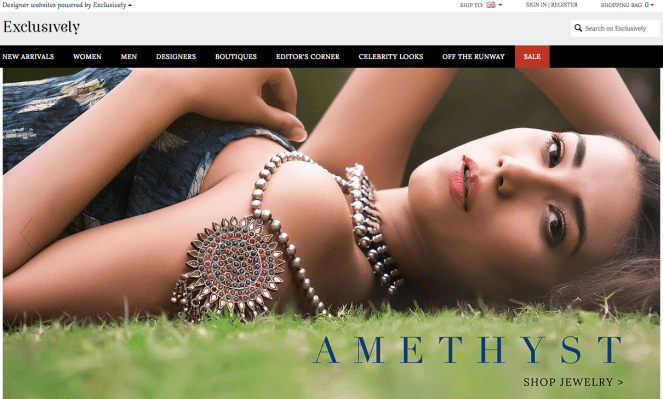

On the heels of raising $1 billion in funding last year, India’s e-commerce marketplace Snapdeal is now in acquisition mode: the company has acquired Exclusively.in, a shopping portal that focuses specifically on the luxury market, as part of its bigger strategy to capture $2 billion in gross merchandise value in online fashion in India this year. It will also help it compete more sharply against Flipkart, which is also making moves to invest in high-end, online fashion through its Myntra acquisition; and Jabong, part of the Rocket Internet e-commerce empire. We’ve described Exclusively.in as the “Gilt for Indian fashion” in the past.

And in a twist of musical-chair ownership, Exclusively was also once a part of Myntra. In 2012, before Flipkart bought Myntra, Myntra acquired Exclusively.in, Inc. It then sold the company back to the founders and exited completely. Exclusively.in has been independent until now.

Terms of the deal are not being disclosed by the companies, Snapdeal’s CEO Kunal Bahl says. We’re still trying to find out. All Bahl would say is that “I see this as a billion dollar business in next three years.” Exclusively will remain as a standalone brand, with its existing team — including co-founders Sunjay Guleria and Mohini Boparai-Guleria — leading the charge to continue building its online luxury mall.

Right now that mall focuses on high-end Indian designers and brands — with names like Manish Malhotra, Tarun Tahiliani, Manish Arora, Anita Dongre, Rohit Bal, Gaurav Gupta, JJ Valaya, Ritu Kumar, Varun Bahl, Shivan & Narresh and Neeta Lulla among them; as well as powering standalone stores for Manish Malhotra, Tarun Tahiliani, Manish Arora, Gaurav Gupta, AM:PM and Rohit Bal.

Exclusively will be expanded this year to include international luxury brands alongside the homegrown products.

After being founded in 2010, Exclusively had raised $18.8 million from investors that included Tiger Global, Accel and Helion. In its second life as an independent company, Exclusively.in was funded by private investors. Bahl tells me the company is already profitable and hadn’t been looking for funding when he came knocking.

“The partnership with Snapdeal comes at the right time,” said Guleria and Boparai-Guleria in a joint statement. “With increased awareness and growing disposable incomes, premium and luxury consumption in India is seeing a significant upward trend.”

The luxury goods opportunity is a big one in India. Snapdeal cites research from KPMG that estimates its value today at $14 billion and growing at 30% year-on-year, Bahl predicts that India will see the same trends in luxury demand as China. But despite this, there has been a constraint in the country in terms of how to meet demand, with only three physical shopping malls dedicated to luxury items in the whole of the country.

“That is the gap,” he says. “The cost of real estate is so high that we realise that we can solve the problem with brands and designers by providing them an online platform. Right now, aspiration and money have no geographic purchasing power, spread across India.”

The acquisition will expand the kinds of consumers that Snapdeal targets with products, but it will also be a way for Snapdeal to offer aspiration products to Snapdeal’s existing 40 million consumers, who may want to occasionally splurge on a more expensive item.

“I spent eight weekends going to those three luxury malls in Bangalore, Mumbai and Delhi trying to get a sense of what consumers are going there and what they looking for,” he tells me. “One of the key insights is that contrary to what most thought it’s not necessarily someone stepping out of a Mercedes but fairly normal people who want one Gucci bag. There is going to be democratization that will happen.”

This is the second acquisition for Snapdeal in two months. In December the company made a tech acquisition, buying Wishpicker to help with product recommendations. There will be more, Bahl tells me as it looks for better economies of scale for its marketplace business model, and also to make that marketplace model work better.

“Stay tuned,” he says. “The meta-goal is to create the best ecosystem for brands and merchants to reach consumers in India. This is an expansion on the merchant base that will enable us to connect the dots on supply.”

Updated with more detail about Exclusively.in’s ownership history.