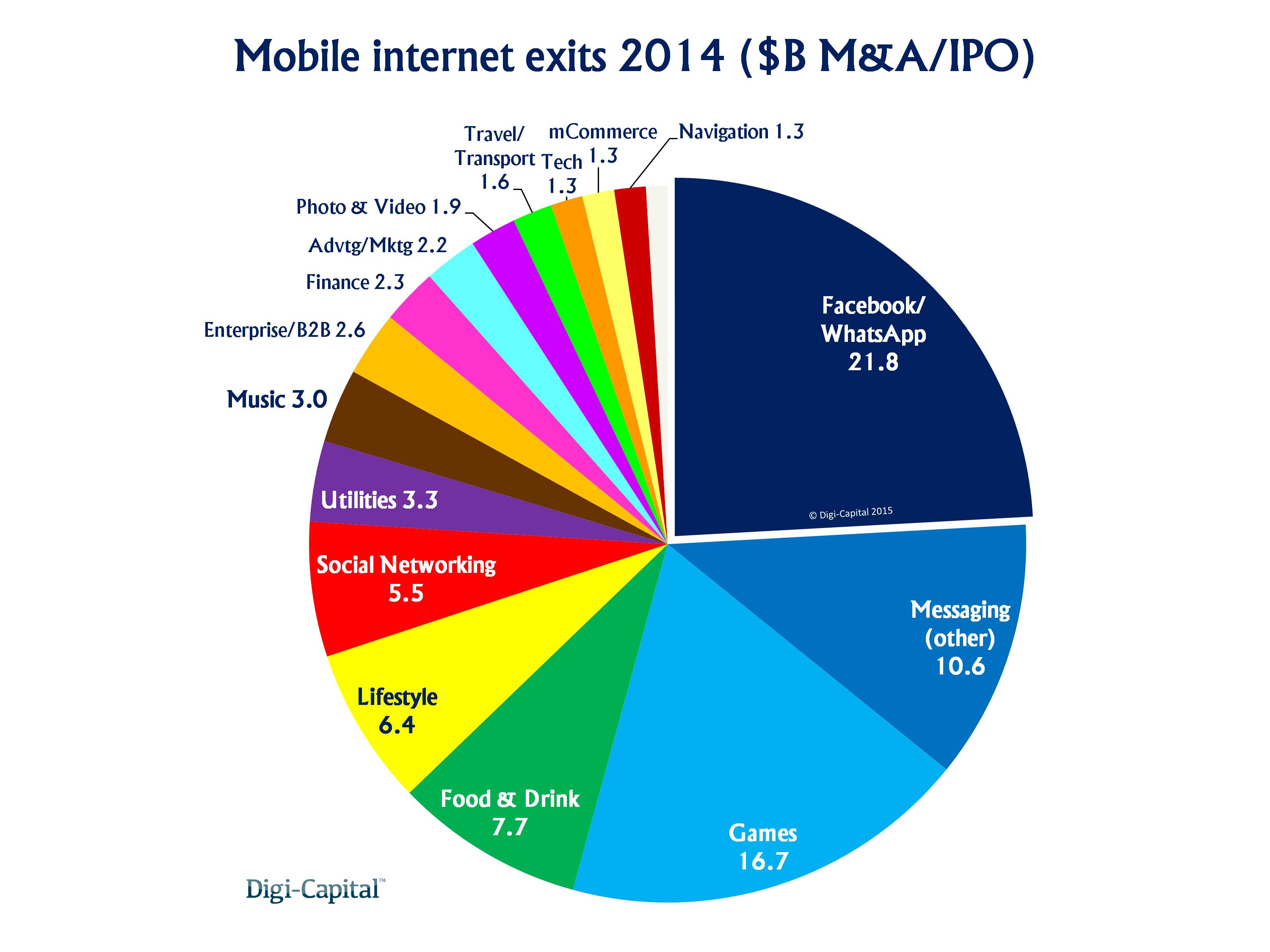

Fifteen mobile Internet sectors each did over a billion dollars of exits last year. Messaging took a third of the exit market at $31.4 billion ($10.6 billion without WhatsApp) followed by games $16.7 billion. Food and drink, lifestyle, and social networking returned over $5 billion each. Utilities, music, enterprise/B2B, finance, advertising/marketing, photo and video, travel/transport, tech, m-commerce and navigation each had over a billion dollars of exits, with the 12 remaining sectors adding another $1 billion in total.

