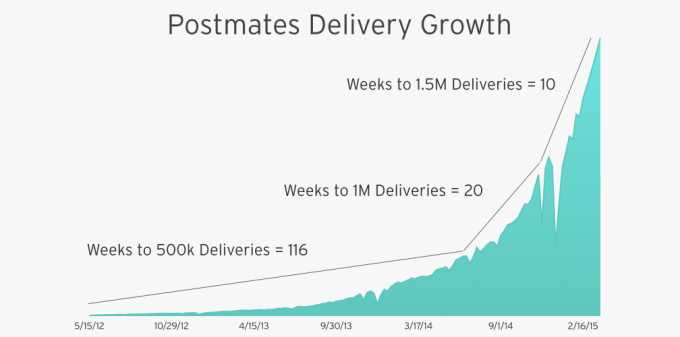

Postmates, a startup that allows users to order nearly anything in their city and have it delivered in an hour for a fee, is growing quickly. The company’s CEO, Bastian Lehmann, tweeted out a graph yesterday detailing how quickly the firm has scaled its delivery service.

Here’s the chart:

And here’s a version that TechCrunch’s own Bryce Durbin cooked up:

I decided to dig into the company’s financials a bit, so that we can better understand what that 1.5 million figure means. Let’s get started.

Fundamentals

Postmates is a facilitator between couriers and consumers. You use its app to request an order, and then a courier accepts the delivery and executes it. The delivery denizens are not Postmates employees. Instead, they are independent contractors, a model that is currently in vogue with startups seeking to control labor costs as they scale.

Postmates collects 20 percent of the delivery fee that it charges. The other 80 percent, along with all additional tips, goes to the courier. That’s simple enough. Postmates also collects a 9 percent fee of the cost of goods. The 9 percent fee doesn’t have a cap, I confirmed with the company. The startup doesn’t mark up goods that it sells, so its cut of the delivery fee, and its own fee, are how Postmates collects the bulk of its revenue.

That’s all correct for 94 percent of Postmates orders, at current pace. The remaining 6 percent are monetized through the company’s Preferred Merchant Program, which it recently announced. The company partners with restaurants in that model and charges a lower delivery fee. I presume Postmates collects a cut from the restaurants that are part of the program.

So we have a decent understanding of how Postmates operates financially and how quickly it’s growing. All we need now is an average order size, and we can run the numbers on how much revenue Postmates is currently racking up.

Naturally, the company declined to share that number. A quick scan of Twitter led to a failed assortment of random guesses. We’ll have to run the spread.

The Numbers

Postmates declined to comment on its cashflow status, and its relationship with profitability. Most private companies decline to share data of that sort, so we won’t take it personally. However, the company did indicate that its gross margins are improving as its scale expands.

Returning to the original graph, Postmates most recently executed 500,000 deliveries in 10 weeks. That’s 50,000 per week or an average of 7,143 per day.

To calculate an estimate of Postmates’ revenue1, we select an average order size, average delivery fee, and crank. For example, if we guessed that the average Postmates order is $30, before other fees and the like, and that the average delivery fee charged is $8, we can do the following:

(7,143 x $30 x 0.09) + (7,143 x 8 x 0.20) = $30,715 in daily revenue, or an annual run rate of $11.2 million.2

You can ratchet the numbers around to get different results. Let’s presume a $20 average order size and keep our delivery estimate in place:

(7,143 x $20 x 0.09) + (7,143 x 8 x 0.20) = $24,286 in daily revenue, or an annual run rate of $8.86 million.

The run rates for $10 average orders and $40 average orders — again holding our delivery fee at an average of $8 — are $6.52 million and $13.55 million, respectively.

Is That A Lot?

Given our lack of a firm average order estimate, our revenue results are annoyingly broad. However, given that range, we can cap, to an extent, Postmates’ current top line. Given that a $10 per-order average is likely quite low, we know that Postmates has a revenue run rate clearly north of $7 million. And as the average order size is likely not north of $40, the company is likely not generating revenue at a run rate of greater than $14 million.

So, it’s in there. What matters more to Postmates is that its revenue run rate is quickly expanding. Presuming that its average order size did not decline in the last 10 weeks, when the company saw quick growth, Postmates has doubled its run rate in the last 10 weeks from the pace it set in the preceding 20. Not bad.

Postmates has high gross margins on a per-order basis but has other costs, including software work and support. It isn’t clear that at its current revenue pace the firm is profitable, but if it can keep growing as it has, the idea doesn’t seem too implausible.

A potentially profitable startup? And I thought those were banned.

1. We are only playing with regular orders in our math. I presume that the financial difference between the 6 percent of orders sourced from partners and the 94 percent sourced in the company’s traditional manner is slim enough that we don’t have to run separate functions for each.

2. This is simply the number of orders placed per day, multiplied by an average order size, and then reduced to Postmates’ cut of that figure, summed with the company’s cut of the delivery fees tied to that order quantity.

FEATURED IMAGE: LORD ENFIELD/FLICKR UNDER A CC BY 2.0 LICENSE (IMAGE HAS BEEN MODIFIED)