Bigger than big, stronger than strong

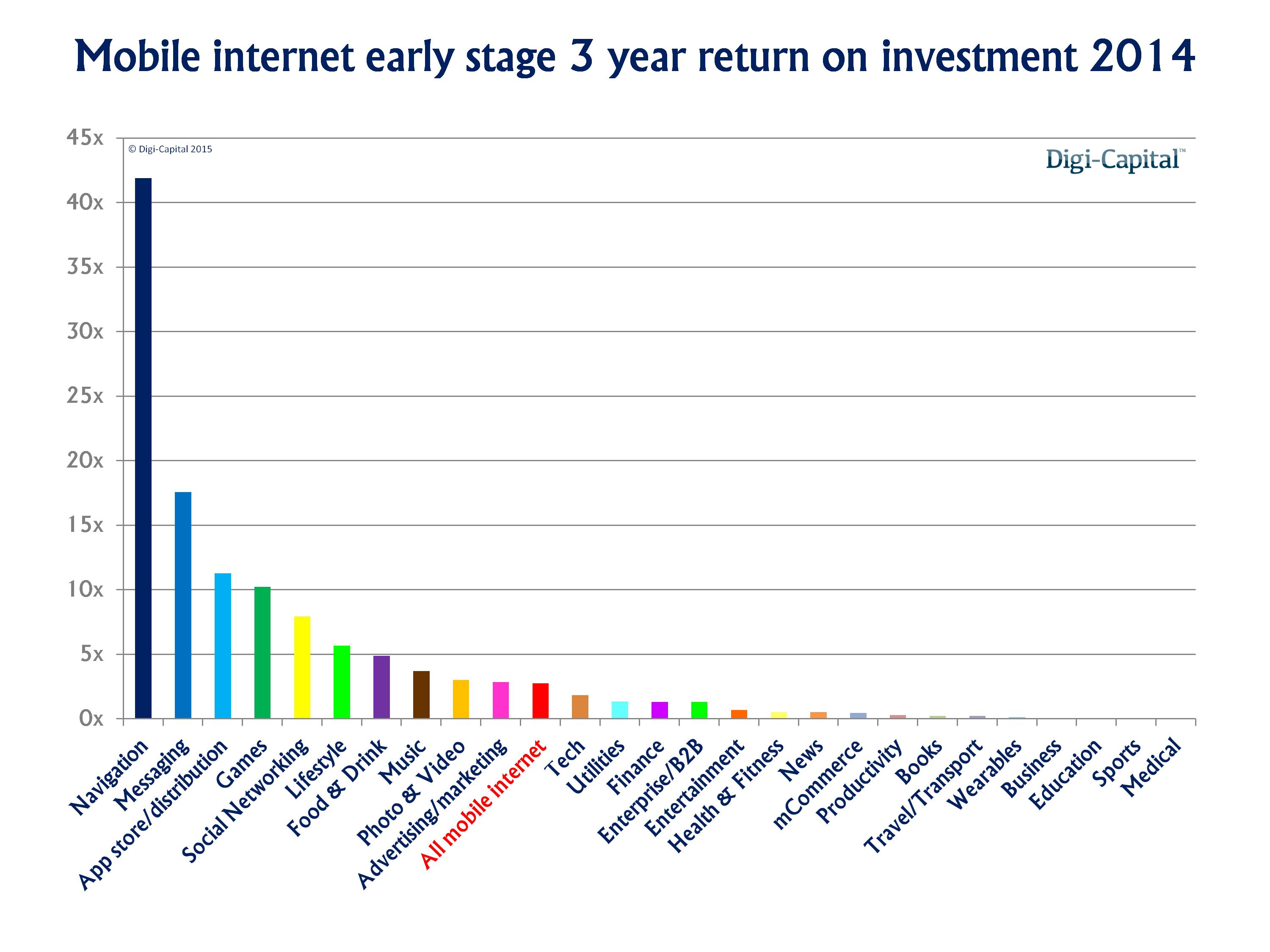

All of these exits were a bonanza for mobile Internet entrepreneurs and investors, with three-year sector returns (or the multiple of dollars received in 2014 for every single dollar invested in a sector over the last three years) of up to 42x investment.

The strongest-performing sectors were navigation (42x), messaging (18x), app-store/distribution (11x), games (10x) and social networking (8x), with average three-year returns across all mobile Internet sectors around 3x. It is worth noting that these are average returns across sectors, as individual deal returns could be much higher (or lower).

$700 billion revenue forecast? Check. Sixty-eight mobile unicorns worth a quarter of a trillion dollars? Check. $120 billion of deals? Check. Early stage investment returns up to 42x? Check. More hope and fear for 2015? Check.

You can read the full analysis here.